The year ahead: Five moving parts behind a 2010 tech recovery

The quarterly data points are looking up and there's a quiet optimism about technology spending for 2010. But there are a bevy of wild cards.

The back half of 2009 could be summed up in one sentence: The bottom is in. Tech CEOs across the board cited sequential improvement in their business even as the year ago comparisons remained putrid. Cisco CEO John Chambers summed it up for a lot of technology chiefs on the company's latest earnings conference call:

The initial phase of recovery is underway based upon (Cisco's) order momentum. While the continued strength of the recovery and eventual job creation may still be in question, we are clearly basing our decisions and our investments upon an optimistic evolution of the economy.

In December, Oracle president Safra Catz gave a similar assessment after a strong quarter:

We are definitely seeing customers back buying. (There were) no giant deals of any sort but lots of very nice sized transactions for every size of company. So we are really seeing a recovery...We see the environment significantly improving.

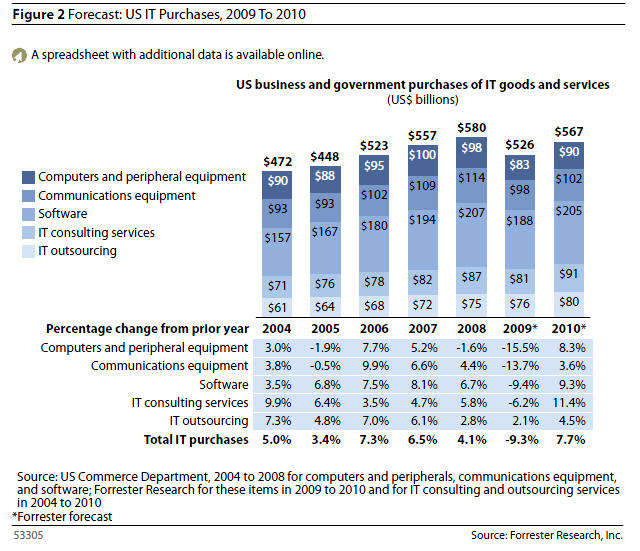

Mid-January's batch of earnings will tell the tale for the fourth quarter, but technology spending is expected to rebound going into 2010. Goldman Sachs is projecting IT spending to jump 5 percent in 2010. Gartner is projecting spending growth of about 3.3 percent. Forrester is projecting IT spending to bounce back 7.7 percent in 2010. No matter how you slice the prognostications, you'll have 2010 IT problems with 2006/2007 resources, says Gartner analyst Mark McDonald. The reality: No one truly knows the magnitude of a 2010 IT spending recovery. The first half should be strong due to easy comparisons (the tech sector melted down this time a year ago), but the outlook gets murky for the last six months of 2010.

Here's Forrester's best guess.

But questions abound. Will Windows 7 drive a hardware upgrade cycle? Will CIOs continue to cling to old IT equipment? What's consumer demand going to look like with 10.2 percent unemployment? Can small business demand prop things up? What will enterprise spending look like when 80 percent of their budgets still go toward keeping infrastructure running? Will customers revolt against the maintenance increases that have kept Oracle and SAP fat and happy for years?

The questions are almost endless. As I look ahead here are the top five key components that will determine whether there is a better-than-expected 2010 tech economy.

The Windows 7 upgrade cycle

The early data from Windows 7 sales have been positive. Generally speaking, early adopters have seen relatively easy installations and Microsoft has an operating system that will make folks forget Vista. That Windows 7 cycle is likely to drive the Microsoft revenue picture in 2010.The consensus view among analysts goes like this:

- Microsoft will see Holiday sales gains from upgrades and new Windows 7 PCs.

- That momentum will continue through the first quarter.

- The second half upgrade cycle will be picked up by enterprise upgrades.

