The untold story of SAP and data centers

This story has yet to be written and much of what follows is based upon two brief conversations held with Drs Hasso Plattner, co-founder SAP and Vishal Sikka, executive board member overseeing advanced technologies plus conversations held with partners and SAP Mentors. It is therefore speculative to some degree but should provide a sense of where SAP is heading and act as a placeholder for what we might expect in the future.

First the back story. It is becoming increasingly clear that if you want to be a serious player in the SaaS/cloud space then you have to own your own data centers and infrastructure as far down to the metal as you can go. Google sets the benchmark with custom designed, commodity servers. Facebook is following a similar path as is Microsoft. Amazon sets storage benchmarks.

During SAPPHIRE Now 2011, our discussions with executives revolved around the three major themes that were much anticipated: HANA, mobile and on-demand. Each of these has a cloud twist to it with SAP telegraphing its ability to run HANA in the cloud, its drive to gaining customer share with its mid-market Business ByDesign solution and on-demand products starting with Sales On-Demand plus mobile which to SAP equates to 'any device, anywhere.'

Right now, SAP only has a modest data center in Walldorf serving its 500 ByDesign customers. As it scales out, that investment needs augmenting by other data centers which Dr Plattner says will take the usual pattern of US/Europe/Asia. Those same data centers will need to be designed around the different needs of OLTP systems and large scale analysis along with the myriad of other uses SAP envisages. Dr Sikka believes for instance that its Smart Grid project, that could reach 1.5 billion users will require something like 2,000 servers. That's a drop in the ocean when compared to the total required compute power running 100K plus SAP systems for more than 10 million daily OLTP users.

Today, SAP has a joint development initiative with Dell and Intel to build what Dr Plattner describes as 'high end' commodity servers. These will not be of the kind that Google employs but he did use an expression that I thought was usually reserved for Google and Facebook: supercomputer.

If SAP is serious about these initiatives then it has to ramp investment quickly. So far we've heard very little about its plans other than that already reported. Having had a few days to mull it over and look back at what others are doing a few facts stand out:

- Facebook is actively investing many millions.

- Microsoft has been investing since 2008 and is rumored to be throwing $500 million at each of its new data center investments.

- Amazon continues to invest massively in real estate for future capacity across the globe.

- Google spent $890 million in the last quarter on data center capacity.

Each is investing eye watering amounts but will SAP be prepared to play the same game? In it's last quarter earnings announcement, SAP said it had about $3.2 billion in total free cash flow. It also has access to considerable borrowings if it so chooses. If it decides to make bold investments then how much will it commit?

Neither Dr Sikka nor Dr Plattner wanted to put a number on it but Dr Sikka said that last year's $5 million was 'peanuts.'

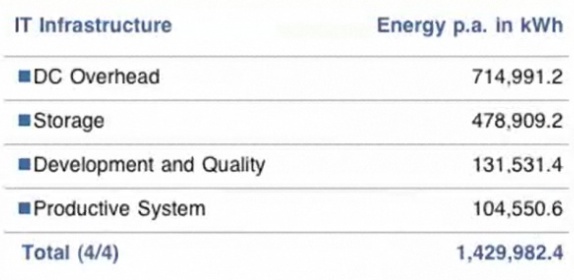

What about the other side of the coin? Potential savings and revenue generating opportunities? In a presentation made at DKOM, Peter Graf, SAP's chief sustainability officer showed a slide indicating the costs of running SAP systems globally. The graphic below tells the story:

I have no insight into how those numbers were compiled but given what SAP was saying at SAPPHIRE Now about the ability to compress data plus the effect of Moore's Law on SSD prices/capacity, there must be huge savings that SAP could instantiate and pass on to its customers on storage alone.

Google etc has shown how investing in massive data centers reduces operational cost (or rather increases operational capacity - it has the same effect) so again, if SAP goes down this road, how much could it carve out of the overall cost equation and especially that charged by IBM, Accenture and many other outsourcers while expanding its reach with on-demand and mobile offerings?

In a meeting with Bill McDermott, co-CEO SAP I produced some dog rough, back of fag packet calculations on providing mobile applications via subscription services. My numbers can be 90% inaccurate on $2-5 per month subscriptions and I still beat out the best case scenarios for SAP selling infrastructure to its customers.

Salesforce.com has shown that modest price points combined with multi-tenanted and efficient operations produce stunning margins.

To my mind, the business case is not only clear but essential if SAP is to give customers what they want while reducing TCO. Bridgette Chambers, CEO ASUG and Otto Schell, board member DSAG said similar things: SAP wants us to invest more but it is reluctant to show how it will deliver value. This is one way to crack that nut. In conversation with Jim Snabe, co-CEO SAP he told a war story about a company he spoke with that was spending $1 billion on technology a year. He committed to reducing spend considerably in exchange for increased investments designed to deliver value. That deal worked out well for all concerned. It is a tale I am sure is capable of repetition many times over. I am equally convinced that the data center play provides the spark for exploding customer wide savings and improved value delivery.

It is a view shared by Vinnie Mirchandani but with more skepticism:

Given the track record around its core, I am not so sure. I can easily see SAP ignoring Apple’s and Google’s mobile ecosystems built by an army of entrepreneurs and continue to rely on its old faithful services partners. I can see SAP continue to avoid building its own data centers and continue to rely on its hardware partners. And a few years from now, we will be bitching about outrageous mobile roaming charges, ridiculous hardware requirements for in-memory computing and who knows what else.

In private email to Vinnie I said it was a great loss to the discussion that he could not make the meetings with Plattner and Sikka. Vinnie has a far better handle on the economics than I and I am sure the conversations would have lit him up - if nothing else to have ammunition for holding the company's feet to the fire in future meetings.

None of this matters if the SAP board doesn't approve large investments though as I noted elsewhere, some board members think it is inevitable. If so then SAP must also take the opportunity to disrupt its partner ecosystem, bring them into the new reality and do what it has not done for many years: actively manage customer cost. It is all part of the package and not an afterthought.

And one more thing. I found it fascinating to see how Facebook operated a form of open sourcing for its data center design. SAP has many thousands of very bright people in its community. I wonder how many of them would actively contribute towards helping SAP figure this one out in a manner similar to Facebook's Open Compute. I suspect the answer is: quite a lot. If correct then that combined with the advanced thinking coming out of the Hasso Plattner Institute gives SAP its best opportunity to capitalise on the latest ideas around data center design in an eco-aware society. That's transformational.