Analyst report: Oracle customers dissatisfied with service but will spend more

In my last post I referenced a Computer Economics report entitled: Go-Forward Strategies for Oracle Application Customers. The report is now live (paywall) and it is worth noting some highlights.

The report is wide ranging in its objectives which are stated as surveying customers:

...to assess their satisfaction with Oracle support, plans for migration to Oracle’s next-generation Fusion applications, use of Sun hardware, consideration of third-party maintenance services, and forecasts for Oracle’s share of their IT budgets.

The key findings can be summarized as follows:

- 42% of customers are dissatisfied with the cost of Oracle customer service

- 58% are dissatisfied with the quality of customer service but only

- 25% expect Oracle to have a smaller share of their IT budget in the next three years while

- 37% cited factors such as organic growth, purchase of additional Oracle applications and standardization onto Oracle as reasons for an increase in spend in the same three year period.

- The remainder indicated that spend levels would likely remain the same.

As I indicated earlier and despite the above, it is in the qualitative data that we see just how badly Oracle is faring. Some of the remarks are devastating although reviews are mixed. For example:

“Oracle’s help desk process can be very frustrating and time-consuming. However, Oracle’s willingness to engage development resources and other internal resources on our behalf has been impressive."

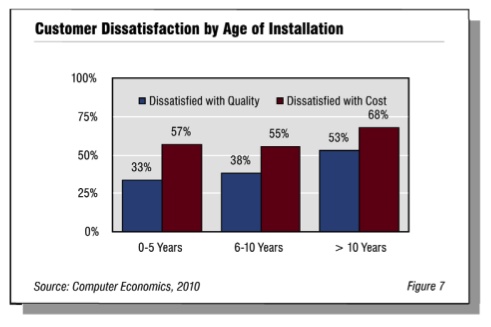

The report notes that the longer a customer has been using Oracle, the more likely they are to be dissatisfied. Some of those same customers hit hard at Oracle. A PeopleSoft customer of 13 years' vintage said:

Oracle has tried to live in the past with the model that says, ‘Once you’ve hooked them, you’ve hooked them for life.’ With SaaS [Software-as-a-Service] options out there, they need to be more interested in pleasing their installed base or they will lose us, guaranteed.

That is interesting because if typical then it lends a lie to the perception that an enterprise software vendor has a customer for life.

Some complaints were typical of what we see in the market place more generally and especially for those customers that have been with a solution for a number of years:

Another customer was annoyed by a recent experience in resolving a production issue. “The entire process takes too long,” he wrote. “We had a major system outage of a critical business application. The opening of the support ticket and the method of posting and retrieving information was horrific. We had to [repeatedly] contact our local sales rep for assistance in escalating the ticket.”

SAP has similar issues from time to time.

As the report authors point out, the time factor is important and lends weight to the idea of tiered support, a topic that colleague Vinnie Mirchandani has long argued and for which we see continuing interest. When viewed through that lens it is hardly surprising that third party maintenance providers are willing to step in.

RiminiStreet believes it can create a scalable and profitable business even though it is halving the cost of Oracle and SAP maintenance to those customers prepared to use its service. That should not surprise when we know that Oracle reports margins north of 90% on this line item.

The report is packed with comments of a similar nature that help shed light on why Oracle customers are dissatisfied. I cannot believe that Oracle is unaware of these issues. However, Oracle refuses to budge on this point leading to other points of discussion:

Another customer, a PeopleSoft and Primavera user in a public utility organization, indicated how difficult it is to contract with Oracle for some flexibility in managing costs. “The Oracle maintenance and support program is inflexible,” he wrote. “It is impossible to scale down during hard economic times, which forces us to look for complete alternatives. A more dynamic contracting framework [that] would allow us to increase and decrease our application footprint would allow us to make a long-term commitment to Oracle. As it is, Oracle is presenting us with an ultimatum: all in or all out.”

Until recently it has been difficult to get Oracle customers to put their heads above the public parapet and provide nuance to analyst findings. Much of what we have seen could only be described as anecdotal. This report represents a step in a direction that I believe will see customers emboldened to take on their suppliers because the authors have contextualized their findings in a way that makes much more sense than numbers requiring considerable interpretive effort.