Don't look now, but Microsoft is starting to morph into a three-headed cash cow

Windows and Office traditionally have fueled Microsoft for decades. Critics love to point out that Microsoft is a two-headed cash cow and that the rest of the company's businesses do little to power it.

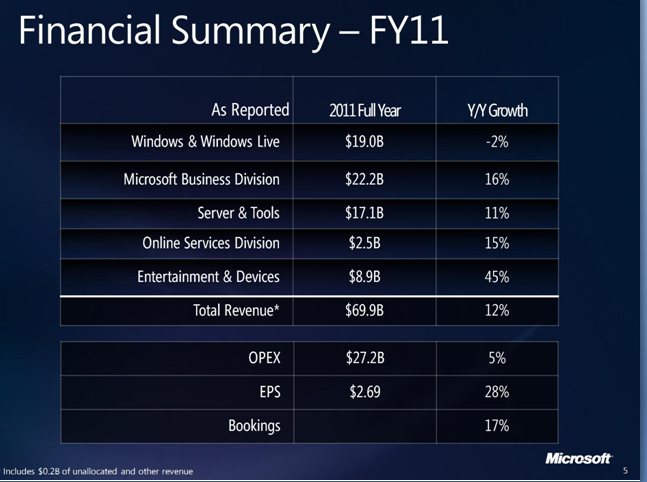

Microsoft's fiscal 2011, for which the company reported earnings on July 21, may finally put that adage to rest. Microsoft is on its way to becoming a three-headed cash cow, with the Windows, Business (Office) and Server and Tools units all feeding the Redmondian beast. Check out the breakout for FY 11 from Microsoft's earnings slide deck:

(click on the table above to enlarge)

Microsoft revenues for FY 2011, which ended June 30, were $70 billion (as ballparked a few weeks early by CEO Steve Ballmer). Office contributed $22.2 billion, Windows/Windows Live contributed $19 billion, and Server and Tools another $17 billion. Server and Tools is the business unit which is responsible for Windows Server, SQL Server, System Center, Visual Studio and Windows Azure, among other products.

However, as my blogging colleague Larry Dignan quipped this evening, the Server and Tools "head" is rather a skinny one (or let's call it pleasingly plump). While operating income for Office was $14 billion, and Windows was $12 billion, Server and Tools was $6.6 billion.

It's still worth noting that Microsoft is slowly but surely making good on its plans to diversify beyond its two biggest successes. Server and Tools is where the future Microsoft cloud action is centered. And its home to several of Microsoft's current $1 billion+ businesses (System Center and SQL Server are both in this category).

Xbox, by the way, also is one of Microsoft's $1 billion+ businesses already -- and an area of key marketing focus for Microsoft as the company works to polish its image as a "consumer" company. But the Entertainment and Devices division where Xbox lives is still smallish compared to the other units, with $8.9 billion in revenues and $1.3 billion in net income for the past fiscal year.

I'll update this post during and after the earnings call at 5:30 p.m. ET. In the meantime, see "Microsoft rides corporate upgrade cycle, crushes Q4 target" and "Microsoft's online sinkhole: $8.5 billion lost in 9 years" for more on the Q4 numbers.

Update: The word of the day for Microsoft was enterprise. As I noted above, Server and Tools -- which is predominantly enterprise-focused -- is cooking with gas. In Server and Tools, multi-year license revenue grew 12 percent and enterprise services revenue grew 14 percent, officials said. Premium Windows Server and System Center revenues were both up over 20 percent, and SQL Server Premium revenue grew almost 20 percent, officials said.

Other divisions got a big boost from enterprise, too, including the Business Division (where Exchange, Lync, SharePoint and Dynamics live), as well as Windows. Enterprise deployments of Windows 7have increased almost 50 percent since March 2011, Microsoft execs said today.

Windows division revenues were down for both the fourth quarter and the FY 2011 year, as was operating income. Why? Netbook sales were way off, and consumer Windows sales are slowing. What's not slowing is business sales of Windows. From Microsoft's 8-K (as noted by @sharonpianchan), for Q4 FY 2011 compared to Q4 2010: "We estimate that sales of PCs to businesses grew approximately 8% this quarter and sales of PCs to consumers declined approximately 2%. The decline in consumer PC sales included an approximately 41% decline in the sales of netbooks."

Oh, one more thing: Although Microsoft officials wouldn't say on the call which division gets the credit for monies received from IP licensing for Android, it is, indeed, the Entertainment and Devices unit (where Windows Phone lives).