Oppenheimer analyst Brad Reback said in a research note following Microsoft's earnings in October:

With the Windows 7 cycle just commencing, and several other significant product cycles lined up, we believe Microsoft is well positioned as the economic rebound plays out, likely in 2010. Over the near term, we anticipate strong consumer uptake of the company's new PC OS, with the real growth potential coming in CY10 as enterprises upgrade to the new OS.

Thus far, the early reviews of Windows 7 are strong, the upgrades have been relatively smooth and the operating system has momentum. HP CEO Mark Hurd said on the company's most recent conference call:

We saw good consumer acceptance of Windows 7, particularly in the U.S. We are well-positioned to win when corporations upgrade to Windows 7.

The problem: The crystal ball can be foggy this early in the game. To wit:

- Early adopters only give you a small slice of the Windows 7 view.

- Your mom four months from now will tell you whether Windows 7 has legs.

- Consumers are driving the upgrade cycle for now, but it remains to be seen how the handoff goes to the enterprise.

Dell CEO Michael Dell and HP chief Mark Hurd see Windows 7 driving a powerful upgrade cycle. The good news for IT buyers is that Dell and HP may just kill each other trying to win your dollars.

Small business demand

What happens when there are so many unemployed folks? These people start businesses or side ventures. Legions of workers aren't going back to corporate America. And what do you do when that reality hits home? You spend some dough on your home office. Enter HP. And Dell. And Lenovo. And the rest of the tech vendor army.I've watched Best Buy earnings for the last eight quarters and the only category that has shown growth for the retailer is home office. In addition, Dell cited small business confidence. As did HP.

Check out the home office line from Best Buy's most recent earnings report:

Dell CFO Brian Gladden also noted a pickup in small business demand:

We saw improving demand momentum in our large enterprise and small and medium businesses later in the quarter and this appears to be carrying over into our fourth quarter.

Clate Mask, CEO of InfusionSoft, a company that provides on demand CRM and e-mail marketing software, sums up the landscape:

From a broad macro trend we're seeing droves of entrepreneurs leaving Corporate America. They've been forced out, but they are also realizing the barriers to entry to start a small business are lower than before. Over the last several years, we've noticed a lot more people calling themselves entrepreneurs. Five or 10 years ago they would be small business owners. The people don't have a ton of money, but they have savings and severance and about six months to a year to figure something out. The number of one man and sub five man shops is exploding.

That pop means that there's a lot opportunity for software as a service companies such as InfusionSoft and larger players like Salesforce.com and NetSuite as well as IT giants such as Dell, HP and IBM. During Salesforce.com's most recent earnings conference call, CEO Marc Benioff said "the small and medium business had a spectacular quarter actually." Cloud computing providers such as Amazon Web Services and Rackspace are also likely to benefit. Simply put, IT vendors that typically focus on the large enterprise are going to look downstream to grow revenue.

Is there really an IT infrastructure crunch?

To hear data center players tell it, the enterprise is being run by creaky old equipment that's about to give out. Once CIOs recognize the risk they'll upgrade their infrastructure. They'll have to.Dell CEO Michael Dell said in November:

I think there is an aging installed base for sure. You just have an accumulation of new technologies at the hardware, software, virtualized client and these IT managers really know they cannot extend the life of these client assets forever. While I don't think it is all going to occur at once, I think it will be a rolling refresh that occurs over perhaps 18 months.

And you expected vendors to say anything else?

Nevertheless, Goldman Sachs had a similar take. Here's a snippet of the investment's firm's IT spending survey:

In a nutshell, there's a pent-up infrastructure cycle waiting in the wings. What remains to be seen is whether any growth in the economy will trigger a mad rush to upgrade servers, networking gear and storage systems. Meanwhile, developments such as virtualization and cloud computing mean that CIOs won't have to buy as many servers.

Gartner analyst Peter Sondergaard made the following points in October:

- In 2010 will be dominated by old equipment. The point: Enterprises have to prepare for increased failure rates. CFO comments like "it still works why replace it" will be the norm.

- A million servers around the world will have their replacements delayed. That's 3 percent of the installed base. By 2011 that tally will be 10 percent.

