SAP's McDermott: 'HANA pipeline 10 million euro a week'

Following on from this morning's earnings announcement I spoke with Bill McDermott, co-CEO SAP with a view to getting more color on the results. Key questions for me centered around the impact of HANA (SAP's High-Performance Analytic Appliance software) on revenue, discovering where SAP is at in Business ByDesign implementations, relative weakness in Germany, an update on the cost mix and the On-Demand strategy.

On HANA, McDermott said that the pipeline is in the 'triple digit millions' and that the pipeline is currently growing at a rate of €10 million per WEEK. He added that SAP is seeing the strongest demand in Japan though there is also strong demand in the US. From conversations I've had with colleagues, demand for HANA is across the board but with an emphasis on retail, CPG and utilities.

On ByDesign, McDermott says the company has already surpassed the 400 customer count which he had previously hoped would be reached by the time we get to SAPPHIRE Now. I will get an update on customer numbers at that event mid-May. In discussing the On-Demand strategy, McDermott said that the indirect channel is growing at a good clip and that the company expects a full 40% of its revenue to come from this source by the middle of the decade. SAP will have to ramp the channel very quickly to achieve that target. The company affirmed that the channel will include large SIs able to sell ByDesign and similar solutions into the subsidiaries of large companies.

McDermott said that revenues from Germany tend to be 'back end loaded' towards the end of the year but the company is satisfied it is slightly ahead of target for that country and that there is 'lots of room to expand.'

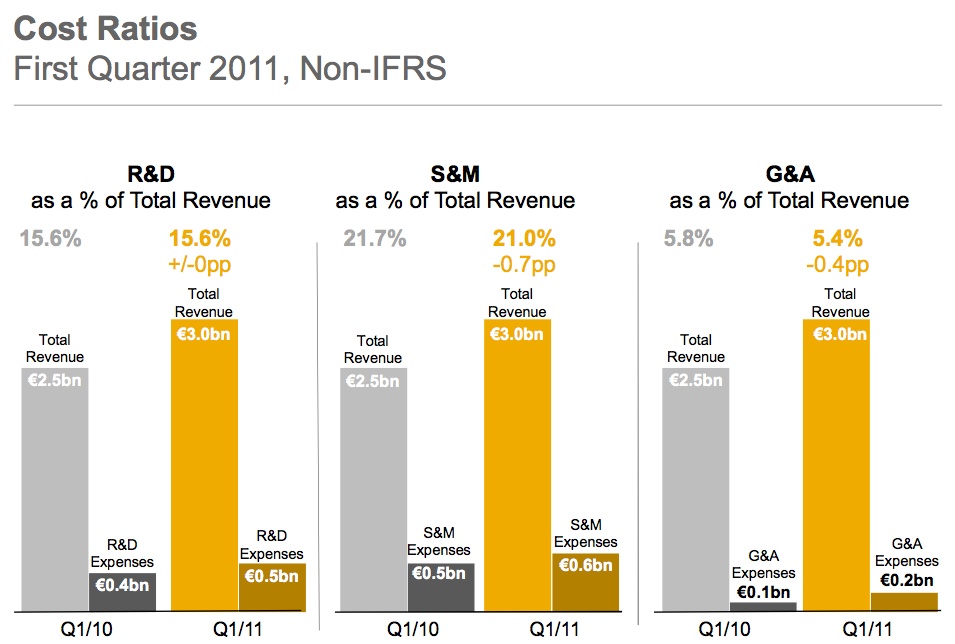

On the cost base, the company has said in the past that it plans to see a relative decline in R&D as a percentage of total revenue. This was something I had queried in my earlier post. McDermott pointed me to an unusually high level of stock compensation being charged in the quarter. While others may be befuddled by this, it makes sense in context of the way SAP compensates its employees and how they tend to exercise options. The cost incurred in this quarter is effectively a one off.

Overall? SAP is adamant that contrary to some analysis - which principally missed the stock compensation issue - the company is on target to deliver in line with what it has said to the market.

Clearly there are detailed questions around the relative importance of the whole On-Demand and ByDesign portfolios but we need to spend more time with SAP on this topic. Right now it appears to be the 'poor relation' from a sales standpoint and if SAP is to meet its stated goals then it will require continued and substantial investment in advance of revenue ramp up. How that impacts the bottom line requires more detail which again I hope to get at SAPPHIRE Now.