Cloud accounting service fills payroll gap

As promised, upstart software developer Xero has begun the launch of an integrated payroll module for its cloud accounting service -- just in time for the end of calendar-pegged fiscal years.

Payroll in Xero handles the basic sorts of functions you would expect, including:

- Automated calculation of federal and state payroll taxes, along with the ability to file them electronically

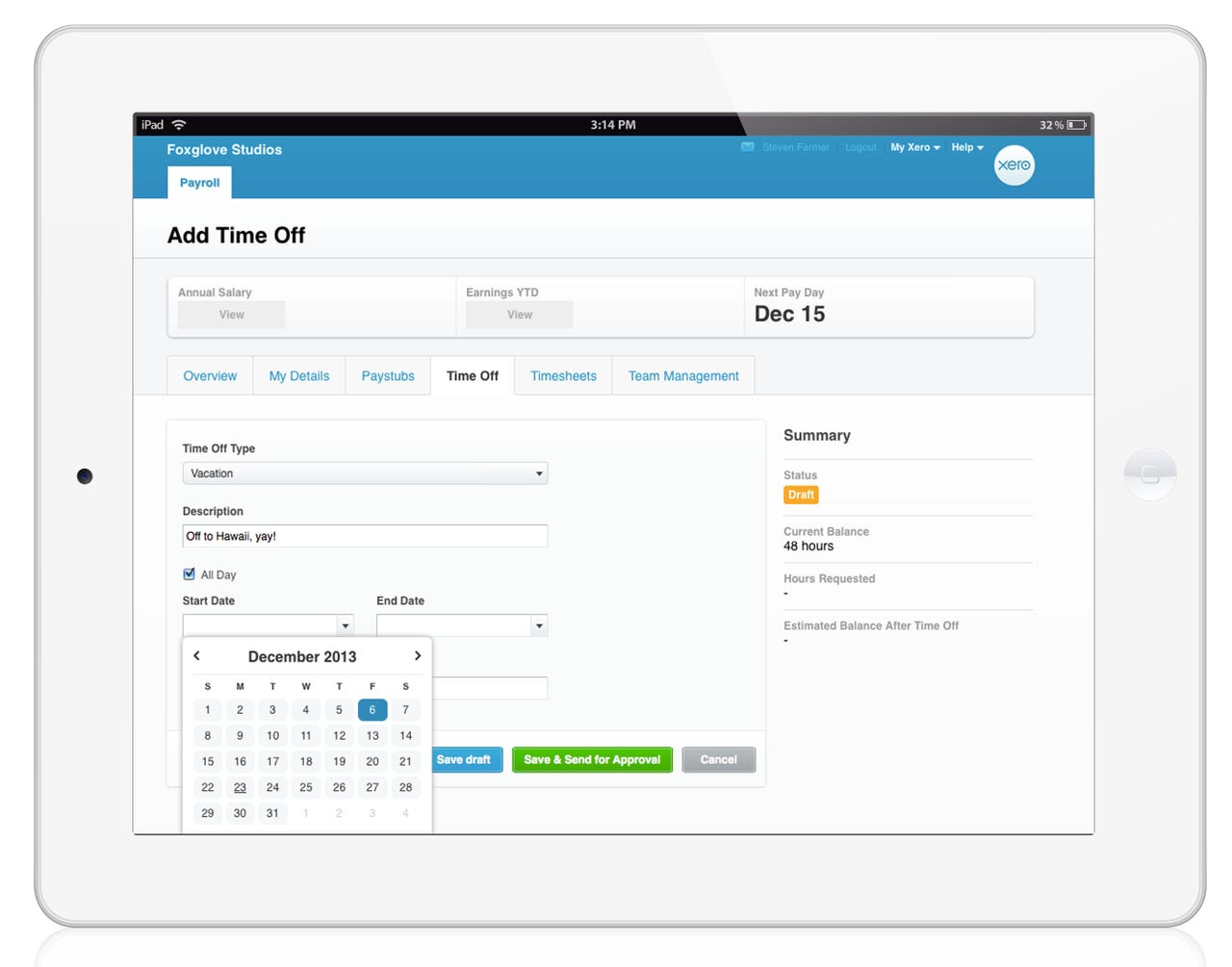

- Electronic timesheet submission through an employee portal, which also allows them to apply for time off or check past paystubs

- An application programming interface (API), which enables the payroll information to be connected with other business applications such as separate time sheet managers, scheduling systems and human resources (HR) management software

Previously, Xero users were forced to handle these functions separately. "Simply put, Payroll in Xero is an absolute game changer to the efficiency of my firm, saving our practice 45 hours a week, easily," said Steve Chaney, managing partner with Chaney & Associates, an accounting firm that specializes in small businesses.

The payroll features aren't in the entry-level plans for Xero; they kick in with the Premium 10 plan, which covers up to 10 paid employees for $70 per month.

In addition, right now, your company has to be in certain states to benefit: California, Florida, New Jersey, New York, Utah and Virginia. You can track the state rollout schedule here.

Payroll management is becoming an increasingly active area of development. Intuit recently moved to bolster its position with the acquisition of Prestwick, and anothing cloud accounting startup, Kashoo, received an infusion from payroll giant Paychex in October. Two other companies focused explicitly on this space are venture-backed startups, ZenPayroll and Justworks.

Related stories:

- Cloud startup simpliefies small-business payroll

- Cloud accounting developer Kashoo gets infusion from payroll giant Paychex

- Cloud accounting service Xero launches QuickBooks conversion tool

- Get paid faster: Xero integrates Stripe online payment services

- Cloud providers connecting accounting, time tracking services

- Looming year-end inspires small-business accounting software updates