CRM Idol 2011: The Reviews Continue #3A

Wow. We are pouring it on aren't we? CRM Idol has so far been interesting and you'll see at the end of week one and before we go to Dreamforce, an analysis of what the primary judges have noticed so far, given what we've reviewed. Some fascinating findings though keep in mind our sample is 39 companies That's for later.

For now, today up is 2 more reviews: FreeCRM and RelayWare.

FreeCRM

FreeCRM (CRM ASP, Inc.) was founded with Angel funding in 2003 by Eric Stone, a person who clearly loves what he does and prides himself on the technical prowess of his solution. The company has 10 employees. Their CRM solution is focused on the small business market with most of their customers being very small businesses. They have a freemium model that drives their business and that we'll discuss a little later in this review.The Market

FreeCRM is focused clearly on the smaller side of the SMB market. With their freemium model, they claim 220,000 customers in 120 companies, with roughly 85% of them (give or take 5% at any given time) taking the free version and 15% (again, give or take 5% at any given time) paying customers. That would mean, with these numbers being presumed to be approximately accurate, roughly 187,000 free customers and 33,000 premium customers, still a significant number. They also state that they have a 5-10% conversion rate when it comes to free to premium subscriptions, decent by any standards.The bulk of their customers come from companies with 1-50 employees, and are under $20 million in revenue. They have perhaps 15 customers who are part of multibillion companies, primarily on small sales teams and perhaps 5-10% of their customers are at multi-national entities.

