Taleo's November to forget

An HR Soap Opera

This month hasn’t been a good one for Taleo. Here’s the timeline of events and an analysis of the lawsuits that are originating from recent events.

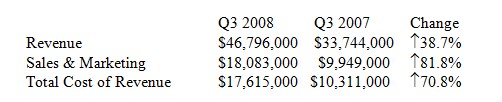

On 11/3/2008, the company announced its Q3 earnings and they didn’t delight Wall Street. While the company added 230 customers and reported record earnings, net income went from $2,233 million in Q3 2007 to a net loss of $ (8,151) in Q3 2008. From my quick review of their financials, one can see:

- a number of adjustments being made to account for the acquisition of Vurv (This is not unexpected) - Sales & Marketing costs, relative to revenue seem to have grown materially since last year. - Cash on hand has materially dropped. From 12/31/2007 to 9/30/2008, cash and equivalents has dropped to $49,004,000 from $86,135,000. That’s a reduction of about 43%.

Then, on November 10, 2008, Taleo reported that its auditors, Deloitte & Touche, LLP, wanted the firm to re-evaluate its revenue recognition processes and/or results. Taleo filed notice with the SEC that its financial filings would be late while it re-examines its books.

The stock price for Taleo is now way off the mark from its 52-week high. I looked up Taleo’s stock performance on Yahoo finance (Symbol: TLEO). This Yahoo chart (click on image to see the full picture) pretty much sums up the stock’s performance of late:

On November 17, 2008, Taleo and its executives were apparently sued by shareholders in US District Court for California. Plaintiffs are alleging that Taleo accelerated the recognition of revenue.

Then, on November 18, 2008, Taleo was notified by NASDAQ, the exchange where its stock is traded, that it is no longer in compliance with their listing requirements as a consequence of the delay in its reporting Q3 earnings to the SEC.

Today, November 21, 2008, BusinessWire reports that a law firm, Hagens Berman Sobol Shapiro LLP , is investigating potential securities fraud action against Taleo. Specifically, the firm will investigate whether Taleo and/or its executives conducted “extensive insider selling while improperly recognizing revenues by the Company’s leadership”.

My early read on this is as follows:

- Apparently, some Taleo executives sold off shares of stock they owned in Taleo. In the last six months, insiders apparently sold approximately $10.8 million in Taleo shares. However, the law firm is reporting that insiders have sold approximately $121 million since the company went public in 2005. My math tells me that insiders have been selling a lot more stock in earlier years than they have in this last year of 2008. Does this suggest a smoking gun? I’m not so sure. Many software executives have pre-arranged sell orders with brokerages so that these individuals can make their investment liquid and/or diversify their holdings. Most executives have these plans as the planned schedule of sales is known and controlled by the brokerage and not the executive. This is done to prevent the appearance (or reality) of insider trading. Given the magnitude of prior sales, this may be a dubious claim if the sales were triggered by third parties.

- Some measure of Taleo’s stock price decline may be due to revenue recognition concerns (real or perceived) but the timing of these events may also indicate that some of the decline is due to the corresponding decline in stock prices overall. Anyone with a stock or mutual fund portfolio is keenly aware of the recent plummets on the NYSE, Nasdaq and other exchanges globally.

- Investors are also discounting stock prices as they believe future revenue streams (and, by inference, future profit streams) will be diminished for some time as the economy will not be as robust as it was in 2007. Different investors see different timeframes for the recovery period but these lowered earnings expectations are dropping stock prices for almost every firm in the market.

The real issue here will be whether revenue was incorrectly recorded, the magnitude of the recording error, if any, and how it will affect the published financials. Given the time-intensive nature of these auditing/accounting reviews, this could be more than a year and maybe up to several years before it is resolved. The faster Taleo and Deloitte can get through this, the better for Taleo and its executives.

Does any of this reflect poorly on Taleo’s products or the Vurv solutions they purchased? No. Will it be a management distraction? Yes. Will it cost a lot of money? Absolutely. Will competitors bring this up in selling situations? Bet on it.