WebSideStory becomes Visual Sciences; bolsters enterprise focus

Web analytics company WebSideStory has changed its name to Visual Sciences and launched a bevy of new software products to expand more into enterprise software.

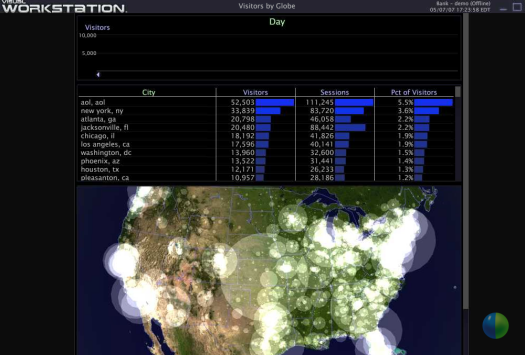

| Image Gallery: These screenshots show the latest Web/data analytics software from Visual Sciences. |  | |||||

In February, WebSideStory (WSSI) merged with Visual Sciences. Now the integration of the two companies is complete, the combined firm will be known as Visual Sciences and trade under the VSCN ticker beginning Thursday.

Melissa Purcell, vice president of product marketing at Visual Sciences, says the company's plan is to take the company's Web analytics expertise and expand it to monitor other forms of data from repositories such as interactive voice response (IVR) systems, customer support communication and point of sale systems.

"WebSideStory was a great brand," says Purcell. "But it represented the Web analytics space. It's not reflective of the applications we have to day. We're focused on tracking a number of different systems such as call centers."

There are two ways to look at this move. On one front, Visual Sciences, which competes with CoreMetrics and Omniture in Web analytics, is moving upstream to garner more corporate spending. Instead of pitching its wares to just chief marketing officers, CIOs may also be interested. However, as Visual Sciences moves into the enterprise space it's likely to run into a bevy of business intelligence software vendors and companies that focus on data warehousing. In the most common scenario, Visual Sciences will ride on top of a data warehouse and pull information in real-time from various data buckets.

Purcell added that in the enterprise software market Visual Sciences' wares will be more of a complementary sale with traditional business intelligence and data warehouse applications. For instance, Visual Sciences is partnered with Interwoven and email marketing software companies.

Visual Sciences' big argument is that the Web is just one channel to monitor in a company. Other channels should also be tracked just like Web traffic is today--in real time. The company's trademark is its visual representation in its applications launched today.

Purcell and CEO Jim MacIntyre maintain that Visual Sciences isn't leaving the Web analytics market. To that effect, Visual Sciences announced an upgrade of its HBX Analytics, its Web analytics application. The latest is called HBX Analytics 4.0. An application called HBX Workstation can import the analytics data for ad-hoc reporting.

To the enterprise though, Visual Sciences Technology Platform 5 will be of more interest. This software would allow a company to analyze credit card information, Web traffic, kiosk data, surveys and other data types and deliver information in a visual format. Visual Sciences calls Platform 5 "tera-scale real-time analytics" application.

The ROI case for these new applications is based on time primarily. Here's a slide from the Visual Sciences pitch.

If that slide pans out Visual Sciences will have some staying power in the enterprise--or be acquired by a larger rival. In fact, Stephens analyst Kyle Evans said in a research note ahead of the name change that Visual Sciences is an obvious acquisition target for business intelligence or CRM providers.

In the meantime, look for rivals such as Omniture and CoreMetrics to portray the name change and enterprise focus as a distraction on the Web analytics side of the business.

Update: Visual Sciences also reported first quarter earnings of 16 cents a share excluding charges on revenue of $20.6 million. Wall Street was expecting earnings of 14 cents a share, according to Thomson Financial. The company's outlook for the second quarter was in line with expectations. Statements are also out on the name change and Platform 5 and HBX upgrade.