The Product

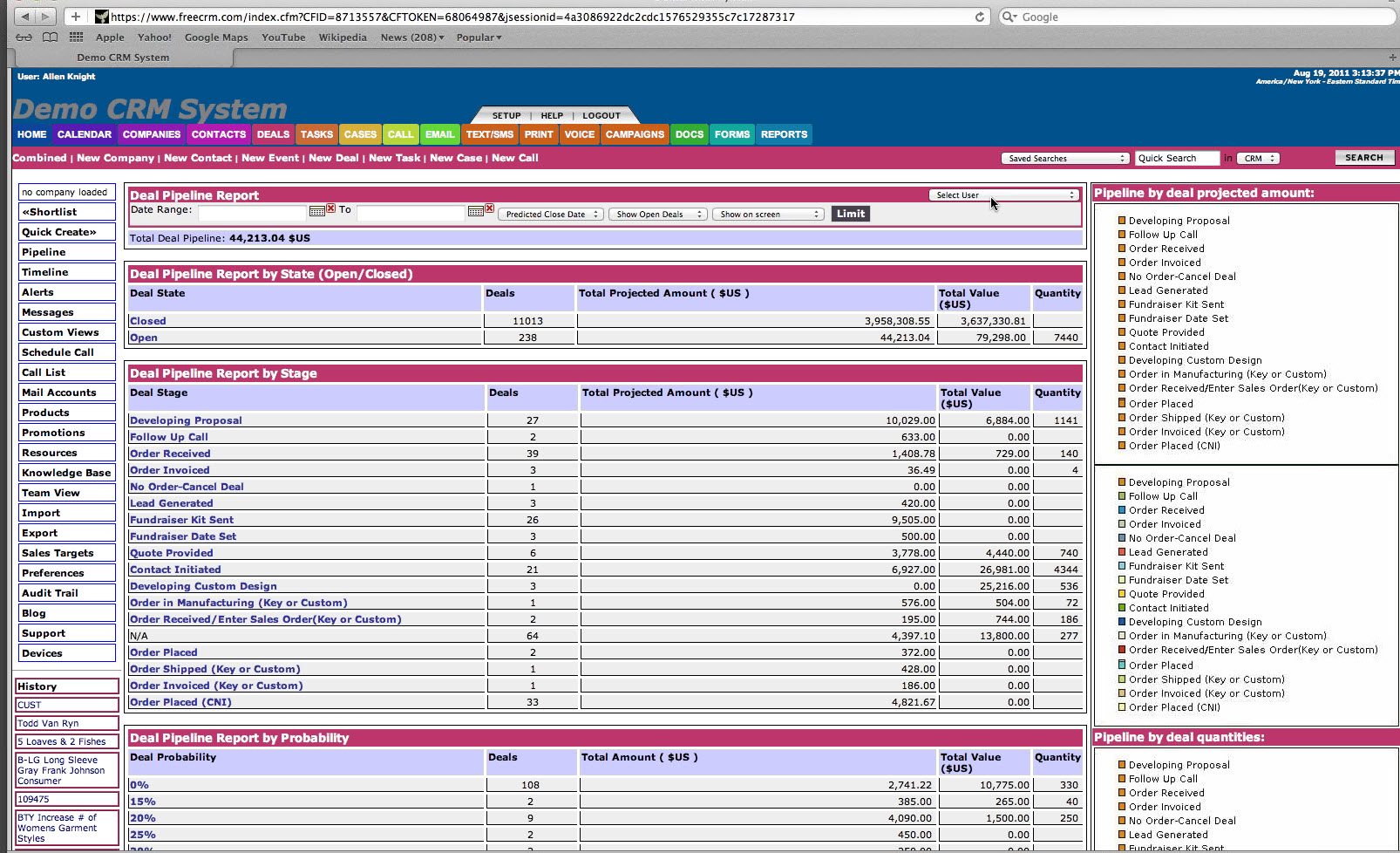

What makes FreeCRM more than just interesting is the incredible level of functionality that Eric incorporates into his solution, and then gives away. That is the strength - and the weakness of this company. This company may be among the few with the most complete functionality for an on-demand CRM product that we've seen incorporating pretty much all you need when it comes to sales, customer service, and interestingly enough, marketing - a place where the better known CRM suites are often deficient. Additionally, he offers less frequently available capabilities when it comes to almost all small business CRM suites such as Knowledge Management, blogging (though we've seen this more frequently in the first 20 CRM Idol contestant's applications than we do in the rest of the CRM world), and even audit trails.Here's a screen to give you the idea of the scope of this application.

As impressive as the breadth of functionality is, so is the depth of each of the functions - at least what we've seen. For example, the sales force automation component has what you expect at the level of salesforce.com or other major SaaS players. Lead management, opportunity management, pipeline management, integrated calendars, sales targets are just a partial list of the extraordinarily rich functionality that FreeCRM provides.

It doesn't stop being impressive with just its applications. The company has two geographically diverse data centers - impressive enough, right? Well, these data centers are not just up and running but are compliant with Sarbanes-Oxley, HIPAA, Gramm-Leach-Billey and Federal Rules 26 and 34. Additionally, and perhaps most importantly, the data facilities have been audited as SAS 70 compliant by the American Institute of Certified Public Accountants (AICPA). What all this means is what you see is what you get, when it comes to the controls that are claimed by FreeCRM at the datacenters.

To add to this, Eric Stone, in the demo/review, claimed that they are at "five 9s" uptime right now (99.999%) and "looking forward to six 9s."

Their product architecture is built on Linux and MySQL, like many of the other participants in CRM Idol.

It has very little social integration, with the initial odd, but interesting choice of Skype to start, rather than Twitter, Facebook or LinkedIn. However, the integration of these three social standards is part of their roadmap for the immediate future - and needs to be effected quickly, since, if they want to complete in the CRM market, this level of channel integration is becoming de rigueur.

Their roadmap also calls for improvements in the UI which is colorful but a bit heavy and mobile and HTML5 clients, both important and smart choices for a near future release.

The Business Model

While we can't begin to cover the number of features/functions that are inherent in this nearly complete product, and while we think extraordinarily highly of the product itself and the exacting standards that FreeCRM places on the development and quality of the product, we do have several concerns with the business model and the marketing.Their business model is centered on the freemium idea. The actual difference between free and paid subscriptions isn't features though. The Pro version and the Free version have nearly the same fundamental functionality with the only differences being that you get up to 50 users for the free version and more limited storage and records. Beyond 50 users, you have to pay $14.95 per user/month and you do get some added functionality, though the vital stuff is part of the Free version too. What you are paying for primarily is the level of support and maintenance ranging from a minimum standard of customer support for $19.95/user/month to $24.95/user/month for premium support. If you care to, you can add voice functionality (they call it VoiceCRM) to the premium support for their top priced $39.95 month.

We feel that this model is inherently problematic because they are giving away too much functionality for nothing. Even the name of the product "FreeCRM" puts the customers in a frame of mind that says, freemium is good enough, impacting their potential revenue. Additionally, 50 users for free is more than most small companies will ever need. Support alone shouldn't be the difference. We suggest that some of the more vital feature set be part of the Pro version only.

