By the numbers: telcos' wage war

If Optus is to lose 750 jobs, as reported last week, then it's for a good reason; big telcos are carrying a much heavier wages burden than more nimble competitors.

Last week, we heard how Optus embraced the cloud by making sure that there was a dark one hanging over the heads of 750 people. But that's just a drop in the ocean. During the year to June 2011, Telstra shed more than 5000 full-time jobs — a 12 per cent drop in staff in only 12 months.

On the other hand, Vodafone manages to run a global operation with just over twice the staff that Telstra uses to service just one country.

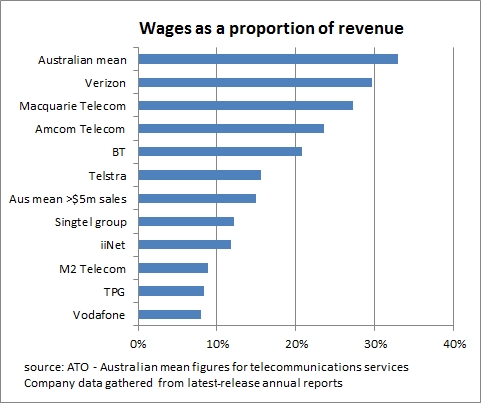

As this graph shows, Vodafone's wages bill is just 8 per cent of its sales revenue; that figure is 16 per cent for Telstra. It's a significant difference that investors will be pushing to change.

(Credit: Phil Dobbie/ZDNet Australia)

It seems that telecommunications companies can be split into four categories, based on how much they spend on salaries. The first are big, old-school telcos — let's call them the dinosaurs — with legacy processes and high staff costs.

Take Verizon as an example: it has a 30 per cent wages-to-revenue ratio. BT falls into this bracket, too. Telstra was there, but is trying hard to bring that ratio down.

Then there are the relative newcomers, which seem able to generate revenue without the high staff costs. TPG has a wages-to-revenue ratio of just 8 per cent; and iiNet, at 12 per cent, isn't far behind. It has grown up without the legacy systems and attitudes that pile on the costs for the dinosaurs.

The third category consists of those bigger telcos that seem to have figured out how to operate efficiently. This is where everyone wants to be. Vodafone seems to be the prime example (despite the local issues that the company has experienced in Australia). The company has fewer than 84,000 employees globally — more than half in customer care and administration. The SingTel group, with its cost cutting, is moving into this category, with a wages-to-revenue ratio of just 12 per cent.

The final group comprises the smaller fry, for whom staff costs are a big issue. "="" class="c-regularLink" target="_blank" rel="noopener nofollow">Data from the tax office shows that for telco providers with sales totalling less than $1 million annually, the wages-to-revenue ratio is higher than 30 per cent. Compare that to companies that are turning over more than $5 million, where it drops down to 15 per cent. Macquarie Telecom (27 per cent) and Amcom (24 per cent) fit into this category, although M2 Telecom does seem to be bucking the trend at 9 per cent.

What does all of this tell us? It indicates that the economies of scale issues in the telco business are enormous. Start-ups face high wage costs that make it hard to compete, making early cash flow a big barrier to entry. The bigger you get, the better the chance of reducing the relative cost of employing people; Vodafone has shown this to be so (although it helps having 13 per cent of your staff based in India).

The exceptions to this "bigger is better" rule seem to be the dinosaurs; they're haunted by their old way of doing things, even as companies like Telstra try to move into category three. They need to cut what they spend on wages to compete. The danger here, of course, is slashing and burning without improving processes. The alternative is to drive change first, and then see how many people you can get rid of. But that's a complex process.

What many seem to be doing is making the cuts, and hoping that people will figure out how to work harder. The problem is: if they don't, you end up with fewer people able to do less, reducing sales and doing nothing to improve that ratio.

If that's the approach the dinosaurs continue to take, it could well be extinction time again.