That giant sucking sound: Sun's server share continues to deteriorate

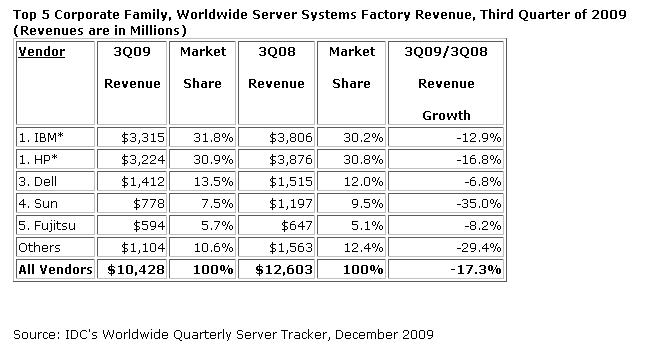

Global server revenue fell 17.3 percent in the third quarter, but sales were up sequentially for the first time since the fourth quarter of 2008, according to IDC data. However, Sun Microsystems' sales continued to fall 35 percent as the company lies in limbo as regulators ponder a deal with Oracle.

Let's roll the stats (IDC statement):

All of the vendors are down, but there are signs of relative strength. Dell is doing well with the smallest sales decline and anecdotal reports indicate that IBM and HP are ripping out a bunch of Sun boxes in server installations.

Meanwhile, Sun sits with market share of 7.5 percent, down 2 points from a year ago. The third quarter picture was even uglier than the second quarter in terms of raw factory revenue. It's clear that the Oracle purchase of Sun revolves a good bit around software, but the price tag should justifiably be lowered. Sun just isn't the same company it was when Oracle initially offered to buy it. Blame the EU for the delay, but Sun is cratering fast.

There is a glimmer of hope. Sun is at least holding fourth place in the server race. IDC says:

Sun maintained its fourth place position by posting a 35.0% year-over-year revenue decline and holding 7.5% market share for the quarter as many customers wait for additional product roadmap detail following Oracle's pending acquisition of Sun.

Among other data points:

- Microsoft Windows server revenue was $4.5 billion in the third quarter, down 12.8 percent from a year ago, but good for 43 percent of the sales pie.

- Linux server revenue fell 12.6 percent to $1.5 billion in the third quarter, good for 14.8 percent of server sales.

- Unix server revenue fell 23.8 percent to $2.8 billion in the third quarter. That's good for 26.9 percent of quarterly server revenue. IBM gained 5.1 points of market share in the third quarter.