Brocade exceeds guidance, analyst targets for Q3 earnings

Brocade turned in its fiscal third quarter earnings report after the bell on Tuesday.

Read this

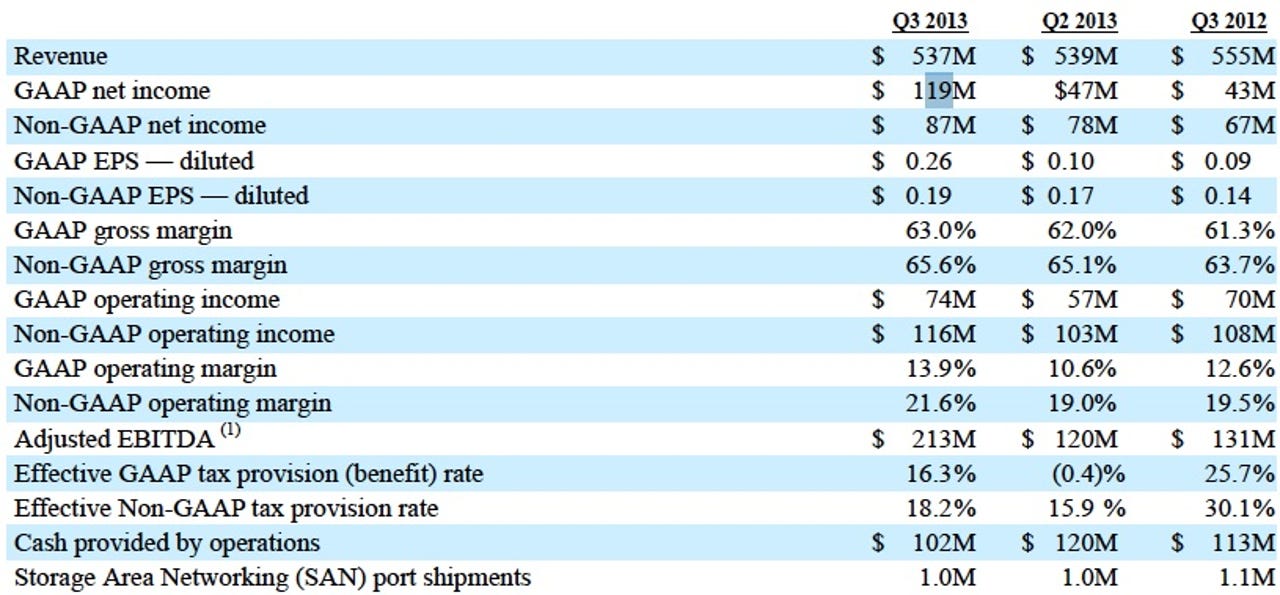

The networking solutions provider reported a net income of $119 million, or 26 cents per share (statement).

Non-GAAP earnings were 19 cents per share on a revenue of $536.6 million, down three percent year-over-year and down slightly quarter-over-quarter.

Nevertheless, that was good enough as Wall Street was looking for earnings of 12 cents per share and $518.84 million in revenue.

CEO Lloyd Carney kept the focus on the balance sheet in prepared remarks:

In Q3, Brocade exceeded our guidance for revenue, non-GAAP operating margin, non-GAAP EPS, and cash flow. The storage market is recovering more quickly than we had anticipated entering our third quarter and, coupled with continued strong adoption of Gen 5 Fibre Channel, contributed to good Storage Area Networking (SAN) revenue results. In IP Networking, our Federal sales were disappointing while Brocade VDXTM switch revenue showed continued strong growth in Q3, underscoring our leadership in Ethernet fabrics. We are making great progress toward our spending-reduction goal, and are already seeing the benefits in our financial results and cash flow.

Here's a closer look at Brocade's Q3, by the numbers:

- Storage area network (SAN) business revenue: $369.2 million, down two percent year-over-year and one percent sequentially

- IP Networking business revenue: $167.3 million, down six percent year-over-year and up two percent quarter-over-quarter

- Estimated Federal revenue: $19.9 million, down 42 percent year-over-year and five percent quarter-over-quarter.

- Non-Federal IP Networking revenue (including data center, enterprise and service provider customers): $147.4 million in the third quarter, up three percent year-over-year and three percent quarter-over-quarter.

Despite some of those downturns when looking at revenue by department, Brocade did reiterate some positive forecasts in its Q3 earnings presentation.

For instance in the SAN segment, Brocade cited IDC figures projecting that demand for storage capacity is expected to grow by at least 38 percent over the next five years.

Furthermore, data center networking was highlighted as the "first focus" now in Brocade's business strategy:

Within this space, we are prioritizing markets in which we can be most successful and where we can hold a leading market share position of meaningful size. Specifically, we will continue to invest in maintaining our considerable installed base in SAN, and growing our footprint in data center IP and emerging technologies, such as software networking. We will also make targeted investments in campus networking where price-performance and ease of use are the value drivers for this market. We believe that this strategy will best leverage our core competencies, product strengths, and competitive positioning. According to IDC, Brocade holds the number two position in worldwide market share in data center networking. Our investments in technologies, such as Ethernet fabrics, 40/100 GbE, SAN innovations, and SDN, will provide additional opportunities for market share gains.

For the fourth quarter, Wall Street is looking for revenue of $548.52 million with earnings of 15 cents per share.

Brocade provided a Q4 revenue guidance range of $545 million to $565 million in revenue with earnings between 17 and 19 cents per share.

Screenshots via Brocade Investor Relations