Who's on Oracle's shopping list?

There's no question that Oracle will continue its rapid-fire acquisition pace. The only question: Who's next?

One amusing exchange on Oracle's fourth quarter conference call went like this:

Analyst to Oracle CEO Larry Ellison: 30 acquisitions over the last three years, five in just Q4, can you just talk in a very high level in terms of your pace? Do you expect it to slow or continue?

Ellison: I expect that the pace to continue.

That response isn't too surprising given that Oracle executives said "acquisition" 15 times on the conference call.

Oracle (see all related content) didn't provide many hints about its acquisition hit list, but that didn't stop Cowen & Co. analyst Peter Goldmacher from compiling a handy list of targets. He also compiled companies he doesn't see as Oracle targets.

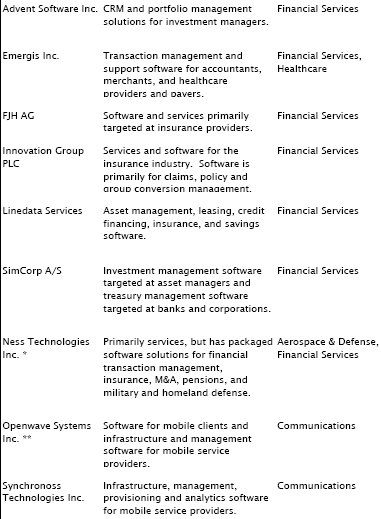

Goldmacher's list includes 48 publicly held vertical app vendors with annual sales between $50 million and $1 billion. These companies would give Oracle more depth and potential distribution. Here's the recap from Goldmacher's report:

- Expect Oracle to bolster its position in financial services and communications. These verticals have the biggest IT budgets.

- Oracle is likely to steer clear of Business Objects, Cognos and BEA Systems. The PeopleSoft, Hyperion and Siebel acquisitions make business intelligence companies like Business Objects and Cognos unlikely targets. BEA just doesn't add anything to Oracle, says Goldmacher.

And here's the list, which includes a lot of companies that could fill gaps for Oracle. Many aren't household names and the asterisks refer to analyst coverage. Goldmacher's report includes the complete financial analysis of the companies on the list.