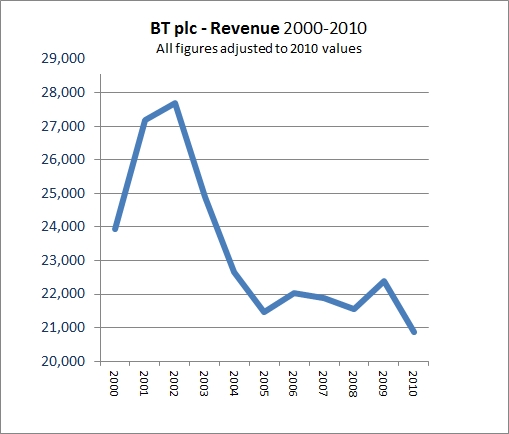

By the numbers: BT predicts Telstra's future?

A forced separation hasn't been the best news for BT. Can Telstra learn from BT's mistakes?

Moves to see through the separation of Telstra's wholesale and retail arms are well advanced. If the whole thing is seen through next year, it will be seven years behind BT, which went through a similar separation in the UK back in 2005.

For BT, the result has been far from encouraging — total revenue has fallen sharply and it's struggling to hold its own. Profit (after tax) has wavered around the mark of 10 per cent of revenue. This is hardly the sign of a company going somewhere.

(Credit: BT)

What is interesting, though, is where BT has enjoyed the most success. You'd expect, faced with increased competition and no favours from their network arm, that BT retail would be struggling. The reality is that it's the division that's doing the best. Sure, revenue slid, but profits are up. In other words, faced with competition, they have become hellishly more efficient. Perhaps Telstra, too, will rise to the challenge.

(Credit: BT)

It's the areas where BT has struggled that should be setting off warning sirens for Telstra. The company is talking of new wholesale products and broadening their footprint overseas. These are the areas where BT has struggled — wholesale has seen its profits halved, and its global division is struggling to break even.

Whatever the magic answer for future growth, BT hasn't found it yet. It seems a big retail company is good at one thing: selling to the public. When push comes to shove, they can hold their own. But when it comes to new channels and distribution models, that's going to be the bigger struggle.