RightNow: right for now

I've just had an extensive briefing from RightNow, the on-demand customer service solution provider. The company's business model, offering and pace provide a solid case study in what it means to be an on demand provider in a downturn economy.

RightNow turned profitable in Q4 of 2008 for the first time and I was interested in understanding what this means and how they've achieved this position after 11 years in the market. One of the beauties of the on-demand model is that it is relatively straightforward to adjust cost levers. By scaling back some activities, the company could turn losses into pennies of profit without damaging the revenue stream. That's important in a market where, for example, SAP has very publicly said it needs to find some $200 to 300 million in savings. The on-premise 'big box' vendors don't have the same agility. They have large GSA organizations that take some restructuring. You can of course argue that RightNow has the benefit of a relatively small organization that is readily molded to the new economic realities. By the same token it means RightNow is able to demonstrate to the financial analyst community that it represents an attractive investment opportunity.

The company likes to get year long agreements with its customers but will go down to monthly renewals. During our conversation, the company said that while it offers pilot trials, it is seeing an increase in the number of customers that want to enter into multi-year contracts. RightNow encourages that by offering long term deals based on current pricing with no ratchet. That gives customers certainty and transfers the inflationary risk back to RightNow. As Vinnie Mirchandani notes, this is not exactly welcome by the analyst community but reflects a relationship value proposition that can be readily factored into the decision making process.

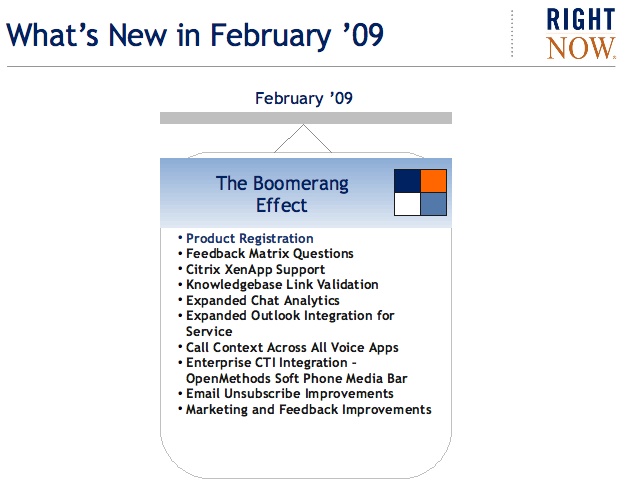

On the product front, the company is in a continuous but controlled release cycle where it delivers new functionality every quarter. That's almost a given these days for the on-demand vendors and again, contrasts sharply with on-premise vendors who typically are in one and two year release cycles.

However, all this innovation goodness has to be consumed. RightNow offers a 24 month grace period during which customers can decide which upgrades they want and when. This is a huge differentiator because it means customers can avoid forced release cycles when they may not be ready. Customers can also skip releases. Looked at through the development lens, it means that while RightNow pushes forward, it always ensures backwards compatibility.

The last six months has seen a change of emphasis in the release cycle. Rather than introducing blockbuster new functionality customers are saying they want incremental step change that improves existing functionality. The idea is that customers should be able to hone existing solutions that are directly relevant to their needs in the current recession. RightNow has some 47 projects running in its labs. Somwe are aimed at new while others are about enhancements. This makes and emphasis switch relatively easy.

One example I saw was the 'product registration' module. Here, the company is responding to the trend for retail customers to buy from warehouse style operations but to have service handled directly by the originating vendor. That requires a registration procedure from which the vending company can target service more effectively while providing the opportunity to undertake new marketing. Another example is widget syndication where the customer is able to deliver context sensitive content, tweaking that according to configurable business rules.

RightNow uses the Microsoft .NET framework as its founding technology. That's interesting at a time when the general impression one gets is that on-demand vendors are eschewing Microsoft for open source or other alternatives. The choice of Microsoft opens the door to a massive community of developers who are used to Microsoft while at the same time demonstrating the massive scale the company has achieved.

Technology vendors like to believe they are making a difference. The current economic climate is showing that older models may no longer be the right choice, especially when you have to rapidly change course. Taking a 'deep dive' discussion with RightNow has been valuable on multiple levels. Business model, go to market and technology are combining to give the company the ability to please both financial masters and customers. More important, the company is signposting the way forward for new classes of application where there really is a different kind of engagement between customers and the vendor community.