Something has to break right? The larger question is whether a hardware replacement cycle gets swapped by a move to cloud computing as CFOs aim to swap capital spending (building your own data center) with operating expenses (paying a cloud provider each month).

One of the key case studies at the Gartner Symposium/ITexpo was Eli Lilly, the pharmaceutical giant. Eli Lilly went with a multi-vendor cloud approach. It used Google Apps for collaboration, Amazon Web services for data sharing and access and software as a service.

The Lilly example was also noted by Amazon CTO Werner Vogels at the Supernova conference in December.

That Lilly approach doesn't scream server sales in the long run. Increasingly tech vendors will be selling servers and other gear to cloud computing providers. Can that be a long-term strategy? What happens exactly when everything in your data center is in the cloud? And what will that mean for your purchase of servers, routers and all the things your friendly neighborhood vendor wants you to buy?

The risk for 2010: IT infrastructure spending may not bounce back as quickly as vendors hope if the move toward cloud computing accelerates. Goldman Sachs noted in a report:

Although the intermediate-term implications of next-generation data center build-outs and the move to Cloud architectures will likely drive incremental spending over the next 3-5 years, we see negative long-term implications for legacy IT equipment vendors as a result of two fundamental forces at play in this transition: deflation and consolidation.

Software (and maintenance fee) upheaval

That cloud computing pall that's cast over infrastructure spending could also apply to software spending.Here's the conundrum: Software as a service is becoming increasingly popular as CFOs look to turn fixed costs into variable ones.

That's just swell---unless you're a software vendor that relies on annual maintenance increases to butter your bread.

The profit margins on software as a service just aren't as sweet as good old fashioned licensing. According to Reuters Fundamentals:

- Salesforce.com's operating income margin was 8.53 percent for the last 12 months.

- Oracle's operating income margin was 37.64 percent for the last 12 months.

- SAP's operating income margin was 26.07 percent for the last 12 months.

- Microsoft's operating income margin was 32.23 percent for the last 12 months.

The big question: When will customers demand a pricing break and skinnier margins from incumbent software giants? Today, there's customer anger, but users seem to go along with the current pricing models. For all the bluster from Benioff it's no surprise that Oracle CEO Larry Ellison dismisses the SaaS player as a rounding error.

After I pointed out SaaS is dinky compared to traditional enterprise software players, an interesting discussion on the Enterprise Irregulars list broke out. Some gleanings:

SaaS has better growth rates.

- The marginal revenue per deal/seat/customer is much lower than traditional software.

- Enterprises are slow to adopt SaaS (the lemmings haven't found the SaaS cliff just yet).

- Enterprises will ultimately get used to spending less on soup to nuts software.

How this software upheaval plays out may impact the outlook for 2010.

The consumer angle

The consumer's grab bag looks like this circa January 2010:- Android, BlackBerry or iPhone smartphone;

- MacBook or Windows 7 laptop;

- Flip;

- iPod;

- Kindle, nook or Sony Reader;

- Netbook;

- And a few gadgets I'm forgetting.

What else does a strapped consumer possibly need?

The question sounds silly since consumers always find gadget lust a few times a year. But the economy is so-so at best, personal income is pinched and layoffs always seem to be looming.

However, it's unclear how much buying power the consumer has. Sure, consumers could buy netbooks every quarter, but the tech industry needs four of those little buggers just to equal one full-featured laptop in terms of revenue.

There will be anomalies. Apple's tablet PC---the equivalent of spotty a unicorn---will be a hit, but consumers could just opt to say no to many devices. The new normal features:

- Shorter cycles for premium pricing (a $199 smartphone goes to $99 in a month);

- Gadget fatigue;

- Less income;

- Questionable personal ROI on new gadgets.

How consumers react to this new normal will be critical to the outlook for the first half of 2010. After all, consumers are expected to carry the tech economy for the first half of 2010. It's a shame because consumer psychology is impossible to game.