Cisco's quarter, outlook upbeat; Eyes data center turf

Cisco Systems typically is among the first technology companies to see economic uncertainty and weak IT spending. Conversely, Cisco is also among the first to see an uptick. Cisco's most recent earnings report may warrant some optimism.

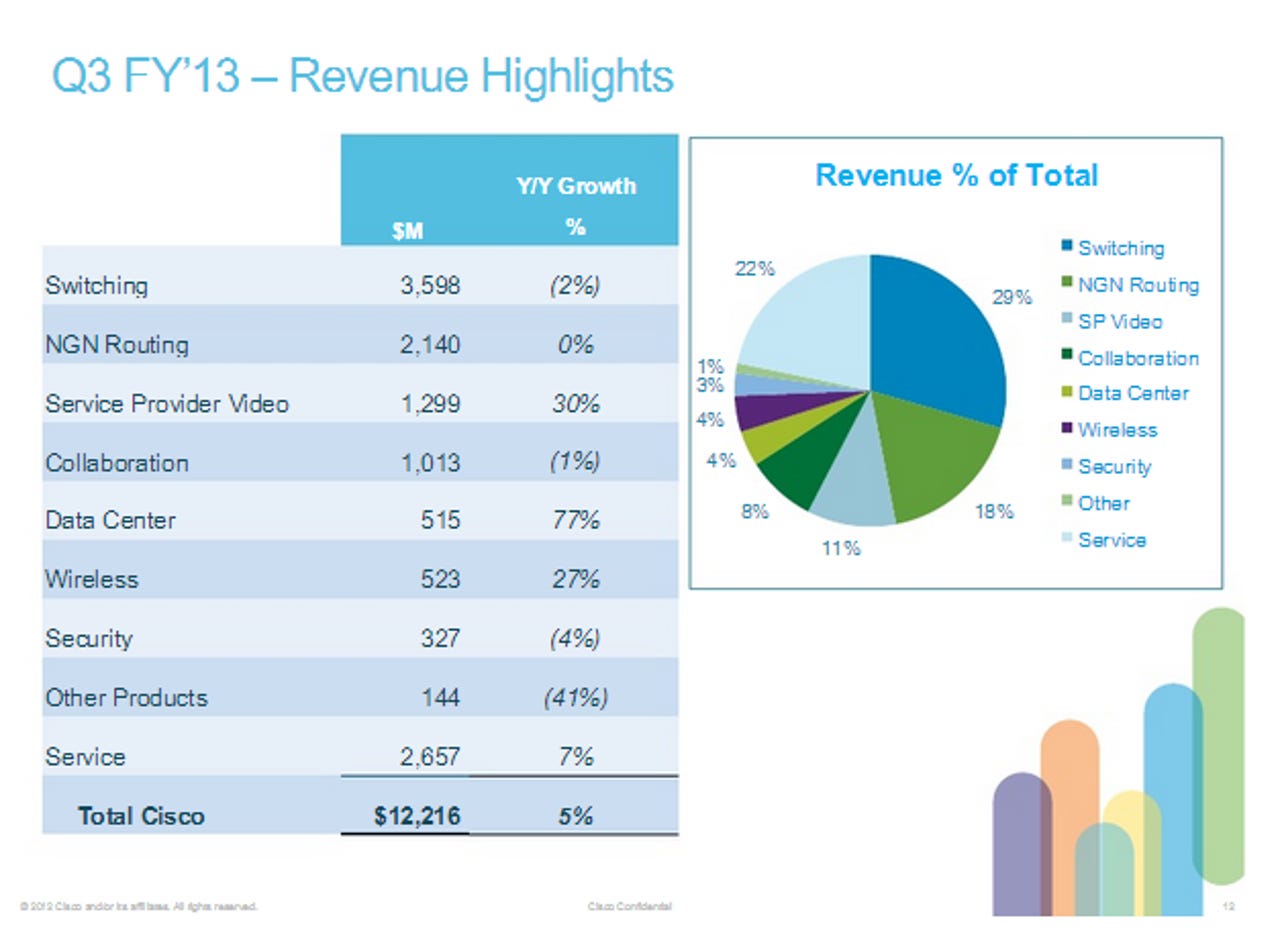

The networking giant on Wednesday reported fiscal third quarter earnings of $2.5 billion, or 46 cents a share, on revenue of $12.2 billion, up 5.4 percent from a year ago. Non-GAAP earnings were 51 cents a share. Wall Street was looking for earnings of 49 cents a share on $12.17 billion.

Sentiment leading up to Cisco's results was negative. Other networking companies indicated that information technology spending was weak. Complaints about sluggish economic conditions became the norm.

However, Cisco's outlook and comments from CEO John Chambers were upbeat---somewhat optimistic even. Chambers said that Cisco was seeing some positive spending signs in the U.S. and emerging markets. He also noted Cisco was well positioned for industry turns such as software defined networking.

As for the outlook, Cisco projected non-GAAP fourth quarter earnings to be 50 cents a share to 52 cents a share with revenue growth of 4 percent to 7 percent compared to a year ago. That outlook was in line with expectations.

On an earnings conference call, Chambers noted that cloud data center revenue growth was up 77 percent, wireless was up 27 percent and WiFi sales growth was more than 100 percent. Meanwhile, U.S. commercial revenue was up 13 percent and enterprise was up 10 percent. Asia-Pacific, Japan and China orders were flat as was EMEA. That tally was an improvement over declines in the second quarter.

Chambers said:

We were especially pleased with the progress we made in Q3 in the emerging countries, with growth of 13%. As a reminder, emerging countries grew 6% in Q2. We are also pleased with the balance across emerging countries, with India growing 29%, Russia growing 16%, Brazil up 14%, China up 8%, and Mexico up 4%. The remaining emerging markets around the world, which is approximately 50% of our total business from emerging countries, was also very solid, with growth of 13% as well.

The 21st Century Data Center

The big question here is whether Cisco is taking share or calling a tech spending turn. Chambers said:

In terms of what is changing in the market, our architectural approach -- tying together our products to solve our customers' top priorities quicker than anyone else -- is really gaining traction. That's especially true in enterprise, where (the focus is) selling to the business customer, in conjunction with the CIO, in meeting the CEO's top priorities...We have a number of challenges coming at us. In the end it will be in our opinion an architectural play -- where software will play a key component, but it will be an architecture where our place will I think win in the end.

On the broader economy and where Cisco fits in, Chambers also was upbeat. He said:

The enterprise growth is on a very good trend. I don't see seasonality on that, and I think it's probably a very good indicator of economic growth. It's nothing to write home about, but it's very solid economic growth in terms of slow but steady in terms of the U.S. is how we're modeling.

In terms of our relevance as an IT player, it's increasing. When you get Board of Directors coming through -- not the CIO, but the Board of Directors and top management, it really speaks Cisco's position in the industry is changing. When we catch our competitors, we usually leave them behind fairly quickly. Sometimes, we take a little bit long to get focused on something, but we really close well. That's a nice way of saying I'm real comfortable across all key customer segments where we're going. I think we are dramatically better positioned than the traditional data center players such as HP, Dell, and IBM as this transition occurs.