Consortium offers to buy BlackBerry for $4.7 billion

BlackBerry said Monday that it will be sold to a consortium led by Fairfax Financial in a deal valued at $4.7 billion, or $9 a share.

Following a profit warning on Friday, BlackBerry was burning cash and appeared to have limited options. Wall Street analysts were urging a quick sale.

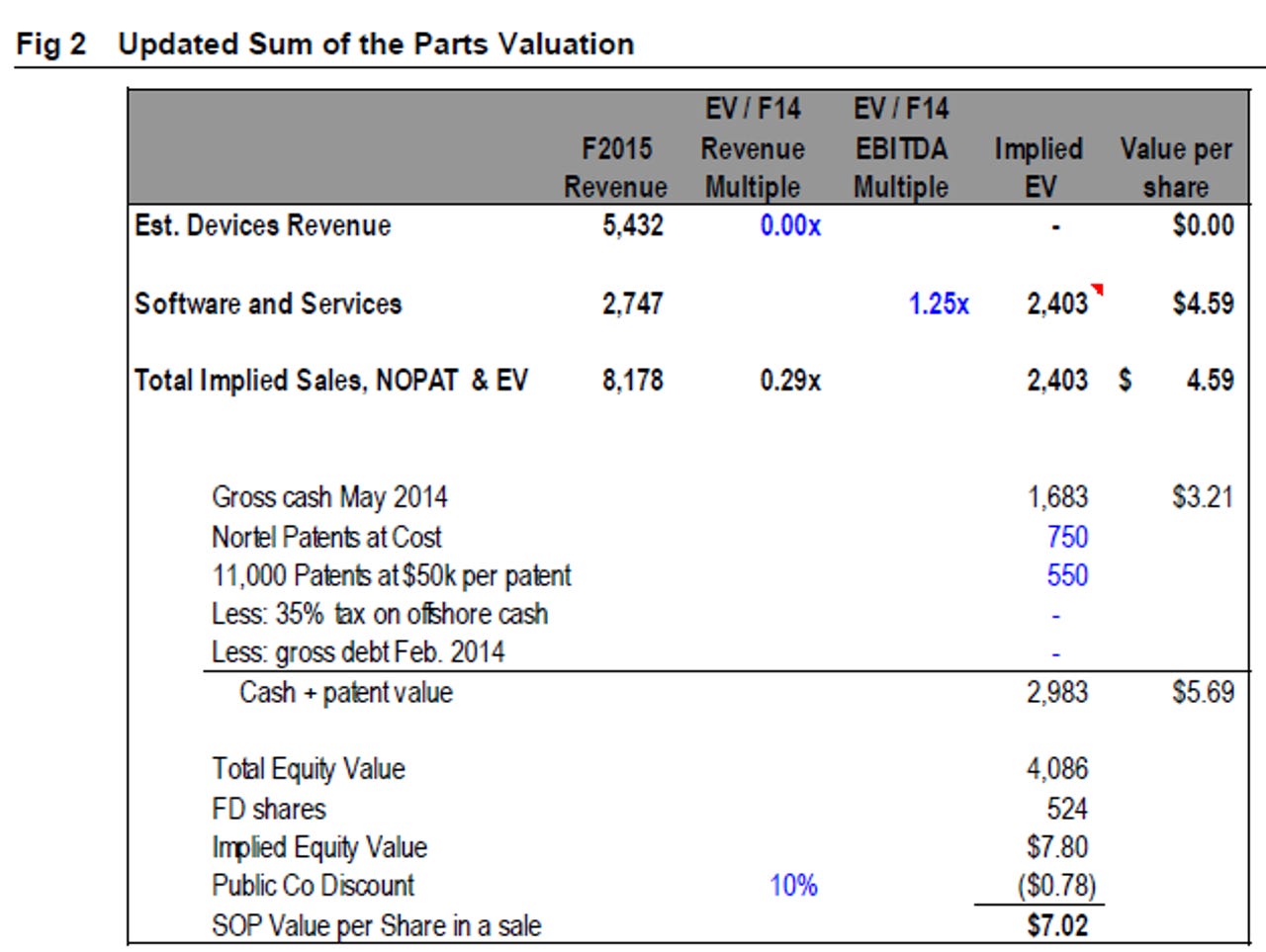

Looks like BlackBerry delivered. Analysts were looking anywhere from $7 a share to $12 a share for the company. Here's a look at how Macquarie valued BlackBerry.

In a statement, BlackBerry outlined that it signed a letter of intent to sell out to the consortium. BlackBerry now has a six week window where the consortium conducts due diligence and the company can find a better offer.

Previously: BlackBerry's tough spot: Keep enterprises, find buyer pronto | BlackBerry confirms 4,500 jobs cuts, slashes device portfolio

Under the letter of intent, which BlackBerry signed, Fairfax and its consortium would acquire the shares Fairfax doesn't own with cash. Fairfax is a major Canadian financial company.

Now the deal will be evaluated by BlackBerry's special committee to review strategic alternatives. The due diligence is expected to be complete by Nov. 4.

It's unclear what the consortium's plans for BlackBerry would be. BlackBerry said that it plans to focus on the enterprise and specifically security and mobile device management. On Friday, BlackBerry said it will cut 4,500 jobs, report sales of $1.6 billion (nearly half what was expected) and take a massive writedown due to BlackBerry Z10 inventory. The plan: BlackBerry will circle the wagons around its enterprise and prosumer business and drop the consumer dream. The challenge with BlackBerry's plan: Enterprises would worry about the company's financial footing.

Prem Watsa, Chairman and CEO of Fairfax, said:

We believe this transaction will open an exciting new private chapter for BlackBerry, its customers, carriers and employees. We can deliver immediate value to shareholders, while we continue the execution of a long-term strategy in a private company with a focus on delivering superior and secure enterprise solutions to BlackBerry customers around the world.

News of the letter of intent may avert enterprise defections at least for a bit and provide a floor to BlackBerry's valuation. If BlackBerry's smartphone business and stock price unraveled, its enterprise ambitions could be derailed.