Additionally, for a company with 220,000 customers, they have little market impact, though hopefully, their participation in CRM Idol will begin to address that in some way. Their marketing tends too strongly toward the functionality of the product and not how it helps the customers do the jobs they need to do.

Final Thoughts

All the concerns aside, FreeCRM competes as a product with any SaaS based CRM product out there when it comes to features and functions. The care that the staff has taken to be as functionally complete as they are and as flaw-free as they can be is something to be applauded. If they can fix their business model and dramatically improve their marketing, they could be a serious player in the SMB CRM market.RelayWare

Partner relationship management (PRM) has gone in and out of style as much as Sergeant Pepper's Lonely Hearts Club Band. PRM is the branch of CRM that does the hard work of managing indirect sales channels for vendors that prefer to sell through distributors and resellers. There are good reasons for the channel and many of us forget that about half of technology sales go through the indirect channel including the business-to-business side of the equation. It can be confusing for the consumer - the Apple Store is a direct channel but Best Buy is indirect. Go figure.Demand for PRM, or at least the attention it gets, is partly driven by where an industry is in its renewable lifecycle. Attention is low when categories are new because the vendors need to employ direct sales forces to drive a missionary message. Demand for PRM rises as the market becomes familiar with a category and the vendor looks to cut costs by managing a channel rather than an in-house sales team. We are in one of those periods when PRM is back in style.

PRM vendors have come and gone in the last decade but RelayWare is one with staying power and one of the most complete solution sets in the business. Founded in 2000 near Oxford, UK, RelayWare has changed significantly. The entity today employs forty people, is privately held and they say profitable. It addresses an international market and is headed by CEO Mike Morgan who led a management buyout a few years back and moved part of the company from Oxford to Redwood Shores, CA. The company also eats its own dog food and has a distributor in Singapore though historically it used a direct model to sell its solution. Importantly RelayWare is not a modified CRM system, PRM is their only business.

Interestingly, the company claims that PRM is inherently social (they may be right, but...) and uses this to claim ten years of social involvement. There is social and there is social and we saw little evidence of what might be more commonly thought of as social in the product though it is on their road map.

RelayWare has built a solution that encompasses the basics of managing a channel along with the extras that channel managers have come to depend on. They told us that they have application support for every phase of the partner lifecycle and we concur. Often there is no analog in CRM for what PRM does and that is why CRM is often inappropriate for managing the channel.

For instance, managing market development funds is a big deal in the channel. Partners are given amounts of money by the OEM for marketing programs based on their past success. Awarding this money and tracking results is a part of channel management that vendors must have. So is lead registration. In conventional CRM or SFA a lead might be assigned to a representative in a territory and often those two things are the same. However, in a channel partner territories may overlap and a partner always wants a way to make the lead uniquely its own. At the same time, the OEM wants the lead aggressively pursued and the OEM needs a way to track if the partner is indeed pursuing it. So deal registration works in both directions and neatly demonstrates the multi-directional nature of PRM.

RelayWare has gone well beyond the basics of PRM. Because the company has been in the business and invested in its product line for a long time it has a distinct advantage over some of its newer competition. CEO Mike Morgan is a self described channel guy who understand the unique demands of vendor life in the channel. Nothing demonstrates this better than RelayWare's approach to analytics. In addition to offering basic reporting capabilities up and down the channel, RelayWare also offers a special service to its customers. It strips out identifying information in its data and analyzes it to develop metrics across its universe. Individual vendors can then compare their own performances against these metrics to see how well their organizations perform or where they need to improve.

RelayWare has done a good job of building a complete product set for PRM and we think their approach will carry forward so they get high marks for vision. The briefing was solid though we dealt with a minor login problem. No matter, the demo suffered from a condition that we have seen in other briefings as well. The vendor spent too much time on tactics - "this is how you enter data" - rather than on how the product advances the business aims of the customer. Business aims were better covered in a presentation but the demo and presentation have to synchronize with one reinforcing the other. The demo would improve with greater attention to the business issues.

We believe demand for PRM is likely to increase as market conditions continue to favor situations where innovation happens within the category rather than through developing net new categories. We're likely to see a plethora of product line extensions that will only make sense when specialized partners bring them into relevant customer situations. This is something the channel excels at provided it has the tools to manage all the data it is likely to churn up. This should mean good times ahead for PRM.