Yahoo's post Bartz ledger: What the new CEO will inherit

Yahoo is looking for a new CEO and anyone interested in the job will need an answer to this core question: Can this company be saved?

Listen to the analysts, the few Yahoo supporters and an army of critics and you're excused for not having a great answer. Yahoo is at an inflection point. Yahoo will either become an also-ran that will fade or it will leverage its top 5 Web property standing and evolve into something new.

The negatives are well known. Yahoo's board of directors is a joke -- who can forget the idiotic move to turn down Microsoft's bid? -- email is on the decline, and the company's search deal with Microsoft hasn't quite delivered. Meanwhile, Yahoo's ad sales are hurting amid turnover and falling rates as marketers use networks to aggregate audience.

Here's a look at the good, the bad and the wild-cards that face a new leader at Yahoo.

Also: Yahoo's Bartz era: The non-stop drama in her own words

The good

Audience. Yahoo is No. 2 in ComScore's top 50 ranking with 177.6 million unique users in July. Google has 182.3 million uniques. Microsoft, Facebook and AOL round out the top 5. That audience means something. Yahoo can aggregate eyeballs in one place better than anyone. Yahoo is still the home page for many Internet users whether for finance, e-mail, news and fantasy sports. Yahoo is basically a Web broadcast network.Some heavy technology lifting is complete. Bartz wasn't perfect, but on her watch Yahoo did become more efficient and eliminate technology silos. Yahoo now has cloud services that can be delivered to multiple properties. The company can also spin up new sites and categories much faster. Toss in Yahoo's Hadoop analytics capabilities and you have solid infrastructure that may need work, but is in much better shape than three years ago.

Mobile. Yahoo has multiple mobile properties and apps that position it well going forward relative to rival AOL.

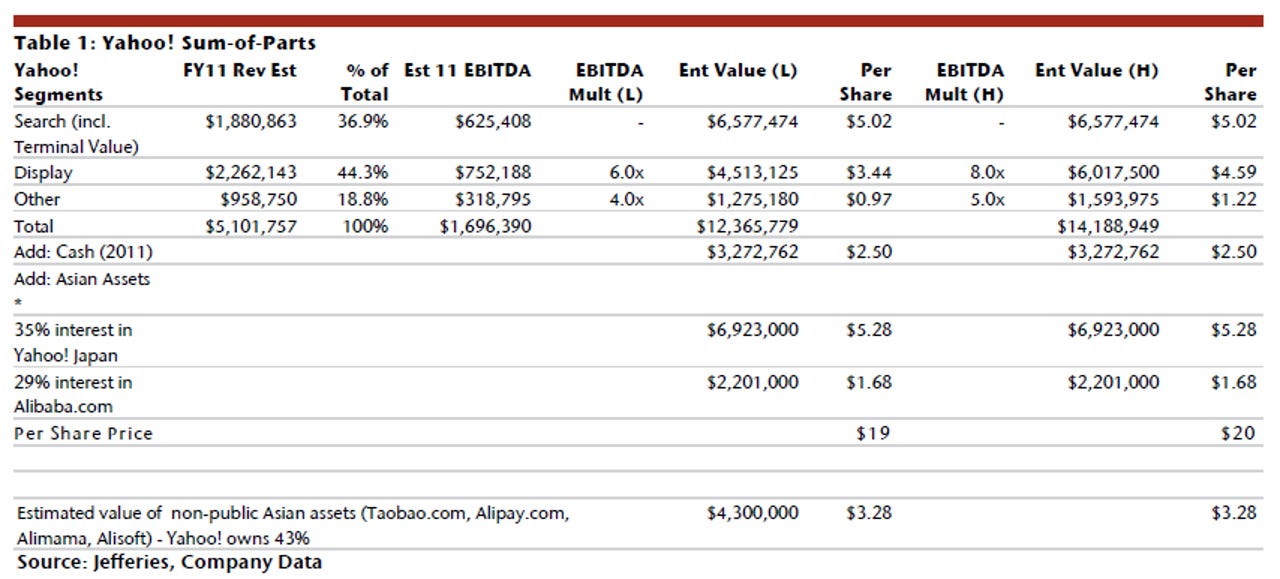

International assets. Deutsche Bank analyst Jeetil Patel values Yahoo's Asia assets at a bit more than $8 a share. Yahoo shares got a lift from the Bartz departure, but closed at $13.61. There's about $2.50 a share in cash on Yahoo's balance sheet. Add it up and Yahoo's U.S. business is nearly worthless. Youseff Squali at Jefferies values Yahoo's international assets---public and privately held---at about $13.3 billion.

The bad:

Turnover and a major sales problem. While the Wall Street Journal notes that no one factor caused Bartz to get the boot, her last screw-up was fatal. She restructured the sales unit, alienated her execs and lost multiple people. During Yahoo's latest quarter, which disappointed Wall Street, Bartz had an odd confessional.In May we made a decision to reorganize the US field organization into — and to move aggressively to position ourselves for more rapid Display growth in the future. However, the combined short-term result was significant turnover in our field sales ranks that is the actual feet on the street. Turnover accelerated as all of these changes affected the sales organization. As with any reorg, we initiated some of the departures and some people chose to leave on their own.

Frankly, however, we underestimated how much the changes would increase turnover; enhance our ability to close premium class-1 sales in the back half of Q2.

If the new CEO can't correct Yahoo's sales problems it will lose its edge in display ads. As for turnover, it's worth noting that Yahoo's executive team was largely hired under Bartz's watch. The new CEO will want his or her own team in there.

Willy nilly strategy. Yahoo comes up with these strategic initiatives, but there's doubt about whether it will stick with them. Exhibit A is Yahoo's content strategy. Yahoo wants to build up its content ranks, hire journalists and create compelling features, but Bartz's departure may mean the company backs off. Yahoo has carved out a content niche in sports, but other categories are a work in progress. Fortunately, Yahoo is competing with AOL, a disaster that makes Yahoo look as well run as IBM.

Yahoo's board. Yahoo's Board of Directors has a dysfunctional ring to it. You have a co-founder in Jerry Yang that flopped as CEO and there are signs that Yahoo's board may have a little HP in it. And that's not good. Bartz's exit interview with Fortune says a lot about the board.

Structural issues. Yahoo missed the search curve, tried to get back into the game, and then wound up outsourcing to Microsoft. The problem is that Microsoft can't deliver the necessary revenue per search Yahoo needs. And then there's social. Web users are spending more time on social networking sites like Facebook. To its credit, Yahoo has built bridges between Facebook and Twitter and integrated well with these properties. It remains to be seen if that integration is enough over the long run.

The wild card

The Microsoft search deal. On paper, Yahoo's search deal with Microsoft looked like a good deal. The reality is that the search partnership has been disappointing so far. Further integration is on hold until Yahoo and Microsoft figure out the search revenue problem. The choices for the new CEO go like this:- Work through the Bartz-Steve Ballmer partnership and see it through.

- Look for an exit, which would be another significant search change.

In either case, advertisers will want Yahoo to convert searches into paid clicks. If the Microsoft-Yahoo deal falters, the new CEO will have a major headache that could last multiple quarters.

Bottom line: Yahoo can be saved, but it's unclear whether investors, employees or the board has the patience for another 2 to 3 year turnaround effort. The new CEO may just be a caretaker to maximize value and then monetize the impressive assets Yahoo has via a breakup.