Verizon shared data plans reset wireless economics; AT&T to follow

Verizon this week outlined new shared data plans that raised a bit of a ruckus among the prosumers that woof down gigabits in big chunks. In a nutshell, Verizon ended grandfathered unlimited plans and introduced shared family data plans.

Needless to say, Verizon's moves caused a bit of consternation. CNET's Roger Cheng noted that consumers may be getting a raw deal. For my personal account, I'm pretty sure I'll wind up paying more.

CNET: Verizon unveils 'Share Everything' family plans for data | Hoping to keep your Verizon unlimited plan? Here's how | ZDNET: Verizon's new Share Everything plans; setting the bar for family plans | Verizon offers buckets of data with the Share Everything plan

In a nutshell, all devices in a family will have unlimited voice minutes, texting and data. Smartphones, modems, phones and tablets are included. Verizon is pricing 1GB of data in $10 increments so there's a $50 a month plan for 1GB and $100 for 10GB. If you had an unlimited data plan with Verizon for $30 a month you'll want to hold on to your grandfathered phone forever.

But then there's the business justification for the move. Verizon's move alters the economics of the wireless business. And rest assured that AT&T will follow a similar model.

What's the goal of shared data plans? Simply put, Verizon moved to align revenue with its network investment. A few Wall Street analysts were gushing about Verizon's plans because they improve return on invested capital (ROIC). Verizon made voice and texting unlimited since they were both in decline and hurting revenue per user anyway. Instead, Verizon will charge by the data usage, which will see hockey stick-like growth.

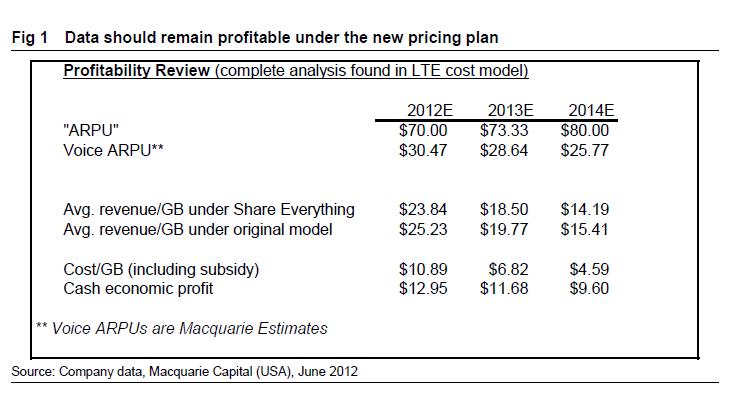

Macquarie analyst Kevin Smithen called Verizon's move "brilliant" and "one of the most important developments in wireless in years." Smithen also noted that Verizon has "once again redefined the economics of mobility and paved a path to sustain economic profit/GB after LTE conversion benefits begin to subside in 2014."

As you can tell, Smithen was a bit excited about Verizon's new wireless math. If Verizon's move plays out as expected, terms like ARPU (average revenue per user) will become less important. Revenue per account will be the metric that matters.

In other words, Verizon needs to keep data service profitable since it'll have to build out its network. The company's voice network will barely be touched going forward.

Here's Smithen's projections:

Verizon now can ensure data profits and collect more revenue as usage goes. Given that LTE networks are more efficient, Verizon should be able to hold the line on costs.

Barclays James Ratcliffe also noted that Verizon is aligning revenue and costs.

Ratcliffe said in a research note:

The new plans effectively make family plans unlimited voice and text. For a two smartphone family plan the previous floor was $130 ($70 monthly access, $30 for 4Gb data for each smartphone). This floor remains in place at $130 ($40/line for smartphones plus $50 for 1GB of data), but the mix has shifted, with unlimited text and voice now included, but the data available at that price point down to 1GB from a total of 4GB.

Given that new plans offer unlimited voice and text plans, but charge customers for incremental data usage, we believe plan pricing is now better aligned with Verizon's actual network opex and particularly capex. Voice and text have very little incremental cost, and likely minimal associated capex.

Besides, data is the future. Piper Jaffray analyst Christopher Larsen said:

The move insulates Verizon from alternative voice messaging options that run over the data network (like iMessage and Skype). The plans include unlimited voice and messaging (which may see declining usage in the future) for a fixed fee while they charge for incremental data use (which is expected to increase). With these plans, we expect ARPU to rise with increased data usage. Second, the plans make it more attractive to add additional devices like tablets and USB sticks. Finally, the plans can act as a retention mechanism; as customers add multiple devices, it becomes more expensive (and less likely) that they will churn.

Add it up and the economics work nicely for Verizon. User economics will vary. My guess is that many of us will be looking to offload to Wi-Fi networks. Economic models don't account for Wi-Fi usage as everyone tries to stay under a certain data tier.

Related: