Payday loan firm 'targets students' online, the warning remains clear

In the midst of public outrage and fury aimed at Wonga, an online payday loan firm, a website page publicising their services that 'targeted' students has been removed.

Following the U.K. Coalition's reforms of higher education, which will see fees rise as high as £9,000 per year in 2012, resultant panic among students who are unsure if they can afford university could mean more companies are likely to go for the jugular and play upon these emotions to gain loan customers.

Students need to make sure they are aware of exactly what they are signing up for.

Before the offending page was removed, the Wonga page stated:

"Student loans are usually far cheaper than your standard personal loan. But there can be a downside -- you potentially end up borrowing more than you need, while a nasty debt accumulates for your graduation that could take years to repay. With a Wonga loan, the interest rate is much higher, but you only borrow it for a month and pay the loan back on a date that suits."

MP's, students, and charities called for the page to be taken down. In less than 24 hours it was removed, and the loan service cited 'search engine optimisation' as one of the reasons the 'several years old' page existed.

Martin Lewis from Moneysavingexpert.com, posted the Wonga page on Twitter to 82,000 followers -- calling the company a "moral disgrace".

Wonga has now taken the offending page down, stating:

"We listen to our customers and public opinion, so it was clear the old article here gave rise to misunderstandings. [ .. ] We make decisions based on thousands of pieces of public data, not someone's educational status. A student would need to have a regular income to be considered for a loan and students represent a miniscule proportion of our customers."

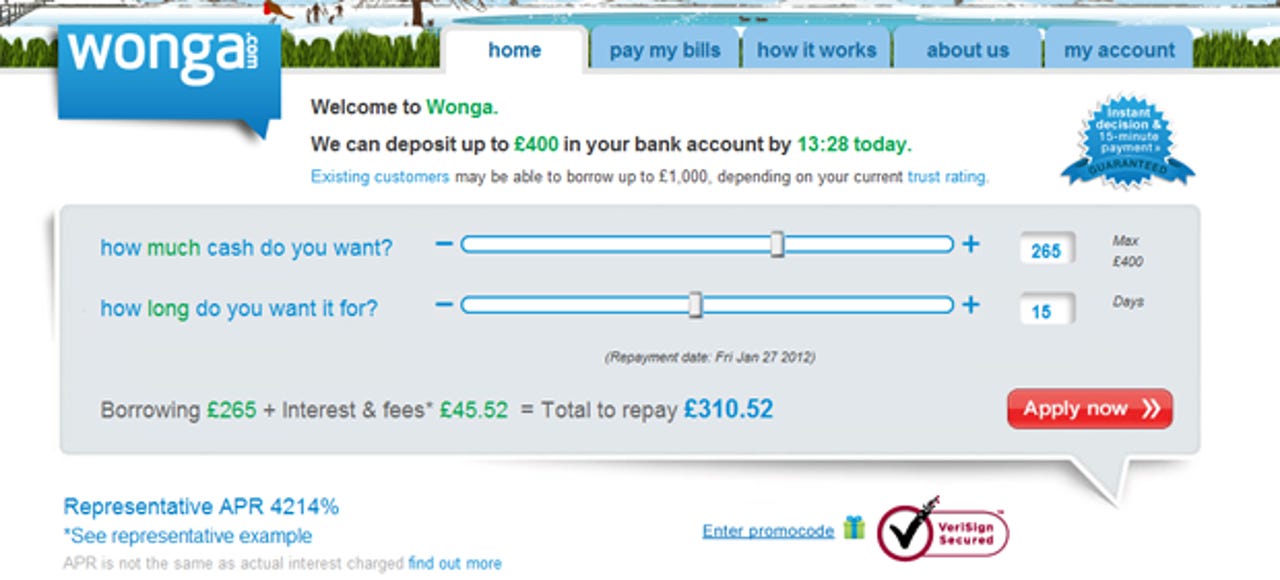

The services Wonga 'marketed as an alternative to Government-based student loans' may have now had its offending article removed, however, the warning remains clear. Students need to research any alternative loans thoroughly before signing up through private companies, who often charge APR rates of between 4000-5000 percent.

The company denies that it targets students, however, it is unlikely that Wonga is the only option students will consider when financial worries cause them to struggle. In the same manner that recent phishing scams have targeted students, convincing language, bright colours, and a friendly interface online can persuade people to agree to things against their better judgement.

A problem the Generation Y faces is that we have grown up with online networks. We also probably trust information seen online more than our predecessors. Students, already hit with additional tuition fee rises, are therefore seen as an enticing target more likely to hit the 'apply' button.

The website page suggested that young people could take out one of their short-term loans for "occasional emergencies or unexpected events". Appealing to day-to-day situations that we all may face and worry about is one of the reasons these kinds of campaigns work.

The U.K.'s NUS (National Union of Students) called this 'predatory marketing'. For young people who are entering higher education and may not have much financial experience, and who may not understand the consequences of applying for these kinds of loans, the online process of submission makes it extremely easy and quick to embroil yourself in.

Perhaps due to the familiarity of online networks and ease in which we exchange information digitally, a panicking fresher is likely to turn to the web for a solution to their financial issues than pick up the phone to their prospective university or college and ask for advice.

Many of our financial transactions are conducted online -- from shopping to applying for government-endorsed loan options. It may be due to this familiarity that in the same way we fill out an online application for public loans, students more easily sign up for private schemes, believing the familiar to be safe, and fail to read the small print.

It is no wonder that private companies may use this fact to their advantage -- and I predict an increase in these kinds of online campaigns in the future.

Related: