By the numbers: TPG right for iiNet?

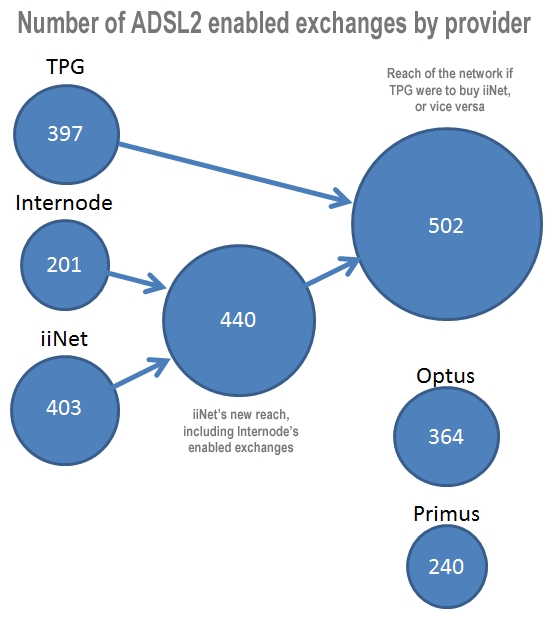

iiNet's purchase of Internode has given it a lot of new customers, but it's done little to expand the reach of iiNet's network. If TPG were to buy iiNet (or the other way around), that'd be a different story.

Of the 201 exchanges where Internode rolled out its own DSLAMs, iiNet was already in 164 of them. By my reckoning, that means the acquisition of Internode added just 37 exchanges to iiNet's coverage, extending their reach to 440 locations. There's also been a mutual benefit in seven locations, where one or the other of the ISPs was almost out of ports.

But what if TPG bought iiNet? After all, it did edge its ownership of iiNet shares up to 7.24 percent at the end of November 2011. It's a small holding, but an iiNet buyout is not beyond the realms of possibility. Michael Malone himself said on Twisted Wire last week: in this industry, it's a case of buy or be bought.

Such a deal would not only bring in many new high-yield customers, it would also increase TPG's footprint markedly. At least 105 new ADSL exchanges would be added to the TPG network — growing its access network by one fifth. That may not sound like a lot, but with 502 ADSL2 locations, TPG would be well ahead of everyone else except Telstra.

Under such a deal, TPG would be able to reach many more customers with its own ADSL2 products, rather than reselling Telstra's wholesale offering. That'd create a significant improvement in margin per customer, particularly now that TPG, through its acquisition of Pipe Networks, is a significant owner of backhaul. And, although the NBN is still a few years away, its presence shortens the timeframe for reaping the rewards of an ADSL investment, so acquisition has more appeal than the slower path of organic growth.

(Credit: Phil Dobbie/ZDNet Australia)

Of course, this speculation is all really about jockeying for second place. Telstra has well over 2000 exchanges with ADSL2 enabled. Strangely, it finds it more commercially viable than anyone to provide such broad coverage, and Telstra is adding to that number all the time. It is likely that its dominance will not be challenged unless another mega-giant appears to compete against it. That needs scale, which demands more industry consolidation. Perhaps the third chapter in this story might begin when Singtel buys TPG, or vice versa. It could be quite a year.

Exchange data sourced from http://www.adsl2exchanges.com.au.