The Voodoo Economics of Hypervisors

Virtualization promises to reduce capital and operational expenditures through virtualization supply-side economics…add more VMs, retire more hardware, save more money. But how much exactly?

While many agree that virtualization makes good financial sense, surprisingly very few can actually put a dollar figure on that savings. Most understand that they will not have to pay for any new hardware when they deploy a new virtual machine (VM), but then it seems like voodoo is needed to figure out the rest.

For mature organizations that employ a ‘charge back’ model putting a price on a VM is a real challenge. So, how do you figure out the real savings or cost of virtualization? The approach that I suggest is quite simple: identify virtualization opportunities, understand what to measure, and compare that measurement to the cost of deploying a new virtual infrastructure.

First we have to identify the cost of running the existing physical server(s) in the environment. For this analysis we will need the cost of existing equipment (capital expenses) and the cost of running it (operational expenses). Did your eyes glaze at ‘capital expenses’?

Second, we have to create a model (yes, math is involved, but it is easily worked out in a spreadsheet!) that lets us compare the cost of what we have, to what we want, or think we want. Lastly, we need to create a business case for virtualization. We need to show how the organization will benefit. Simple enough.

What to measure? That is the first question. Really, we are looking for the most efficient way of weeding out Total Cost of Ownership (TCO). There are a number of things that could go into the measurement.

In a recent white paper by Hitachi (http://www.hds.com/assets/pdf/hitachi-hypervisor-economics-white-paper.pdf, 2011) there were as many as 24 costs associated with hypervisor cost measurement. In doing many of these assessments, I have found that the real savings are found in hardware, software and facilities costs. The rest while impactful, are not as significant in the preparation of a business case.

1. Hardware Costs

To figure out the hardware costs use the following industry standard assumptions.

- A server typically has a useful life of 5 Years, after that time the server is retired and you need a purchase a new one.

- The hardware maintenance cost for the life of a server will be about 12% of the hardware purchase cost.

- The overall growth rate will be about 5% per year of the purchase price.

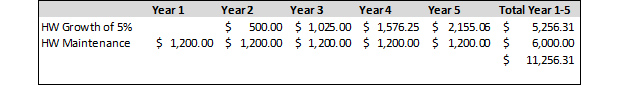

So if the price of your server is $10,000, you need to add $1,200 per year more for maintenance contracts and $500 per year for growth over the 5 year life of a server. The actual cost of that server is shown in the graphic below, notice that we added 5% to the second year, and that we add the 5% to the cost of the server and take 5% of that new number ($10,500) for year 3 and so on through year 5.

We can see where in this example the cost of maintenance and growth over 5 years equals more than the original cost of the server. Adding the cost of the server back into the equation, we see that the real cost of this server, from a hardware perspective, is $21,256.31 – this is the real capital expenditure for that machine year over year, for 5 years.

2. Software Costs

If you have the correct software costs simply add them as a line item to the spreadsheet below hardware costs. If you do not have the actual costs we can calculate them as a percentage of hardware costs. Using the same formula above we adjust the percentages to the following:

- For the software maintenance cost as percent of hardware figure 22% of the original hardware cost.

- Overall growth rate is, again, about 5% so we will use this number.

The real cost of software for the server, in our example, is $16,256.31 as shown in the figure below.

Putting it altogether we see a capital expenditure that is significantly higher than the original purchase cost of $10,000.

It is easy to see that if we had the virtual infrastructure in place, and this server was a viable candidate for virtualization, creating a new VM, rather than buying a new server makes sense. Imagine the capital expenditure savings if we could find 50 servers to virtualize. It is easy to see why this is an approach that CIOs could get behind.

The next category to explore is operational expenditures. Again, I have provided some industry standard numbers you can plug in if you get stumped.

3. Facilities Costs

Facilities are where you will likely find the greatest savings, believe it or not. The last assessment I did saw savings of 32% in this category alone. These costs are easy enough to calculate, but you will need to find the cost of real estate of the datacenter where your assets are housed. And the size of the racks by vendor for which you wish to make a business case.

- Number of square feet per rack: 7 Square feet is a good assumption if you cannot find the specifications for your server. You also have to calculate how many servers fit in those racks.

- Cost per square feet of facilities space: you will need to call a local commercial real estate person to get the figure in your area. There are online resources also, but I found them to be dated. By way of example, $400 was the cost per square foot for a facility in Boston, which I assessed last year.

- Overall growth rate in facilities cost figure 3%.

4. Power and Cooling

In this area you will need to contact the vendor and get the server specifics. It is worth investigating as it will add 5-8% to your business case in savings. Again, if you do not have the actual numbers we can calculate using the numbers below.

- Current cost of power will vary by region but you can use $ 0.08/Unit if needed

- Normalized full capacity: 67% of the rated server power is a standard I have used

- Overall growth rate in power and cooling: 3% is a good estimate

5. Systems Management Labor

I don’t agree with the tenet that virtualization saves costs with regard to labor. The way I see it, if it took a staff of 10 to support the business, virtualizing simply moves the assets around and it will require those same 10 resources to continue to support the business.

If you believe that by virtualizing, you can reduce the size of your workforce, here are some stats to work with.

- Image per 1 Full Time Employee varies, but I have seen 20 as a measure recently.

- Average cost of labor may be found at the Bureau of Labor Statistics at www.bls.gov. That said, a rate of $103K per year is likely a good estimate.

- For average rate of increase of salary figure 3%; this too will vary depending on region, but calculating 3-4% is a safe bet.

Lastly, if you have one of these guys in the office that is always going on about their MBA, you could ask them to give you a hand with the Return on Investment (ROI), Payback Period/ Break Even, Net Present Value (NPV), or Internal Return Rate (IRR). These are well known accounting methods and would ensure expeditious approval of your expense.

See also:

- Stretching the compatibility list for VMware vSphere Hypervisor installations

- OpenStack's prospects: Red Hat, VMware agree to disagree

- Gartner lists top 5 server virtualization trends for 2012

- Hypervisor comparisons: It's harder than you think

- Is Microsoft's Hyper-V in Windows Server 8 finally ready to compete with VMware?