SAP Business ByDesign Update: Multi-tenancy, In-Core Memory DB and More

It's not a mirage, Business ByDesign is coming!

This week, several of the Enterprise Irregular bloggers (i.e., Jon Reed, Redmonk’s James Governor, Michael Krigsman and I) were given a briefing on SAP’s Business ByDesign product by Jeff Stiles, Rainer Zinow and Christoph Behrendt of SAP.

Business ByDesign is a SAP application software suite the company announced in 2007. The software is a software-as-a-service (SaaS) product and is remarkable in its overall product breadth.

Since its initial debut the product has had a subdued/constrained rollout. Specifically, SAP wanted the time to refine their SaaS architecture to enable better multi-tenancy capabilities and to create a winning channel environment that would be profitable for both the partners and SAP. To that end, Business ByDesign sales have been limited to six countries for the last year or so.

This week’s briefing quickly illuminated the following:

- Business ByDesign sales will continue to be limited to the same six countries.

- SAP believes it has reduced the TCO (total cost of ownership) of Business ByDesign by 20X

- Business ByDesign is now SAS 70 part II certified

- SAP has enhanced the user interface within the product

- SAP has introduced a volume reselling pricing plan for the channel partners. It has also created a revenue sharing plan for the partners, too. Note that SAP has not changed its pricing for the product. It’s still $149/user/month.

- The company expects sales to take off measurably in 2010 but I would suggest that it make take much of 2010 to get the sales volume to climb demonstrably as it takes time to train channel partners, develop a sales pipeline, etc.

- Unlike other SMB (small-to-medium sized business) applications from SAP, this product line is still being run on SAP’s own data centers and hardware. SAP had sold its hosting center to British Telecom earlier in the year but this center did not support the SaaS solution.

- When Business ByDesign is involved in a competitive sales situation, there is little consistency in the competition it faces. SAP representatives told us that in 10 recent deals, about 40 different SMB application vendors were involved. Microsoft products were not seen as often as SAP expected; however, one SAP executive indicated that there are over 300 SMB ERP (enterprise resource planning) product lines for sale in Western Europe alone.

- The typical Business ByDesign customer is a cost conscious firm. They are firms that can use a fairly standard ERP solution (as opposed to customers who must have customizations or insist on numerous non-standard modifications).

- The ideal Business ByDesign channel partners will be firms that can create extensive and market relevant vertical extensions to the Business ByDesign product line. Like NetSuite did a couple of years ago, SAP has come to understand how important it is to find partners that are really more software developers than just generic implementers.

- The relationship between SAP and its Business ByDesign customers will be secondary to the relationship between the Business ByDesign channel partners and their customers. That fact was borne out in a panel discussion on Tuesday where a number of SAP’s SMB customers discussed their experiences in a panel discussion. The channel partner is the key to customer satisfaction, product knowledge, support, etc.

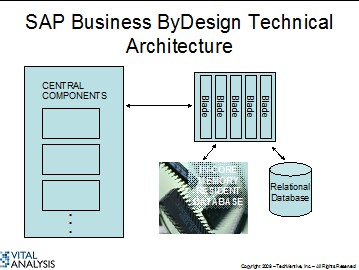

Next, we got into a lengthy discussion re: multi-tenancy and Business ByDesign. Rainer displayed a slide very similar to the one below (if my rendition is incorrect, I assume someone from SAP will correct me).

Originally, SAP could support approximately 20 concurrent users (not customers) per blade. Today, the company believes it can support 150-200 concurrent users/blade. SAP believes it is now practical to achieve multi-tenancy within a blade. The improvement in capability, if I understood it correctly, comes from the following:

- blade capacity and capability continues to grow a la Moore’s law - SAP has moved much of what filled up a blade to other locations

That latter point is worth discussing in detail. SAP has created a number of ‘central components’. These are data and processing constants that do not change because of a single customer. Think of these components as containing functionality and tables to support: tax calculations, printing services, knowledge management and more.

Next, SAP has moved customer specific data to a relational database. This database is stored on a more traditional disk storage device. I did not get a chance to ask if SAP’s blades are configured with on-board disk storage as well. I suspect they do as this allows the blade to more quickly process certain customer specific requests in a more rapid fashion as customer unique configuration requirements can be permanently loaded here.

Alternatively, SAP is also ramping up its use of in-core, memory resident technology. A 1 TB (terabyte) memory database was discussed. SAP is bringing over T-Rex and Business Objects technology here to optimize reporting, analytics and other capabilities with in-core technology. Going forward, more ERP vendors will be moving more and more data and functionality to in-core technology as its speed dwarfs that of data served up from traditional servers. Relational databases will become more focused on data recovery, backup and permanent storage. In-core database technology is faster as there is no seek time or other latency issues.

Multi-tenancy, by definition, means that a vendor, like SAP, could issue one code patch and have it simultaneously be applied to all of its customers. The goal of multi-tenancy is to reduce maintenance costs for the vendor and the customer. If the vendor must apply upgrades to each customer individually, then this environment is no different from what on-premise solutions offer. From what I gleaned from this briefing, SAP has carved up their product to put different components into different spaces so that upgrades/updates can be applied appropriately. For example, the central components would only need one patch to be effective for all customers. Customer specific data is mostly relegated to the relational database and should remain relatively unchanged for updates unless a data structure change is mandated. How SAP handles that, I do not know. When processing logic must be changed (e.g., to permit new functionality), then it would appear that these changes will be rolled through, one blade at a time. On that point, I’d double check this with SAP.

Will Business ByDesign become the next R/4 or R/5? While a number of bloggers have speculated on this, I was pointedly told: NO. The company intends to share product innovations from each platform (Enterprise, BusinessOne, All in One, Business ByDesign) with other platforms.

Going forward, SAP executives realize that they must re-create the buzz and excitement that existed when the Business ByDesign product debuted. Energy and market excitement are needed to get both prospect interest and channel partner interest up.

FTC Blogger disclosure: SAP provided flight and hotel accommodations for me and dozens of other market analysts to attend their Influencers Summit in Boston. Ground transportation, airport travel, parking and other expenses were not covered by SAP. SAP did not pay me for my time or for anything I may write or may have written concerning this event.