SAP reports healthier Q2 2010

SAP has reported its Q2 FY2010 results. They are looking healthier than this time last year but it was something of a mixed bags with declines in professional services margin offset by improvements in software licensing and support margins combined with a continuing emphasis on cost control, despite an expansion in sales and marketing.

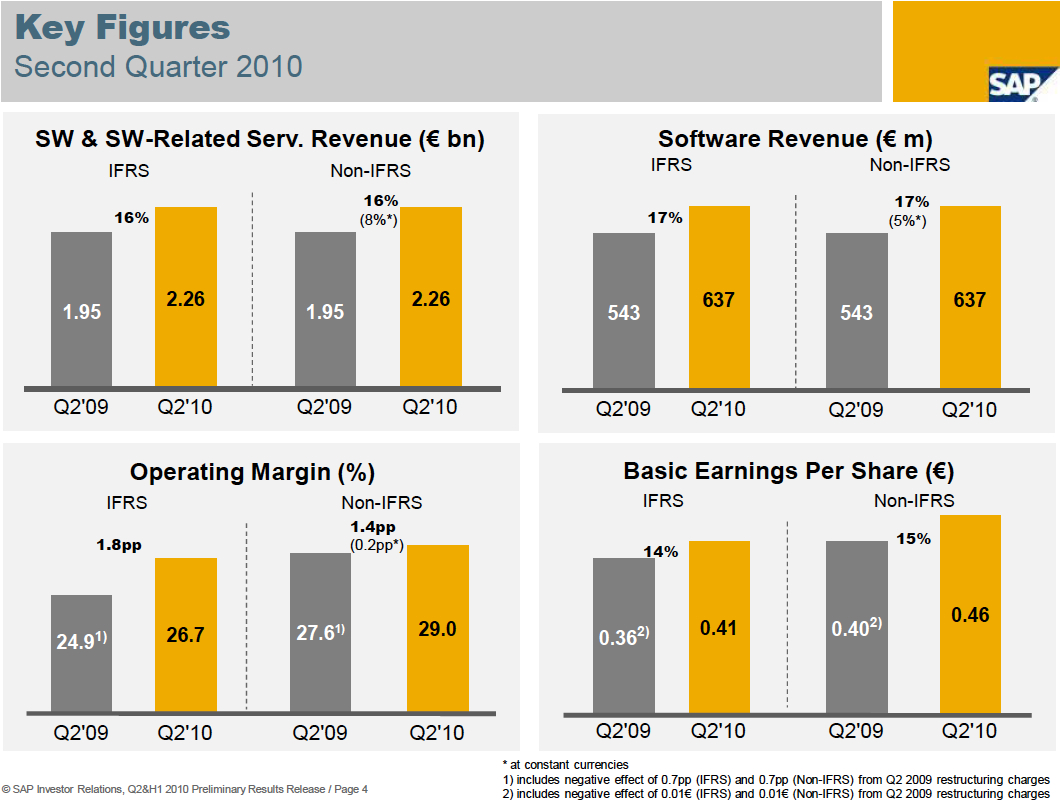

Key revenue and profit numbers (all stated millions euros):

As always, the devil is in the detail. It is worth noting that in the regions and under constant currency measures, software revenue in EMEA fell 9% offset by a 64% jump in revenue in the Americas and an 11% improvement in Asia Pacific year over year. Using the same method of measurement, total software and software related services (SSRS) revenue was strong in the Americas, climbing 28% in the US and 31% in the rest of the Americas.

On a sequential basis total software revenue climbed 37% overall while support revenue grew a modest 9%.

Analysts will be pleased to see a return to growth in the Americas but whether that is sustainable or not depends on many factors including macro-economic confidence. The offsetting fall in EMEA will be a concern, especially given the relative importance of SAP's German home market.

In the press release, Bill McDermott, c0-CEO is quoted as saying: "Customers continue to invest for growth across large, midsized and small enterprises and within many industries. We had outstanding growth in strategic markets like the U.S. and we saw continued double-digit growth in key emerging markets in Latin America and Asia. This solid performance is due to renewed customer confidence, an ever-expanding ecosystem, as well as focused execution on our go-to-market strategy."

Bill's remarks do not surprise. He is the consummate sales person but is largely 'stuck' in the US. From what I am led to understand, the company is preparing to put its foot cautiously on the Business ByDesign gas. That will mean an expansion in marketing spend as the company rolls out its go to market strategy. It is clear from this set of numbers that SAP is slowly getting customers to buy into its Enterprise Support story. I am not surprised given the relative penalties for not doing so.

I expect we will get more color on these results during the earnings call, scheduled for 9am ET.

As an aside, in the last week, both Forrester and Gartner have come out predicting significant growth in cloud computing in the coming years. Some have interpreted this as representing the demise of the traditional software business going as far as to say:

This a SaaS market dominated by vendors that sell services more than on-premise licenses. The growth is proof that the IT kings of the enterprise face the greatest potential disruption as traditional licensing models are replaced by subscription services.

I'm sure SAP along with Oracle and others would have something to say about that. Even so, the fact that subscription revenues are chugging along at a healthy 30% year over year increment will provide some cheer to SAP, even though it represented a modest 7% sequential rise.