Asian-Pacific enterprises to lead global IT investment growth and universalize cloud computing

Last month, a group of global IT players and investigators gathered in Singapore to discuss PC maker HP's cloud strategies in the Asia-Pacific Region.

At the meeting, Vice President and Research Director of Forrester Research Michael Barnes said the IT market growth in Asia is gaining the most powerful momentum ever as cloud is enjoying vast popularity in the region.

In his report on investors' enthusiasm for the cloud market, Barnes said some 20-25% of the world's leading IT companies come from Asia, where the average income is rising at a higher speed than the rest of the world.

According to Barnes, China consumed the most resources in 2010, and it has become an important emerging part of the global auto-markets. Its neighbor India is also leaping forward. While the Pacific region, as is represented by Australia, is also fast developing.

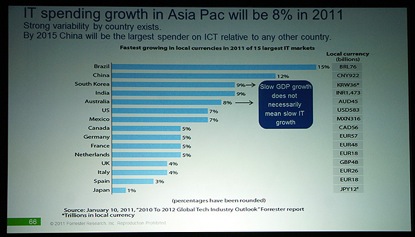

The diagram above shows a list of world's top 15 largest IT markets ranked by their ICT (Information Communication Technology) investment growth rate in 2011.

In the 2011 Global IT investment growth rate list presented by Forrester, showing that there are 4 countries from Asia- Pacific area among the top five. Brazil tops the list with a 15% growth rate and China claiming the second with 12%.

But if it comes to the total investment by RMB, these countries' IT investment in 2011 as below--Brazil,280 billion RMB; China, 920billion RMB; South Korea, 202 billion RMB; India, 190 billion RMB; Australia 300 billion RMB. (It's worthy to note that South Korea and Australia's GPD growth rate falls far below its ICT investment growth rate. ) But the United States, which was ranked at 6th with a 7% growth rate, has invested an overall sum of 3700 billion RMB, nearly quadruples that of China. Japan, which is not calculated as part of Asian markets by some IT companies, has increased its investment in ICT by only 1% but its total spending accounts for about 980 billion RMB.

What the figures tell us is that even though the ICT investment growth rate in Asia-Pacific region stands high, there is still a vast room for its spending rises.

And Forrester even envisaged that China will become the world's largest ICT investor by 2015.

Driven by the trends of globalization, Asia-Pacific enterprises are set to face fierce market competition whether they are going international or not. That pushes those companies to focus their attention on new IT technology and frameworks, from which they are seeking an efficient, flexible and apt basic framework to ensure an effective business expansion. That's why many companies have chosen cloud as their Optimization Policy.

Of all the 2741 companies participating in the research, Michael Barnes said those in the Asia-Pacific region have shown a higher interest in cloud implementation. Chines and Indian companies are the keenest pursuers. 56% of the 184 Chinese (including Hong Kong SAR) companies gave cloud implementation a top priority in their plannings. India's ratio is 56%?while others are lower than 40%.

The preference can also be found through their IT investment. 71% of Indian and China companies put infrastructure virtualization -- a compulsory means to implement cloud -- as their priority in IT investment, with those from Australia (69%) and Canada (68%) following close behind. Others stand above the average 63% include the US and France, while the UK, German and Japan come below the average line.

The difference is easy to explain. Many companies from the Asia-Pacific region, especially the Chinese and Indian ones, could have evolved overnight from Stone Age to the Age of Civilization. As their IT framework are generally low-grade, these companies, with enthusiastic willingness to evolve and few obstacles in the way, can implement cloud just at one go. In contrast, many companies from the developed countries, with an early start in IT development, have chosen to head towards cloud bit by bit, and some even have already completed the virtualization and cloud implementation.

To sum up, it's easy to see that the Asia-Pacific region will serve as the driving power of the global ICT investment growth, especially in terms of the cloud implementation. Indeed, several American IT companies have acknowledged their Chines counterparts' pioneering ideas in cloud. And it's safe to say that Asia-Pacific IT companies will in the near future catch up with their co-players from the developed countries, and even leave them behind.