Outsourcing picks up for smaller enterprises

The outsourcing market has traditionally been perceived as something only the larger enterprises entertain. Research from Computer Economics suggests that as the large enterprise business has become tougher, the outsourcing companies are getting better at reaching the smaller and mid-sized market.

The reports author concentrates on providing the stats and not adding a huge amount of analysis but even so, there is plenty to chew upon. I called up Frank Scavo, owner of CE to get his take on a few of the numbers. "These findings suggest the outsourcers are doing a much better job of communicating their value proposition into the small and mid-market. That's interesting because while traditionally we tend to think smaller companies are willing to try new things, in this market at least, they are surprisingly conservative."

From the report's key findings:

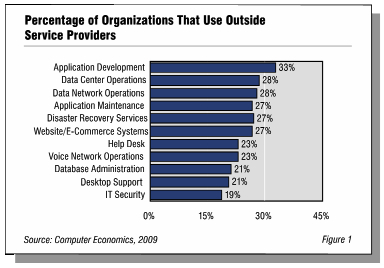

- Outsourcing services gaining the most strength among customers include help desk, desktop support, data center operations, and website/e-commerce systems outsourcing. Large organizations, in particular, are making greater use of help desk outsourcing.

- Outsourcing services making the smallest gains are application maintenance, application development, and data network operations service providers. Application development, while still the single most frequently outsourced function, is losing ground in the current economic environment as organizations cut back on project-based work.

- The three most popular IT functions to outsource include data center operations, disaster recovery, and website/e-commerce systems. These IT functions are both frequently outsourced and outsourced at relatively high levels compared to other functions in this study.

- The typical IT organization spends about 5% to 6% of its total IT budget on outsourcing services. This is true regardless of the organization’s size.

- IT organizations are experiencing the most cost overruns with application development, website/e-commerce systems, and data network operations outsourcing contracts. They have the easiest time predicting costs for IT security, voice network operations, and data center operations outsourcing contracts.

- Application development and application maintenance are most-frequently offshore outsourced IT functions, while disaster recovery services and IT security are the two functions least likely to be sent to offshore service providers.

It was particularly interesting to compare the experiences in applications development between small/mid size and larger enterprises. According to the report, 34% of small/midsize businesses experienced cost over-runs while the figure was 24% for large enterprises: "We know that application development is notorious for cost over-runs and so it has proven. I suspect that the smaller businesses have yet to fully understand what they're buying into, how to negotiate and so on. They'll get better at this but will need some help along the way," said Frank.

Another area of potential confusion is that outsourcing is synonymous with offshoring. According to the survey results this is far from being true with 24% small/midsize and 46% large companies opting for an offshored offering. From the report:

Keep in mind, however, that while the frequency of offshore outsourcing may be rising, this does not mean the actual size of the market for offshore service providers is rising. Along with most other technology vendors and service providers, offshore service providers are experiencing the effects of the recession and a slowdown in IT spending. In particular, capital spending on application development projects, one of the most widely outsourced functions, is being severely impacted. Still, the percentage of outsourcing customers using offshore service providers is rising.

Data of this kind is always useful, especially when you consider the rates at which outsourcers are able to deliver services at or around the expected costs the customer had in mind. Even so, it is clear from CE's report that the smaller customers have plenty to learn from their larger colleagues.

The report is available here including a free download of the first 8 pages