Why Google would want Yahoo: A few opportunities could make it worth the effort

That “person familiar with the matter” is talking to the Wall Street Journal again - and this time, that person is whispering tales of early-stage discussions between Google and some potential partners to make a bid for Yahoo.

Now, before anyone starts hollering “antitrust” in a building filled with government regulators, remember that there’s still no formal proposal yet and it’s very possible that Google might not pursue a bid at all. Instead, it seems like we’re at the stage where the key players are just scribbling out their lists of pros and cons about a possible deal.

Imagine the advertising possibilities, what with those hundreds of millions of faithful Yahoos who check in several times a day. But consider the sort of scrutiny that the deal would experience. Are the growth possibilities or the potential dollars-and-cents for the long run worth the efforts of defending the deal to regulators?

Maybe. If I were scribbling some thinking points on a Google bid for Yahoo, here's what some of those random thoughts might look like:

Search: Google walked away from a search advertising deal with Yahoo once before - almost three years ago - after the Department of Justice said it would file an antitrust lawsuit against it. They went big, pared down and still couldn't shake the feds - and so they walked. A year later, Microsoft inked a 10-year search deal with Yahoo. Certainly, regulators will be interested in search and how a Yahoo-Google-Microsoft love triangle impacts it. In terms of Google taking out a search competitor in Yahoo, that feels like less of an issue. Yahoo hasn't been a search powerhouse for years and Carol Bartz, before she was shown the door, had been pushing the "Don't compare us to Google" message at every opportunity.

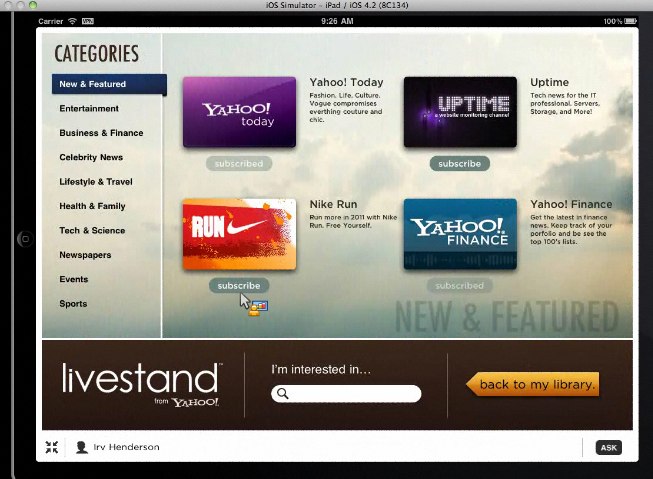

Content: The other half of the We're-not-Google mantra was a "We're a media company" message that Yahoo backed with partnerships and acquisitions.

Advertising: Speaking of advertising, it's always been funny to me that most observers still refer to Google as a search engine when, in fact, Google is an advertising company. Sure, search drives advertising. But Google execs have been saying for years that Google makes money when people spend time on the Web because that's where they're exposed to the advertising. Yahoo's advertising strategy has struggled to compete against a giant like Google, but there's still some value there. In fact, regulators should probably spend more time looking at how a deal might change the advertising business - and industries that are tied to it - rather than focusing their energies on the search issue.

Brand Loyalty: You really can't downplay the significance of the value of the Yahoo brand and the power that comes with hundreds of millions of daily visitors, many of whose loyalty goes beyond what other Web companies experience. (Between email, finance and news, I've already visited a dozen or more Yahoo pages today - all before lunch.)In part, that "stickiness" is due to the company's long-standing presence on the Internet. It was one of the first to offer Web-based email - and, as such, signed up people before Google could. Still, it's kept the offerings fresh and relevant in a changing landscape for communicating with others and sharing information.

Other opportunities: The first thing that popped into my head when I thought about Google getting its paws all over those content relationships that Yahoo has established was how it could impact the efforts around Google TV. Like Apple TV, Google TV is still a work-in-progress. I've long said that I'm a fan of the concept - making both broadcast content and Internet content searchable for a more customized TV watching experience - but Google had a tough time getting the content providers on board. With Yahoo's content offerings, Google TV - and Google News, as well - could get a boost in inventory. Now, if only they could work on that technology.

Some might argue that the time is right for Google to make a bid for Yahoo. The competitive landscape has changed, the technology has evolved, the global economy is in a different state and the political climate in Washington has shifted since the last time the mutterings of a Google-Yahoo deal were heard. Others might argue that the many tentacles of both businesses could prompt a long review of the deal while regulators sift through it all.

I wouldn't be quick to place any bets on a deal happening - but it's good that Google is at least exploring the possibilities. Yahoo has been through a lot in recent years and while it's future might not appear to be so rosy, there's a lot of life left in the company. And if Google (or Microsoft) could get their hands on it - or key pieces of it - the landscape in the tech industry could have some interesting twists and turns on the road ahead.