Economic crisis as a technology change agent

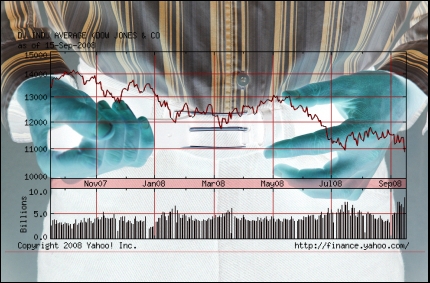

Sometimes, to make an omelette, you need to break a few eggs. However if this week's bloodbath on Wall Street is any indication, then I would say we've made ourselves a full-blown deep dish quiche the size of Yankee Stadium with tens of billions of cartons of eggs. The biggest and most costly damn quiche that you've ever seen, and the likes of which we can hardly afford the indigestion from.

Click on the "Read the rest of this entry" link below for more.

What has happened to Bear Stearns, Citigroup, Lehman Brothers , Merrill Lynch and AIG this year is tragic, and we all know what caused it, which is the subprime mortgage crisis. We all know that this is going to have long lasting effects on the economy and international markets, and that the lives of millions of Americans are going to be affected by the death throes of some of the biggest financial institutions in the world. We can also be certain that the ensuing belt tightening that is going to follow will have a lasting impact on all kinds of spending habits by large corporations as well as individuals, and most certainly will affect spending on technology. The question is, what forms will these changes take?

Clearly the IT services sector is going to have to diversify, particularly those firms which are so heavily focused on dealing with some of these monster-sized financial companies and that engage in big, risky contracts. However, as my colleague Larry Dignan said recently, there is still a lot of room for those firms which have skill sets and experience doing Infrastructure Consolidation.

Infrastructure Consolidation in and of itself is a change agent because as IT spending decreases and the inevitable headcount reduction associated with it also comes into play, we will see many disruptive technologies that wouldn't necessarily see such aggressive adoption come more to the forefront -- case in point, Virtualization, Open Source, SAAS and Cloud Computing. Sure, all these technologies were on the radar in many firms, and they've had their initial pilot projects and the tires have been kicked, but in the new economy, these are going to be recognized as essential components of the reference architecture which is going to allow everyone to do more with less and will become the new model of business computing going forward.

Virtualization solves server sprawl, which begets greater investment in virtual infrastructure and for the largest of companies, mass consolidation of distributed systems on mainframes and large scale midrange systems (the "Big Minis" like IBM's pSeries 570/595 and HP's Integrity systems). Virtual infrastructure and mainframe consolidation begets use of Linux and other Open Source technologies on the server as increased software license costs and the traditional Wintel model starts to become less viable and breaks down.

Once all the server infrastructure is consolidated and we've reduced data center operational costs and moved more and more of our applications to SOA/Web Services in large enterprises and SAAS/Cloud Computing in SMBs that are less tied to managing their own infrastructure (case in point, the increasing popularity of services such as Salesforce.com) the focus will inevitably head towards the desktop and eliminating as much of that infrastructure as possible with Thin Clients, Desktop Virtualization and Linux, or a solution that combines the two.

While this thrashing about on Wall Street is distressing for everyone, myself included, the silver lining may be that the paradigm shift we were all hoping for may be coming quicker than we thought.

Will the economy force us to do more with less and use radical enabling technologies to help us accomplish it? Talk Back and let me know.