Yahoo shareholder pushes for Microsoft search deal; Assumptions too optimistic

Updated: Ivory Investment Management, a hedge fund that owns about 1.5 percent of Yahoo, is pushing the company to do a search deal with Microsoft, but the sticking point is valuation. Analysts say that Ivory's assumptions sound optimistic.

In a letter reported earlier by CNBC, Ivory urges Yahoo to take a Microsoft search deal while it still can. Ivory says a search deal with Microsoft could reap as much as $15 billion--a very optimistic figure given Yahoo's market cap at this moment is about $17 billion.

Ivory said in the letter:

We are writing to express serious concern regarding the failure of the Board of Directors to maximize shareholder value of the company. We would even go so far as to argue that certain members of the Board, in repeatedly rejecting or neglecting various attractive offers from Microsoft, may have obstructed the realization of Yahoo's intrinsic value for its shareholders. As a large shareholder (we currently own 21.4 million shares, or 1.5% of the company's outstanding common stock), we have closely followed Yahoo over the past couple of years. We have regrettably watched the company not only mis-execute operationally, but also mishandle, in our opinion, a bona fide offer from Microsoft to acquire the entire company for $31 per share, which now represents an over 150% premium to the current stock price. In light of Microsoft once again publicly reaching out to explicitly express interest in entering a search deal with Yahoo, we feel compelled to write this letter to ask the Board to take appropriate and prompt action and not miss yet another value maximization opportunity. We believe a search deal with Microsoft could deliver value to Yahoo shareholders of $24-29 per share, or more than double yesterday's closing price of $12.19.

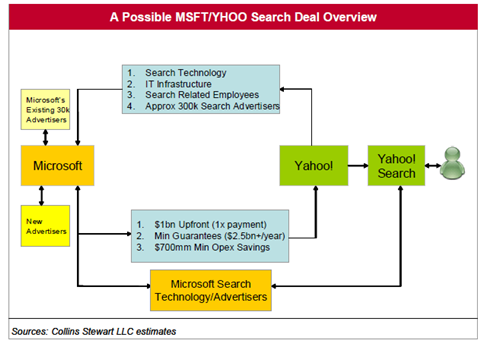

Ivory's plan as reported basically requires Yahoo to become a Microsoft affiliate. Microsoft would own and operate Yahoo's search platform.

The need for a Yahoo-Microsoft search deal is well trodden ground. Steve Ballmer would like a search deal with Yahoo. Carl Icahn wants one. Even fools in the peanut gallery like me see the obvious benefits of a search deal. Not sure what the hold up is, but the inability of Yahoo's board to move on a deal is appalling to shareholders--especially when you can crib a blueprint easily.

Analysts aren't exactly buying Ivory's assumptions. Piper Jaffray analyst Gene Munster wrote in a research note (emphasis added):

Today, Ivory Investment Management, a 1.5% owner in Yahoo!, issued proposed deal terms for Microsoft to acquire Yahoo!'s search business. The proposal suggests Microsoft pay $15 billion upfront for Yahoo!'s search business and through a combination of increased monetization, reduced operating costs, and an 80% TAC rate, Yahoo! could increase its OCF (operating cash flow) by roughly $500 per annum. While we believe the assumptions around cash flow are likely realistic, we believe the $15 billion upfront payment to Yahoo! from Microsoft for the search business seems unrealistic given Microsoft's most recent search proposal to Yahoo (July 14, 2008) offered a $1 billion upfront payment and a $3.9 billion dollar direct tender offer to Yahoo! shareholders. In the proposal prior, Microsoft offered an $8 billion stock investment; thus the maximum prior cash output from Microsoft was $9 billion.

Here's the full text of the letter:

December 10, 2008

Board of Directors Yahoo! Inc. 701 First Avenue Sunnyvale, CA 94089

To Members of the Board:

We are writing to express serious concern regarding the failure of the Board of Directors to maximize shareholder value of the company.

We would even go so far as to argue that certain members of the Board, in repeatedly rejecting or neglecting various attractive offers from Microsoft, may have obstructed the realization of Yahoo's intrinsic value for its shareholders. As a large shareholder (we currently own 21.4 million shares, or 1.5% of the company's outstanding common stock), we have closely followed Yahoo over the past couple of years. We have regrettably watched the company not only mis-execute operationally, but also mishandle, in our opinion, a bona fide offer from Microsoft to acquire the entire company for $31 per share, which now represents an over 150% premium to the current stock price. In light of Microsoft once again publicly reaching out to explicitly express interest in entering a search deal with Yahoo, we feel compelled to write this letter to ask the Board to take appropriate and prompt action and not miss yet another value maximization opportunity. We believe a search deal with Microsoft could deliver value to Yahoo shareholders of $24-29 per share, or more than double yesterday's closing price of $12.19.

