SAP's Q2 good enough to help uplift full year forecast

Earlier today, SAP reported Q2 2011 marginally earnings ahead of market expectations. Despite economic uncertainty in the Euro zone, SAP lifted its annual outlook based on better visibility into the forward pipeline. Following the news, the company's share price jumped 6.9% on the New York Stock Exchange.

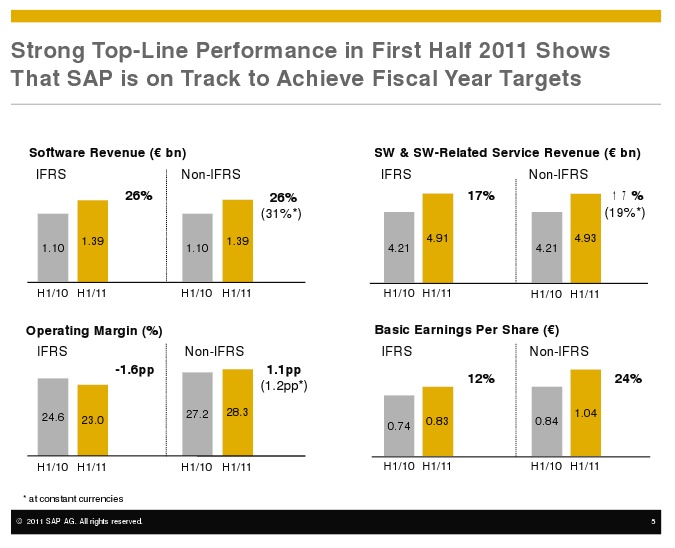

By the numbers:

- Top line revenue grew 14% €3.3 billion ($4.78 billion) from €2.9 billion ($4.2 billion) the previous year.

- Software revenue, which provides a leading indicator of future maintenance fees grew 26% from €637 million ($924 million) to €802 million ($1.16 billion)

- Operating profit grew to €857 million ($1.12 billion) from €774 million ($1.12 billion)

- Cash flow from operations grew to €2.27 billion ($3.29 billion) in the first half of 2011 compared to €1.28 billion ($1.86 billion) in the corresponding period of 2010.

- All lines of business contributed increases over 2010 with support revenue showing the largest absolute gain up from €1.526 billion ($2.215 billion) to €1.681 billion ($2.44 billion), a rise of 10%

- Subscription revenue was pretty much flat at €96 million ($139 million) compared to €95 million ($137 million) in Q2 2010.

- EMEA led the overall growth, rising by 16%, with higher growth of 19% coming from EMEA excluding Germany. The Americas grew 10% while Asia Pacific added 19% with Japan showing the highest growth of all markets, popping 23%

Bill McDermott, co-CEO SAP made the following statement:

“Our innovations such as SAP HANA along with our mobility and business analytics solutions are fueling our pipeline as customers want to grow their business and solve their most pressing industry-specific challenges. Our consistent results and ever-expanding ecosystem demonstrate that SAP is the better choice for customers of all sizes.”

Addressing the forward outlook, the company said that it now expects to reach the high end of its 10 to 14 percent growth 2011 forecast for software and related services, which were €9.87 billion ($14.3 billion) last year.

In recent times, financial analysts have been looking closely at SAP's business, seeking to determine the strength of the HANA pipeline, which, last quarter, was said to be running at €10 million a week. It is unclear from these figures whether that pipeline is coming through in the numbers, a topic I will be raising with Jim Hagemann Snabe, co-CEO SAP tomorrow morning. Similarly I will be asking about progress on Business ByDesign. The numbers would indicate that ByDesign has yet to make any material impact on results.

Note: the numbers shown in the illustration are from SAP's 'constant currency' calculations that seek to smooth out currency fluctuations, which, during the quarter had a €154 million ($223 million) negative impact on costs.