The Web video showdown: Content providers, cable companies and the users stuck in the middle

There's a looming showdown over Web video as content providers wrestle with the future as the television business model that has paid the bills for years becomes strained.

In the last day or so, Hulu has been on a tear as it rips down its content from other sites (Techmeme). First up, Hulu pulled content from TV.com, which is run by CBS Interactive, the parent of ZDNet. I wrote off the skirmish between TV.com and Hulu as big media theatrics--these massive media companies are always pulling content down to prove some point. But then there was Hulu's move to rip its video down from Boxee.

For starters, Hulu has every right to make such a move. Hulu--a joint venture between NBC and Fox--didn't have a formal relationship with Boxee. In an explanatory blog post, Hulu chief Jason Kilar spoke like a man caught in between two behemoths he can't control.

Later this week, Hulu's content will no longer be available through Boxee. While we never had a formal relationship with Boxee, we are under no illusions about the likely Boxee user response from this move. This has weighed heavily on the Hulu team, and we know it will weigh even more so on Boxee users.

Our content providers requested that we turn off access to our content via the Boxee product, and we are respecting their wishes. While we stubbornly believe in this brave new world of media convergence — bumps and all — we are also steadfast in our belief that the best way to achieve our ambitious, never-ending mission of making media easier for users is to work hand in hand with content owners. Without their content, none of what Hulu does would be possible, including providing you content via Hulu.com and our many distribution partner websites.

The big question here is this: Why was the request made now? Peter Kafka asks if the cable companies were behind Hulu's put-the-Web-video-back-in-the-bottle attempt.

Jason O'Grady: Hulu’s fantastic suicide

The answer: You bet.

Here's the deal: Cable companies pay content providers like Viacom and Disney big money to carry channels. When the economy was better cable companies weren't going to sweat Web video experiments. It's a different story today. Here's what cable companies are facing:

- High foreclosure rates;

- Consumers cutting back on premium video packages and looking toward services like Netflix for their entertainment needs;

- Intense competition from AT&T and Verizon;

- And questions about the value of cable video.

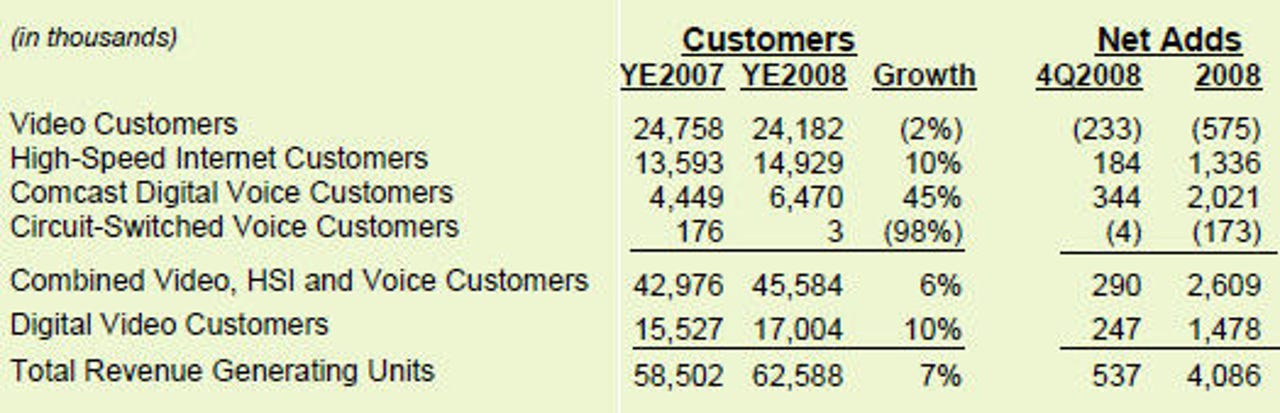

The Wall Street Journal a few days ago chronicled how consumers are saving by ditching the cable service (they're keeping the broadband service though). And Comcast's fourth quarter results tell the tale. The cable giant actually saw a net subscriber decline. A lot of the cable problems are tied to the housing market--when you can't afford to pay the mortgage chances are you're not paying the cable bill either. Meanwhile, housing inventories are bloated and that also means a bunch of empty homes without cable service and customers that certainly won't upgrade service. Here's a look at Comcast's customer metrics:

Comcast CFO Mike Angelakis acknowledged the troubles on the company's earnings conference call:

The weak economy is impacting the consumer particularly on housing growth, vacancies and moves, providing us with fewer opportunities to sell new services.

Comcast operating chief Steve Burke expanded on that theme:

This earnings season everybody seems to be talking about the economy for obvious reasons. Instead of talking about the economy, what I’d like to do is be a bit more specific and talk about our marketplace. Our marketplace is affected by the economy and also by the ebb and flow of competition. In talking about our marketplace I’d like to highlight what we’re seeing, what we’re not seeing and also importantly what we’re doing about it.

In terms of what we’re seeing, first of all there’s more competition from the telephone companies, 10% of our footprint a year ago was over built, and today that number is more like 22%. Secondly, we’re seeing more price sensitivity particularly since the month of October. Third, its simply harder to make the phone ring with marketing and sales, customers appear to be defensive, they’re less likely to go out and subscribe or call up for upgrades or new services.

Hence our connects, the people coming into our business our connects are lower then we had planned. Finally, we’re seeing a very difficult ad sales environment that is currently showing no signs of improvement. Those are some of the things we’re seeing.

Burke then went on to list a few positives and noted Comcast can weather the storm--and it can.

But put yourself in the shoes of Mr. Cable mogul. You're paying carriage fees to content companies that try to squeeze you for more money almost every year. Meanwhile, these content companies are showing video on the Web and kinda sorta monetizing it. Consumers are beginning to use Web video as a cable replacement. It's only natural that cable companies would apply some pressure on content owners, which have to cave because Web video experiments aren't paying the bills.

In the context of dollars, the Hulu moves are perfectly logical. The rub: The Web video genie is out of the bottle and isn't going back in. But in a rough economy there will be many more video skirmishes in the day ahead and users will be stuck in the crossfire. The television business model is complicated and has been under attack for years. The recession--or perhaps more accurately the decession--will push the content-cable-Web tug of war to the forefront.