Over the last several years, the market has witnessed Google grow its search market share and profits at the expense of both Yahoo and Microsoft. Microsoft was an affiliate of Yahoo in the search business until 2005 when each company decided to part ways in an attempt to compete with Google's search business on its own. Since then, it is widely acknowledged that neither company has kept pace with Google's innovation and investment spending. As a result, both companies appear to have fallen further behind in a business area they have each repeatedly referred to as a top priority. To us, the problem is obvious - it's all about scale economies and critical mass. Specifically, we estimate that Microsoft and Yahoo may each spend well over $1 billion per year on the predominantly fixed costs of operating a search business, yet each company individually does not have the proper audience scale to optimize the return on that investment. The solution seems equally obvious -- combine the search businesses of the two companies to eliminate duplicative costs and increase revenue scale.

We envision a deal whereby Microsoft would acquire all of Yahoo's search assets and enter into a perpetual agreement for Microsoft to be the search provider for all Yahoo properties. In this deal, Microsoft would own and operate the combined search platform while Yahoo would become an affiliate that retains 80% of the revenues generated from the search traffic on its own sites. In addition, Microsoft would become the search engine for Yahoo's existing search affiliates. This deal would offer Microsoft the unique opportunity to immediately gain critical mass to better level the playing field with Google, while it would simultaneously allow Yahoo to both receive a sizable upfront cash payment and increase its prospective cash flow (i.e., EBITDA). There are two key reasons why we believe this proposed deal is extremely beneficial to both parties:

1) Approximately $800 million of duplicate operating costs could be eliminated. This estimate is based upon benchmarking Yahoo's and Microsoft's Online Services Business' operating costs versus Google's cost structure. At the Microsoft analyst day earlier this year, Steve Ballmer described the cost structure in their search business: "I think you've got to think of it as sort of almost more of a fixed expense ... We won't have to be as high as Google's $2.3 billion because they're serving up so many more queries, but our COGS percentage will need to be quite a bit higher than theirs will, just to keep up in the ante to index the largest volume of documents on the Web."; and

2) The combined search platform and marketplace would have a much greater "network" effect, resulting in 20% higher monetization rates. Again we quote Mr. Ballmer at the Microsoft analyst day: "We'd like to increase our revenue per search, and the way to do that is to get more queries. The more queries we get, the more advertisers we get, the more keywords they bid on, the higher they bid, you get the virtuous cycle flowing." Furthermore, based on Yahoo's past comments regarding differences in monetization rates between Yahoo and Google, we believe our 20% monetization rate estimate is conservative. On a June 12th conference call this year announcing a search relationship with Google, Jerry Yang described the monetization differential between Yahoo and Google: "At the current monetization rate, we believe there is an approximate $800 million in annual revenue opportunity in the U.S. and Canada on those queries where monetization upside exists." This $800 million represents a 47% increase relative to the $1.7 billion of search revenue from Yahoo's total owned properties. However, this $800 million applies only to a subset of Yahoo's owned properties, so the total monetization differential between Yahoo and Google is actually greater than 47%. Thus, we believe our assumption of a 20% improvement is less than half of the potential opportunity and could grow substantially over time.

We believe the above factors could allow Yahoo to receive more than $15 billion upfront from Microsoft for its search business and increase EBITDA by nearly $500 million per annum. Post this transaction, Yahoo would lose annual search revenues of roughly $1.7 billion from its owned sites and another $450 million of revenues from affiliates (net of traffic acquisition or "TAC" payments). However, offsetting this shortfall would be over $1.6 billion of annual TAC payments received from Microsoft under the new search agreement. This payment stream assumes a TAC rate of 80% and that the combined search platform can garner 20% higher monetization. Finally, we estimate that Yahoo could eliminate over $1 billion in annual costs related to search. While Yahoo does not separately disclose the costs directly associated with its search business, sell-side analyst estimates for these costs range from $700 million to $1.4 billion. In total, we believe Yahoo's EBITDA could increase by approximately $500 million from this transaction. The table below summarizes this conclusion:

Profit Impact to Yahoo of Proposed Search Deal (in millions)

Lost search revenues from owned sites ($1,700) Lost search revenues from affiliates (net of TAC) (450) Total lost revenues ($2,150)

New TAC payments from Microsoft $1,632 Savings from operating costs elimination $1,000

Annual incremental cash flow (EBITDA) to Yahoo $482

As for the benefits to Microsoft, this transaction could allow them to increase net search revenues by approximately $1 billion per annum, comprised of (i) $100 million of revenue synergies from its estimated $500 million of search revenue, (ii) over $400 million from the retained 20% share of the new Yahoo search arrangement assuming higher monetization rates, and (iii) $540 million of revenues from Yahoo's affiliates (120% of the $450 million that Yahoo currently earns). To earn these revenues, we assume Microsoft would have to additionally spend only 20% of Yahoo's current level of search expenses, or an incremental $200 million (due to current duplicative spending). The net effect is a pre-tax profit increase of over $800 million per year for Microsoft. Microsoft has tremendous cash resources (over $20 billion of cash as of the latest quarter) and the ability to borrow at exceptionally low rates (it just issued commercial paper at 1.42% last quarter). Assuming Microsoft earns 3% on current cash and pays a 30% tax rate, Microsoft could pay Yahoo over $15 billion upfront in this transaction and the deal would still be accretive to Microsoft's earnings per share. Over time, with this new critical mass, we expect Microsoft would be able to gain meaningful share from Google (as many advertisers could eagerly re-allocate their ad spending to a strong number two player), making this deal even more attractive in future years.

