Technology budgets 2010: Maintenance gobbles up software spending; SMBs shun cloud

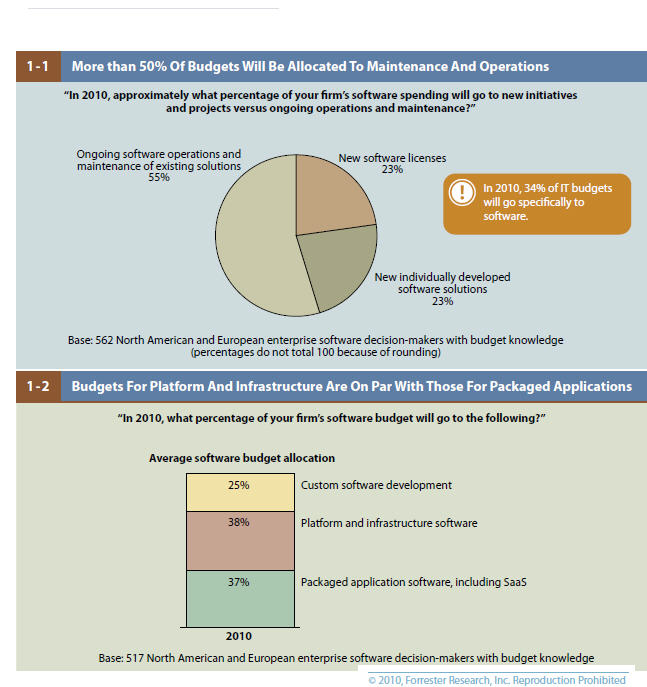

Software represents 34 percent of enterprise technology spending, but nearly 55 percent of the applications budget is consumed by maintenance and supporting ongoing operations, according to Forrester Research.

Add it up and all the talk about enterprise 2.0 and innovative corporate applications just doesn't compute. You're spending too much money on the legacy stuff.

Those conclusions come from Forrester's state of the enterprise software and emerging trends report.

Here's the summary graphic from the report:

Underneath those broad strokes are the following findings:

- 51 percent of enterprises are using service oriented architecture, but only 20 percent say SOA is delivering the expected benefits.

- A third of all enterprises have subscribed or plan to subscribe to software as a service applications in the next 12 months.

- Collaboration is a top priority with 74 percent of enterprises implementing some corporate tool.

- Roughly half of all business applications will be upgraded or expanded in 2010. Forrester reports that there's a backlog of upgrades. Finance and accounting software is most likely to be upgraded or expanded followed by enterprise resource planning, customer relationship management and industry specific software.

The software spending picture for small and mid-sized businesses is largely the same. One key difference: Small businesses are lukewarm at best to cloud computing. Forrester notes in its report on SMBs:

Many vendors mainly position their cloud services in the SMB space. They believe that SMBs will jump on the bandwagon first because they often have more limited IT budgets than larger enterprises. However, this survey reveals the opposite. Both software-as-a-service (SaaS) applications and infrastructure-as-a-service (IaaS) are more commonly used in larger enterprises than in SMBs. Vendor strategists must investigate specific adoption levels by industry vertical, region, or company size to identify their sweet spot for an SMB cloud offering.

Indeed, 33 percent of SMBs said they are interested in SaaS, but have no plans to implement it. Higher percentages (roughly 40 percent) said they were interested in other services---cloud infrastructure, knowledge, business process and platform---but again had no plans to implement.

Forrester surveyed more than 2,200 IT decision makers across large and small enterprises.