The iPhone 3G rollout: Assessing the wild cards

Update 2:35 p.m. ET: Looks like one of these wild cards--the snafus--turned out to be a big issue today. We've got iBricks, struggling servers and other issues with the rollout. Jason O'Grady was first on the case from a store in Atlantic City, N.J. After a rough go at the beginning Jason appears to be mostly up and running.

Apple's iPhone 3G is coming today and there are folks flying to New Zealand, people waiting in line, some conflict in Canada courtesy of Rogers

Sure the iPhone 3G will be big. Sure it'll sell well out of the gate. And yes, there's international expansion to be had, but there is a real possibility that the latest iPhone won't be a slam dunk. Let's ponder the wild cards:

The economy: Rest assured that the first million or so of these latest greatest iPhones will go to Apple's existing customers. Upgrades will abound. The real tell will be what happens after the first two months or so. Folks are cutting back on spending across the board and even though the iPhone is cheaper the AT&T data plan is more expensive. Perhaps consumers won't connect these dots, but a few will. I know. I know. Apple is recession proof. So why am I even raising the issue. Teenagers are cutting back on spending--and they are the most reliable spenders. A Piper Jaffray spending survey of teens predicts that teen spending is going to drop 20 percent from a year ago. And parents are being stingier with the allowance. Teens are also rethinking what they spend on fashion. Will Apple be a fashion casualty? Will iPhone sales lag as parents look over the data costs?

I'd argue the economic questions are valid: Piper Jaffray analyst Gene Munster notes that only 35 percent of iPhone buyers will get the $199 price. The average iPhone cost will be about $407. Munster is still bullish on the iPhone--as am I--but thinks that momentum will pick up when the real cost of the iPhone is $199.

See all incoming ZDNet iPhone posts and galleries as well as CNET's coverage and Techmeme.

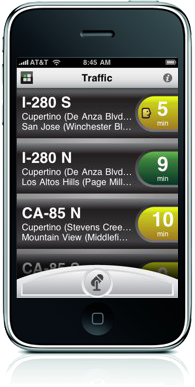

The snafus: The Apple stores will be mobbed and AT&T has its list of things so you'll be iReady. The problem: iPhone 2.0 will be more difficult to set up than the first one. Why? You have to select plans and activate the 3G iPhone on the spot. The first version you could simply walk out with an iPhone and activate at your convenience. Grumbles are likely to ensue (see News.com FAQ)--especially because the policy is designed to thwart iPhones that are unlocked to be sold abroad. Apple is trying to alleviate concerns with personal assistants.Meanwhile, a non-scientific TechRepublic poll indicates that the IT manager crowd isn't exactly hopping on the iPhone bandwagon.

That snapshot as of last night, however, may not reveal the full picture. Lenley Hensarling, Oracle group vice president of application development, said that he expects sales people to get the most use out of the iPhone. Oracle's Business Indicators application for the iPhone is focused on the CFO looking for data quickly. If CFOs, sales and the CEO all get iPhone the chances are good that IT will have to support the device.

Expectations: Wall Street is expecting big things from the iPhone. Analysts generally expect higher average selling prices--courtesy of AT&T's decision to sell iPhones without a contract at a steep markup--and an iPod-ish growth cycle. Following AT&T's disclosure about how it would sell contract free iPhones at for $599 to $699 Piper Jaffray analyst Gene Munster noted that his estimate for an average selling price of $425 is likely to be conservative.Many of these items are wild cards because we just don't know how they will turn out. But we will find out soon enough.