Sustainability: More Capitalist Than Jack Welch?

OK nothing earth shattering here from IBM - this point is well understood by most by now. According to a McKinsey survey on philanthropy last year of global senior executives:

In addition to social goals, the vast majority of companies—nearly 90 percent—now seek business benefits from their philanthropy programs as well.

And in identifying best practice McKinsey say:

It is notable, however, that some 30 percent of the responses to the question asking about business goals indicate that some companies are trying to reach very concrete goals, such as building knowledge about potential new markets and informing areas of innovation. Respondents from companies with these goals are likelier than others to say business concerns should play a role in determining funding for philanthropic programs. Also, their philanthropic programs are much more likely to address at least some of the social and political issues relevant to their businesses; nearly two-thirds say they currently do, compared with just under half of all respondents.

Now Enter Jack & Suzy Welch with some handy advice for managers in how to guide CSR strategy in tough economic times:

You can sprinkle the money evenly, giving a little money to a lot of causes, or you can prune your list and give somewhat more to fewer organizations. Neither choice is bad, in our view, but we favor the latter only because it tends to have a greater impact.

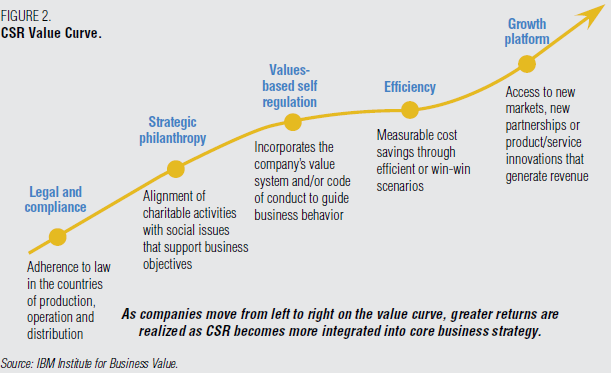

Brilliant! Why is Jack Welch, father of the modern shareholder value movement, advocating the throwing off of corporate cash without much more than a fuzzy strategic connection? What on earth would Milton Friedman say? I'm being only half snarky, yes by all means concentrate efforts for impact. But frankly, I'd prefer to see €1 invested in an idea that could be integrated into the business model & scaled either to improve sustainability performance of enterprise wide processes or better distributed to society in the form of improved products and services than 'sprinkle' around €100 - a la Welch, that is making decisions about social intervention - 'straight from the gut' but not straight from strategy.

So what about product innovation and CSR as a core business strategy? The Welch view:

companies can put CSR into their product and service strategies, focusing on green initiatives, for instance, or factoring environmental concerns into their manufacturing processes....... And then there's CSR as a strategy. Look, when gas costs $4 a gallon, a hybrid Toyota Prius is an attractive value proposition. With gas under $2.50, not so much. When most consumers have good, secure jobs, expecting them to pay more for an enviro-friendly product makes sense. With bank accounts drained, it's a tough sell. Our point: The bar for strategic CSR is now higher than ever. Consumers are increasingly unable (or unwilling) to pay more for something simply because it makes them feel good inside. Today, it has to make them feel good in the wallet, too. That doesn't mean the era of "socially responsible" products is over. It just means increasingly intense cost pressures on the companies selling them, and any manager who ignores that fact is ignoring an oncoming locomotive of competition.

Just imagine what the global economy would look like if we only ever consumed for functional and practical reasons and never because it made us feel good inside. In one foul swoop Jack & Suzy have just wiped out maybe 80% of our global market systems and kicked capitalism as we know it to the long grass.

At any rate I think consumer interest in sustainability is much more deep seated than that. Ask Wal Mart or Whole Foods or Marks & Spencer. And yes, Jack, ask GE about Ecomagination. But more than that, the commentary betrays an attitude that green productization is something of a joke, a consumer gimmick that is easily bolted on and just easily bolted off. It assumes that such products have a weak competitive footing and will quickly wilt in tough economic times. Maybe some will and some won't - like all competitive offerings in the market right now. Nobody expects a free pass. But I'm quite sure Toyota & GE have a better strategic handle on the economic sensitivity of green consumer choice and would not have built their business strategy on assumptions so flaky.

The other elephant in the living room that Jack & Suzy barely get into is sustainability as a strategy to help reduce cost and risk across the enterprise and the extended value chain. For example, reducing energy & resource inputs, uncovering social risk in the supply chain, recyling of materials - this all creates real value for the business without ever making a dedicated green consumer offering. But if Jack really believes Corporate Social Responsibility adds cost and reduces competitiveness does he also believe corporate social irresponsibility has the opposite affect?

There is a new reality here and I dare to suggest the Welch's fail to keep up and are, perhaps, blinded by their own ideology when a more practical approach to strategy is needed. The day has arrived where we look back with nostalgia at the idea of business apart from society, where we could pursue profit in a market system eneveloped in a vacuum. It will be as quaint as white picket fences to think of the luxury of simplicty managers had in not having to think about the sustainability constraints nor seek opportunity & innovation in dealing with them. To the extent that modern corporate managers are adapting their strategy to the challenge of sustainability they are, ironically, proving to be even more capitalist than Jack & Suzy Welch.

In my native Ireland there is a recognised phenomenon through the ages that the country eventually conquers all through assimilation. Wave after wave of battling marauders came but after a generation or two they became assimilated and took the idea of 'Ireland' forward. They became 'more Irish than the Irish themselves'. The same may now be true for sustainability in the marketplace. Once a corporate ideological outrider, it is becoming so well flexed to create real market value that it is starting to nudge aside the more rigid ideology of, at times, self defeating market fundamentalism. Whilst Jack Welch might be surprised by this, I have a sneaky feeling Milton Friedman might not have been so much.