Dell cuts earnings outlook for year, names new enterprise head

Dell cut its fiscal year outlook given "the uncertain economic environment, competitive dynamics and soft consumer business," but remained relatively upbeat about its enterprise unit.

Specifically, Dell said that its third quarter sales will be down 2 percent to 5 percent from second quarter levels. Dell projected non-GAAP earnings of $1.70 a share for fiscal 2013. That sum includes 2 cents to 3 cents a share dilution from the acquisition of Quest Software.

Wall Street was looking for fiscal 2013 earnings of $1.90 a share.

The company also said that Marius Haas, a veteran of HP, Compaq and Intel will become president of Dell's enterprise unit. Brad Anderson, who led Dell's enterprise unit, is leaving to pursue other opportunities.

The disappointing outlook comes as Dell topped estimates with its second quarter earnings on a non-GAAP basis, but delivered lower than expected revenue. The company reported second quarter net income of $732 million, or 42 cents a share, on revenue of $14.48 billion, down 8 percent from a year ago.

Wall Street was expecting Dell to report second quarter earnings of 45 a share on revenue of $14.64 billion.

On a conference call with analysts, Dell CFO Brian Gladden outlined a few of the moving parts as a slowing economy hits customers. For instance, days sales outstanding was up by three days in the quarter. Why? Dell is selling more complex deals and "customer terms are typically longer."

Gladden also made the following points:

- Globally, Dell held its own in mature markets, but its focus on margins hurt it in emerging economies. "While we held share in key mature markets like the U.S., emerging markets were very competitive with both occurring predominantly in the low value space where we have not participated," said Gladden.

- Dell has focused on high value systems and that's hurting its PC volume. On corporate PCs, Gladden said: "We're seeing pressure on consumer and entry-level corporate products. There's particular softness in pricing pressure in key emerging markets like India and China as well as Western Europe. In the quarter we saw the channel drawn down inventory in anticipation of the window -- Windows 8 launch. We also continue to see discretionary spending directed to alternative mobile devices like tablets and smartphones."

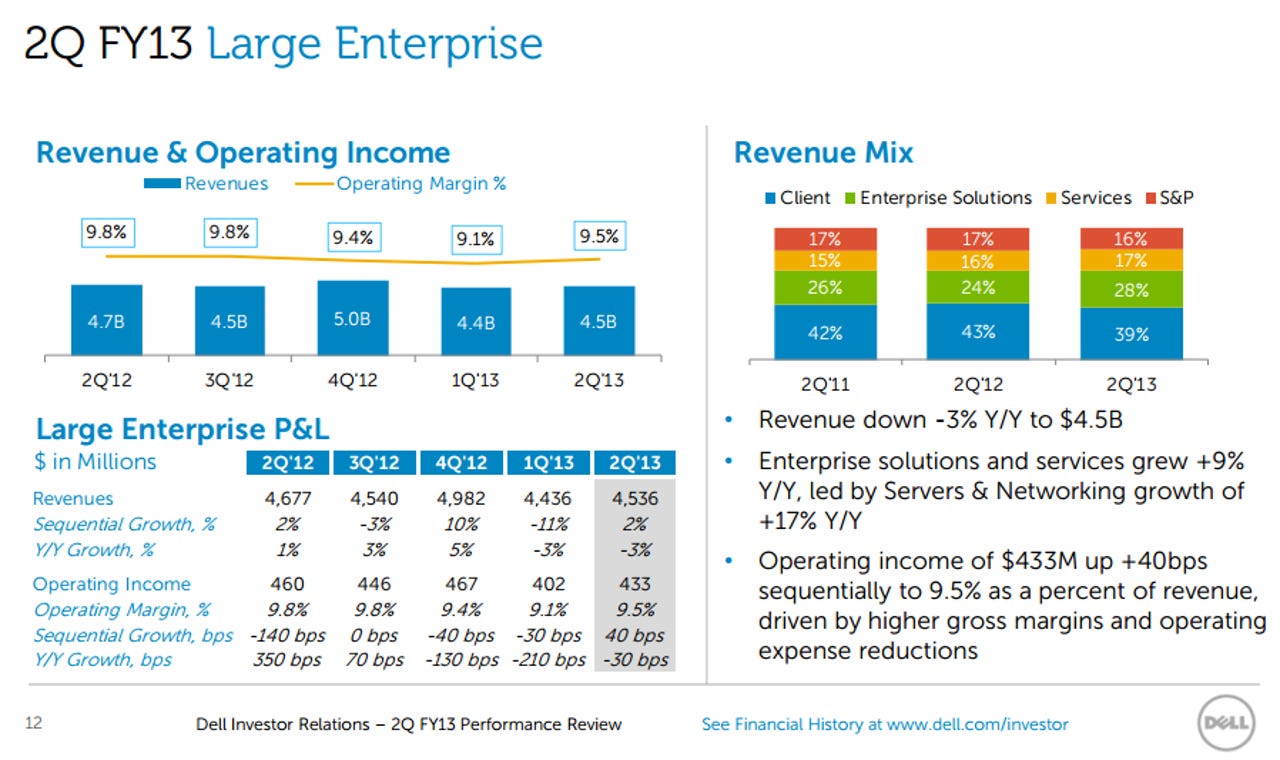

By unit, Dell's enterprise unit saw revenue jump 6 percent from a year ago. Server and networking revenue was up 14 percent in the second quarter and services sales were up 3 percent.

Here's a look at the key figures:

- Dell's large enterprise unit delivered second quarter operating income of $433 million on revenue of $4.54 billion.

- Public operating income was $379 million on revenue of $4.06 billion.

- SMB operating income in the second quarter was $382 million on revenue of $3.26 billion.

- Consumer operating income was $14 million on revenue of $2.62 billion, down 22 percent from a year ago.

A few thoughts on the results:

- It's questionable why Dell bothers with its consumer business. The company wants to be about enterprise hardware, software and services. Should a Windows 8 upgrade cycle fizzle, look for Dell to downplay consumer PCs even more.

- BRIC countries aren't the growth slam dunk they used to be. Dell struggled in Brazil, India and China. Only Russia showed growth.

- Like other quarters, Dell's transformation remains a work in progress. This is a multiple quarter trek for Dell.

- Dell's server and networking sales appear to have allayed the biggest worries from analysts.

More: