Oracle Q4 turns in strong revenue and earnings

Oracle's fourth quarter and full year earnings announcement were more or less in line with market expectations, posting non-GAAP earnings at $0.60 per share on Q4 revenue of $9.6 billion. This was up 40% on the previous year. Hardware systems products and support which relate to the Sun acquisition brought in $1.8 billion.

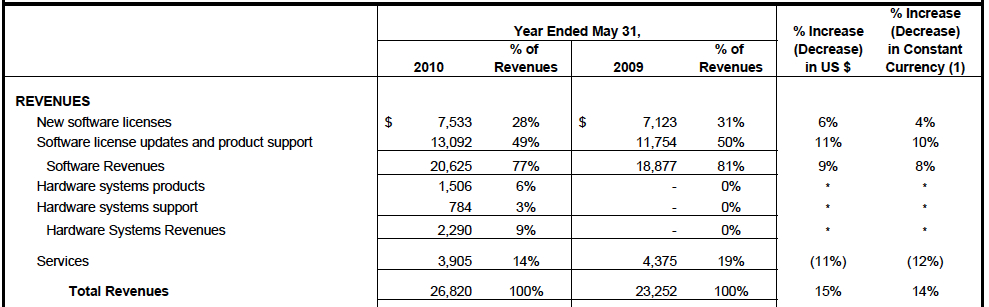

For the full year, Oracle recorded $7.5 billion in new software licenses, up 6% while support and updates ballooned 11% to $13.1 billion. Even after taking the $2.3 billion Oracle generated from the Sun deal, Support represents 49% of total revenue.

By the numbers for the full year:

Oracle's ability to manage market expectations is becoming routine but even these figures surprise given the relative softness in the enterprise market. I still hold the view the company's hammerlock on customers cannot continue forever at current margins but it is hard not to admire the company's ability to not only maintain growth but continue to add to its cash pile which at year end stood at $9.9 billion with marketable securities standing at $8.5 billion. This compares with $9 billion and $3.6 billion respectively. On the flip side, borrowings grew $4.4 billion to a total of $14.6 billion.

As has become tradition, Oracle took pops at SAP with president Charles Phillips noting: “Over the last twelve months Oracle’s applications business has grown 5% on a constant dollar basis while SAP’s business has declined 24% over their previous four quarters. This trend has been going on for a long time: Oracle’s applications business has grown 60% in the last four years while SAP’s business is 7% smaller than it was four years ago.”

Ahem - and it cost how much in acquisitions to get there?

This post will be updated following the financial analyst call.

UPDATES

The non-GAAP operating operating margin was 46% and is expected to rise in 2011. Notable quotes:

Safra Catz, Oracle president noted that: "We are no longer selling Sun at a loss...our sales teams are compensated on margin...There is no doubt that our customers in the UK have been impacted but we now have so many products. There is no doubt we need to get to a new baseline for the hardware business but remember we are selling many more products. Customers are buying a lot of hardware."

"You should know we are focused on growing the Sun business and growing it rapidly...we are adding lot of sales capacity...we are going to more than double the Sun sales force," said Larry Ellison, CEO Oracle.

"We have many more touchpoints with our accounts...and almost any decision they make in the data center could potentially involve Oracle," said Charles Phillips adding that "Edge applications continue to do well in SAP accounts."

Interestingly, while there was much emphasis on Oracle's ability to cross and upsell as a result of the Sun acquisition, there were no questions on the much anticipated rollout of Fusion Applications.