Oracle defies gravity, not out of the woods yet

Earlier today, Oracle executives were once again able to boast revenue and earnings on the up in Q3 after a lack luster Q2. That will keep the Wall Street Whiners quiet for a few minutes.

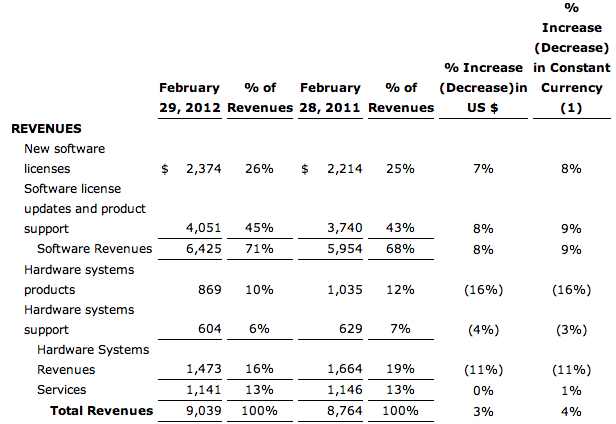

The only major blot on the report book was a slide of 16% in year over year hardware sales coupled with a 4% decline in hardware maintenance revenues. (see image above) Forbes described it as 'inevitable' while sucking up the Ellison & Co kool-aid:

On the call Oracle CEO Larry Ellison made a point of saying: “Next year our hardware story will be a growth story.”

We've heard this kind of rhetoric before. Last June, Bloomberg reported Safra Catz saying:

Hardware sales may rebound in the current quarter, which ends in August, Oracle Chief Financial Officer Safra Catz said on a conference call. Sales of hardware products may range from a 5 percent increase to a 5 percent decline, Catz said.

She was right, but on the wrong side of the equation. However, there is no denying that the company is concentrating upon leveraging margin for what it sees as premium value machines tied to software designed to work exclusively upon that hardware. And therein lies a fundamental weakness. In order for Oracle to enjoy premium value it needs a lock in. Earlier in the month George Gilbert attempted to fathom the likely pricing structure for Exadata and the accompanying appliance for cloud computing workloads. He concluded:

Contrary to Oracle’s claims, neither its Exadata database machine nor its database appliance is a cloud strategy. Both strategies base their pricing on peak capacity, not on elastic metering. Furthermore, discrete hardware is the opposite of cloud infrastructure, which enables near-infinite capacity on demand. Like IBM during the client-server transition, Oracle has the technology to address customer demand. It is just conflicted about the business implications of cloud computing’s metered pricing.

Au contraire says Oracle. From Rachel King's report:

This past quarter Oracle delivered the hardware and software for our new extreme-performance Exalytics In-Memory Machine/ At the core of Exalytics is our new in-memory database technology capable of instantaneous big data analysis; questions are answered at the speed of thought.

And unlike SAP’s Hana in-memory appliance, Exalytics runs your existing applications. Simply plug-in Exalytics and your existing Oracle Business Intelligence applications and Hyperion Enterprise Performance Management applications run much, much faster.

Those remarks and subsequent analyst call are not without problem. Oracle is right to say that SAP Business Suite does not yet run on HANA but we are told progress is swift. I will believe that when I see it. And right now, HANA will not be a replacement for Hyperion, the de facto market leading reporting application. The BusinessObjects people will be up in arms but let's call it as it is. On the other hand HANA is currently solving a different set of problems than those for which Exalytics is designed.

Much was made of its cloud efforts with CEO Larry Ellison, declaring:

"After a long period of testing…Oracle’s cloud applications will be generally available. We’ve named our cloud the Oracle Secure Cloud.”

Note the 'will be' reference. In prepared remarks, president Mark Hurd said:

Oracle president Mark Hurd responded in prepared remarks that “Fusion in the Cloud is winning with great success against niche HCM cloud vendors in the US and worldwide,” and that Oracle’s “modular, integrated platform of 100 apps available in the cloud or on-premise is a key differentiator.”

Which is it? Available now or at some as yet undetermined period in the future? Larry Dignan provides some sharp analysis on this topic noting that Piper Jaffray survey of partners reveals:

In a research note, Piper Jaffray analyst Mark Murphy noted that 47 percent of Oracle partners noted that the company’s cloud computing strategy hasn’t gained tractions. Another 38 percent said there was limited traction. The problem? Oracle is seen as late with its cloud strategy and is trailing amid tough competition.

More to the point:

It is complicated and a pain in the ass. Most people don’t even know who to go to, to figure out pricing.

That is a recurrent theme I hear in the field but with occasional nuance such as Fusion IS available now. I've yet to hear from customers and have not seen a price list. On the one hand we have Oracle playing a sleight of hand declaring futures but giving the impression that cloud is real now while the reality on the ground remains confused. As far as I am concerned this is blowing smoke where the sun don't shine.

As with all earnings calls of this kind, Oracle can bend the numbers to suit itself (because they're not separately broken out) and then spin to its heart's content, certain in the knowledge that most people will concentrate on the sound bites. The trouble is that with uncertainty on the future of its hardware efforts and a certain fogginess around its cloud statements (sic), Oracle has some explaining to do.

Right now, the rhetoric cannot quite cover the widening gap between what observers see on the ground and confident marketing statements. Put bluntly, Larry Ellison is increasingly looking like a CEO who is out of touch with operational reality.