Yahoo: Does Jerry have to go?

Yahoo got its wish. Microsoft is no longer a possibility as a purchaser. The company improves short-term results by partnering on search with Google. Carl Icahn may give up on his proxy war. And the company lives to fight another day--or at least until Aug. 1 when shareholders unleash their collective rage at Yahoo's annual meeting.

The larger question: Can Yahoo CEO Jerry Yang survive? The Friday morning quarterbacking can be summed up with one word: Brutal.

The larger question: Can Yahoo CEO Jerry Yang survive? The Friday morning quarterbacking can be summed up with one word: Brutal.

Also see: Google: Yahoo's savior?

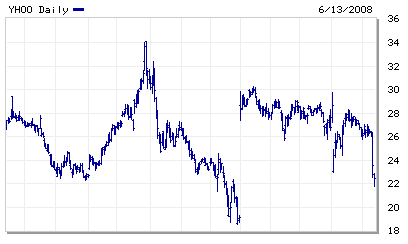

I've been batting this question back and forth with Dan, who notes that Yang's tenure is just about a year old and it has been non-stop chaos. Using the "what doesn't kill you makes you stronger" theory, Yang must be a helluva leader by now. Ultimately Dan concludes there's a battle for Yahoo's soul going on.But even if Icahn walks away, the battle for Yahoo's soul won't be over for Yang as he tries to maintain control of the company he founded in March 1995 with fellow Stanford graduate student David Filo. The fight doesn't get any easier from here as key executives abandon ship, products continue to be slow to get to market and uncertainty hangs over Yahoo's Silicon Valley campus. In the immediate wake of the Microsoft out, Google in announcement, Yahoo's stock has slid 15 percent

Yang might be called a reluctant CEO, and this tangled scenario can't what the 39-year-old Yang imagined when he replaced Terry Semel as CEO almost a year ago, on June 18, 2007.

Dan notes that Yang has some time, but he has a short runway to deliver. But I question how much time Yang really has. I'd guess that Yang's tenure may be a matter of months following the Microhoo saga.

Patience isn't a virtue on Wall Street. Yahoo employees, who have options tied up in the company, can't appreciate Yang nuking their paper wealth. And morale can't be good when you're partnering with the enemy Google in some co-opetition agreement that will likely give the search giant more of an edge.

How do you value Yahoo's soul? If you're a shareholder Yang is a disaster.

- Yang left a $31 a share and $33 a share offer on the table.

- Yahoo shares are headed to the high teens--$18ish a share is the line in the sand.

- Yang does a deal with Google that buys the company some time, but may have mortgaged the company's future.

- Sanford Bernstein analyst Jeffrey Lindsay reckons that the Google deal is only worth 16 cents a share in 2009 earnings. That sum roughly equates to $3 a share, bringing Lindsay's target price to $27, well below Microsoft's final $33 a share offer.

- Yahoo's deal with Google provides a few outs in the event of a change in control, but does deter all of the potential suitors of the company. An SEC filing names Time Warner, News Corp. and Microsoft.

Add it up and you have Wall Street questioning the Google deal. Employees worried about leadership leaving. A thin management bench. And at least a year in the penalty box for Yang. It's doubtful that Yang can recover from this debacle.