Yahoo on Wall Street's hot seat: No shortage of questions for analyst day

When Yahoo CEO Carol Bartz dropped the mother of all F-bombs on Techcrunch Editor Michael Arrington yesterday, she may have done a bit of disservice to her bigger message. Yahoo is a mighty vessel that's still licking its wounds from two blows - a pre-Bartz executive meltdown and a global economic downturn that's just now starting to recover. To expect Yahoo and team to completely flip that sucker around in 16 months under such conditions is unrealistic, if not impossible.

Or is it?

As the company gears up for an Analyst's Day later this week - its second in less than a year - it's not surprising to see that Wall Street's expectations out of it are so low that that's actually turned into a positive for the company. Essentially, any sort of good news that the company has to share will be seen as possible uptick for the company.

In an investor's note, Susquehanna analyst Marianne Wolk notes that, despite being a "leader in display advertising" with about 20 percent share in the U.S., Yahoo is viewed as a "turnaround story" because of the erosion of ad revenue and engagement levels. She notes that page view growth has decelerated sharply over the past couple of years.

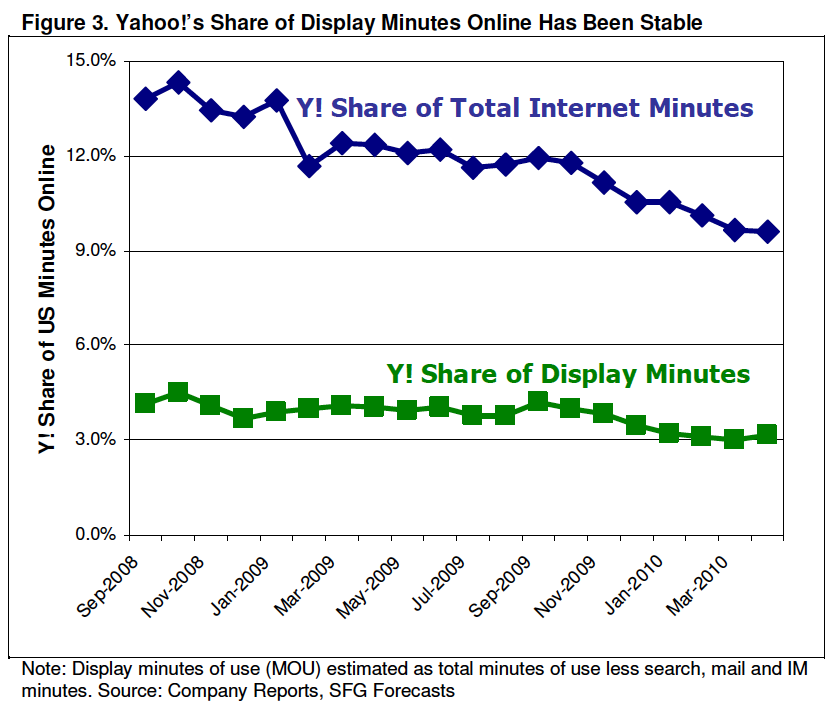

But she also notes that "page views are becoming a less relevant metric to gauge engagement" and that minutes of use are a better indicator of trends. When you strip communications tools (like IM and email) out of the equation for Total Internet Minutes, you find that Yahoo's engagement numbers - which are relatively flat - don't look so grim after all.

Still, before anyone goes cracking open bottles of champagne, it's important to remember that other sites - notably Facebook, Twitter, Hulu and YouTube - are growing their minutes of engagement times at a faster rate. Wolk writes:

If these trends persist, this presents a longer term risk to Yahoo!’s display advertising share as advertisers chase users and users’ time online. With more than 500 mln users, Yahoo! is one of the world’s largest communities online – its opportunity is to bolster social interaction and content to raise usage and monetization. We hope to hear more about Yahoo!’s strategy to improve its momentum at the Analyst Day.

So, there's one of the big questions that analysts will hope to have answered later this week. But there are many others. In their reports ahead of the event, several analysts have asked about the user engagement/display advertising trends and are confident that it will be a major topic of discussion at the event. Here are several other questions that analysts hope Yahoo execs will address during the event:

- What's the latest with the Microsoft search deal? Caris & Company analyst Sandeep Aggarwal is hoping for details on the integration, specifically how pilot projects are going, whether there have been any challenges or surprises so far, an exact timeline on organic and paid search integration and U.S. vs. International rollout.

- How does the M&A playbook look and is Yahoo still looking to invest "a couple hundred million" in 2010? Wolk says that investment amount is a sore point for investors who need some clarity on the investments and their potential returns. Douglas Anmuth of Barclays Capital says reinvestments are an appropriate way to put Yahoo back on a level playing field - but it's unclear when the success of those investments will become more evident.

- How are things looking on the International front? Investors will want to know how big of an impact European economic turmoil might have on Yahoo and they're also interested in an update on what is happening with its Asian assets, notably its stakes in Yahoo Japan and Alibaba.

- How are things shaping up in the social networking and mobile spaces? When will the partnerships. such as those with Facebook and Twitter, start having some impact on the engagement numbers mentioned above? Likewise, when it Yahoo doing to make itself more relevant as a player in mobile?

- Who is making all of this happen? The turnover among senior management ranks has been high in the past few months. If so many folks have left and most not yet replaced, who is driving the turnaround efforts?

- How's the outlook for the bottom line? Yahoo gave analysts some financial guidance toward its longer-term operating model, through 2012, and analysts want to know if those targets are still in sight or in need of an upward revision.