Steve Jobs smart credit move

Regardless of Apple’s economic gymnastics, I suspect it could be in for a rough ride in the coming weeks. While I am an unashamed Mac fanboy, I find it hard to believe the company has done anything other than shoot itself in the foot, generating a lot of badwill in the process. Such an apparent elementary error in pricing judgment so soon after the iPhone came to market cannot be an error in the conventional sense. Jobs is way too smart for that. It has to be deliberate. Therefore while you can always snigger at the people who jumped in early, there is a whiff of cynicism on the part of the company I find hard to stomach.

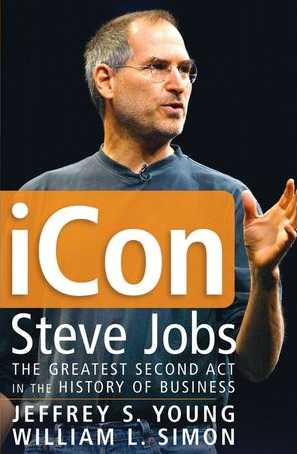

I didn't say that because I actually have an iPhone (I live in Spain) but because of Jobs confirming his a**hole status. If you do a Google search on steve jobs a**hole you get 857,000 hits, which makes Oracle CEO Larry Ellison look positively angelic at 59,400 hits for the same search term.

Today's announcement of a $100 store credit has done plenty to repair the damage. Jason O'Grady certainly thinks so and at first blush, I agree. But being the curmudgeonly accounting type I am, I have a slightly different perspective.

Digging around in Apple's latest quarterly earnings filing reveals that Apple sold $5 milliion worth of iPhones to June 30th, 2007. Petty cash in the context of $5.4 billion total revenues. Overall gross margin is pegged at 36.9% although earlier in the year Gizmodo estimated iPhone margins at 50%. That may have been true earlier on but not now. The recent sales price reduction will have tracked falling costs so it is fairly safe to assume that at the next earnings report, there will be an uptick in margin, especially following the introduction of the new generation iPods. iPhone sales will not have a massive impact on margin as they will come in at less than 10% of total revenue.

While Jobs will draw plenty of plaudits, he's done so in a clever way. On the one hand he plays directly to the heart strings of the Mac fanboys and girls because they get to 'spend' their $100 at his store. On the other, he mollifies Wall Street because he protects his margins. The real cost of redeeming those credits is likely $37-40 so with a bit of luck and a fair wind, Apple could come out net-net even.

The difference is that without the kind of blog media we have today that gives voice to these issues, do you think Jobs would have backed down? I doubt it. Regardless, it is a very good outcome for consumers and one that is sorely in need of replication in the enterprise world where customers are regularly charged premium prices for commodity products. It's such a pity that we see little of those dog eared price books in the public domain.

In the meantime, I wonder if Professor Bob Sutton will be downgrading Steve Jobs a**hole status. ;)

Image credit: Jaanus