What is the bottom line of this proposed deal for Yahoo's shareholders? On an after-tax basis, the $15 billion payment from Microsoft would be $9 billion for Yahoo shareholders, leaving Yahoo with $21.2 billion of cash and investments (up from $12.2 billion today) and annual EBITDA of $2.4 billion (up from the midpoint of current guidance of $1.9 billion). Applying a 5x EBITDA multiple on the "new Yahoo" would result in a value of $24 per share. If Yahoo were to go a step further and deploy the $9 billion in new cash to publicly tender for its own shares at a $16 offer price, it could reduce its share count by 40% which would leave the remaining shareholders with a stock value approaching $30 per share (amazingly close to the original bona fide bid from Microsoft).

Value of Proposed Search Deal to Yahoo Shareholders (in millions)

Existing EBITDA (midpoint of current guidance) $1,900 Incremental EBITDA from proposed deal 482 Pro Forma EBITDA $2,382

Multiple of EBITDA 5.0x Pro Forma enterprise value $11,910

Existing net cash and investments $12,190 New cash from proposed deal (after tax) 9,000 Pro Forma total equity value $33,100

Shares outstanding 1,388 Pro Forma value per share $24

Value to Yahoo Shareholders with Share Tender (in millions)

Share reduction from $9bn tender at $16/share (563) New shares outstanding 825 Pro forma equity value with share tender $24,100 Pro forma value per share with share tender $29

Note that our assumptions and estimates are based on publicly available data and statements from both companies. Even accounting for a reasonable margin of error in our estimates and assumptions, there is no question the proposed deal would significantly increase shareholder value (up to a 140% increase compared to the current trading price).

We believe that there are no other viable strategic options for Yahoo that come close to this proposed transaction. Buying AOL (a declining business) will not enhance shareholder value; in fact, we adamantly believe it would destroy shareholder value. Further, the Department of Justice has made it clear that any workable deal with Google is not going to be approved. Simply focusing on improving the current business does not appear to be a realistic option given Yahoo's track record of poor execution and continual loss of key employees. Based on our analysis, Yahoo would have to nearly triple its annual EBITDA over the next 5 years and then achieve a robust multiple of 8x EBITDA in order for the stock to be worth more on a net present value basis (using a discount rate of 15%) versus doing a search deal with Microsoft today.

We understand that occasionally a company must take its time and "create" options in order to be in a better negotiating position to deal with a potential bidder. However, in this case it is clear to everyone and, more importantly, to Microsoft that no other viable alternatives exist. Fortunately, we and the market believe that this deal is just as important to Microsoft as it is to Yahoo shareholders. For all of the criticisms that Mr. Ballmer has received regarding his handling of the Yahoo deal, we believe he has been clear, fair and reasonable. Rather, it is Yahoo's Board and management team that appear to be acting unreasonably. Microsoft was willing and able to buy Yahoo last February for $31 per share, which represented a healthy premium of over 60% above Yahoo's stock price at that time. Since Yahoo declined that offer, Mr. Ballmer has been willing to engage in discussions to buy Yahoo's search business, but Yahoo has decided against that option, choosing instead to enter into the Google search agreement (which was subsequently terminated due to regulatory concerns). There is no question in our minds that Microsoft has a strong strategic interest in Yahoo's search business. Indeed, Mr. Ballmer has said so publicly, even as recently as December 5th in an interview in the Wall Street Journal. Based on Mr. Ballmer's actions and words, we believe he is interested in doing a "fair" deal for both parties and that he would likely pay more if the deal were to be completed expeditiously.

One of your Board members, Mr. Icahn, has publicly stated that he supports a search deal between Microsoft and Yahoo. Considering the fact that (1) you arguably misplayed your hand by losing the initial $31 per share offer, (2) the stock is down over 60% from that price (vs. a broad market decrease of around 35%), and (3) Microsoft is still reaching out to do a search deal, we urge the remaining Board members to commence constructive discussions with Microsoft immediately. This time around, the Board cannot allow another tremendous value creation opportunity to slip by.

Thank you for your consideration.

Ivory Investment Management, LP Curtis Macnguyen, Managing Partner