Phishing for your tax return

Tax season is right around the corner and the phishing attacks are ramping up faster than the auditors.

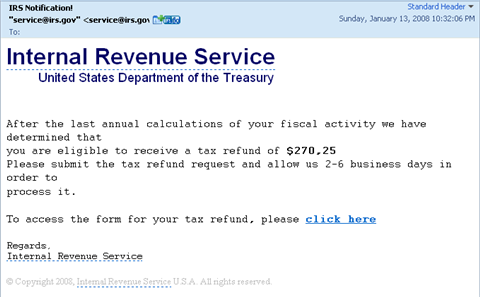

For instance, this email landed in my inbox on Sunday.

While returns are nice I found it amazing that the IRS could figure out how much I should get before I even get my 1099s and W-2s. Amazing. The "click here" link sends me to: http://astrasong.ru/mp3/.spre.php

Double bonus: A Russian site and some music along with my return. It's my (un)lucky day.

These attacks will probably be more successful (and credible) the closer we get to the April 15 deadline.

Also beware the fake IRS site. Trend Micro last week outed a few fake IRS web sites as a public service.

TrendLabs researchers have discovered a number of bogus Internal Revenue Service (IRS) Web sites containing links to a host of malicious .EXE files. These bogus Web sites try to appeal to the attention of business managers and accountants to click on the links supposedly pertaining to information on the latest updates on corporate tax laws.