Financial accounting software: Cloud and other winners

Cloud technologies are not all alike nor are they all adopted at the same time and pace. For many years, I’ve been tracking the adoption of cloud software by businesses. CRM applications were often the first cloud applications to be embraced, en masse, by businesses. HR/Talent Management and Office Automation solutions have followed in subsequent years. Are financial accounting solutions following suit? Will vertical solutions be next?

I develop ‘long form’ pieces for ZDNet and, let’s be clear, this is a long piece. So, pull up a chair, get comfortable and enjoy this lengthy but, hopefully, valuable piece on cloud financial accounting software.

For those of you with attention problems, let me give you this helpful outline:

- Part One – Will cloud financial software follow a market acceptance path like CRM, HR and office automation? Where is financial accounting software in crossing the cloud chasm?

- Part Two – What did CFOs and Controllers tell us? How familiar are they with their organization’s use of cloud software in general? Will they go back to on-premises?

- Part Three – What are the broader market implications? What are the implications for the software and consulting/integrator industries?

And, let me quickly say thanks to the three dozen or so CFOs, Controllers and CEOs that shared their time and feedback with me.

Part One

The Adoption of Cloud Financial (and Other Software)

Cloud-based software applications have experienced varied adoption rates in corporate businesses. Marketplace acceptance of new technologies is often measured against the technology adoption lifecycle (TALC)[1]. The TALC concept has been around since the late 1950s[2] but was brought to significant awareness a decade or so ago by Geoffrey Moore in his book “Crossing the Chasm”[3].

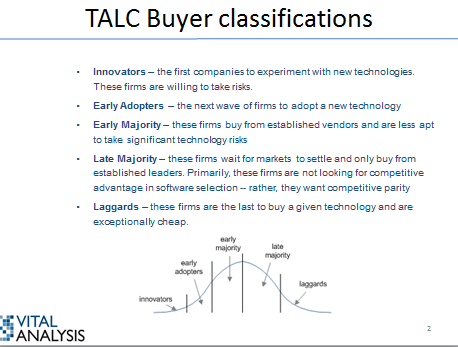

In TALC terms, there are five kinds of buyers, each of which becomes more prevalent as a new product moves through the lifecycle. For example, those people or businesses that are likely to first adopt a new innovation are called innovators or early adopters while the last to adopt are called laggards. The two largest market segments, the early majority and late majority, often make up the preponderance of buyers.

A different psychographic profile exists for each of the five segments depicted on the typical TALC bell curve. For example, innovators and early adopters are fairly risk tolerant and see new technologies as a means of achieving some sort of competitive advantage. The early and late majority buyers wait until the market leaders in a space get sorted out and buy from the biggest, most established and ‘safest’ firms. These buyers are looking to maintain competitive parity with their technology purchases. Laggards love a bargain and will wait and wait until the price point gets to some ridiculous low level.

Geoffrey Moore[4] believes there is a ‘chasm’ between the early adopters and early majority buyers. We agree. We all know someone who had to be the first to have a new technology (e.g., laserdisc and Betamax) only to realize later that the product didn’t catch on with the larger buying public. This happens with business technology, too. As a result, we wondered whether new cloud financial software was ready to cross the chasm.

In 2010, I interviewed executives from a number of large firms to understand whether cloud application software solutions would be relegated simply to the SMB (small to mid-sized business) market or would they also find favor with large enterprises.[5] Those interviews produced a number of observations about the market for cloud application software in 2010.

One of the observations I made in 2010 was that many large and small firms had already made the move to cloud application software via the CRM (customer relationship management) application space, often with salesforce.com. I also noted that a number of cloud-based human resource applications, such as talent management and performance management, were becoming mainstream applications with large and small organizations, too.

In the summer of 2013, I canvassed a number of firms and spoke to a significant number of chief financial officers, controllers, chief executive officers and other executives within a range of companies. My working hypothesis for this research was that cloud CRM applications were now well established in most segments of the TALC and that only some late majority and laggards remained to experiment with this new type of software and deployment method. Further, I hypothesized that cloud human resource applications had also crossed, in Geoffrey Moore’s vernacular, ‘the chasm’ and were now being selected by more early majority, late majority and laggard firms.

My final hypothesis was that cloud financial software may be ready to cross the chasm, too. I knew that a significant number of companies have already adopted cloud financial software. The market uptake that companies such as FinancialForce.com, Intacct, Workday and Xero have received clearly indicates that cloud financial applications were gaining popularity with businesses today. But was this a short-term fluke, market niche characteristic, or, the harbinger for a material shift in software buying?

Please continue to Part 2

[3] “Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers”, Geoffrey A.Moore and Regis McKenna, HarperBusiness

[4] “Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers”, Geoffrey A.Moore and Regis McKenna, HarperBusiness

[5] “SaaS: Now Serving Large, Complex Enterprises”, Vital Analysis, June 11, 2010

Part Two

Cloud Application Penetration

In December 2011, I worked with Baker Tilly Consulting to interview CIOs at a number of credit unions across the United States. One of the data points I collected involved their usage of cloud application software. What I found was that almost all surveyed credit unions had either outsourced or were using a cloud payroll HR product. A number of them had also implemented a cloud CRM solution. Office automation and other applications were often discussed as being imminent candidates for moving into cloud deployment methods. These CIOs also expressed a desire to move more and more applications to cloud environments when such solutions become available.

This summer’s interviews went beyond the credit union space. I interviewed (or received written feedback from) executives from the following firms:

- CFO, Talent Agency

- CFO, Benefits Administration Firm

- COO, Professional Services Firm

- CEO, Marketing Agency

- CFO, Software Firm

- CFO, Hospitality Business Development Firm

- Director of Finance and HR, B2B Advertising Network

- Financial Software Administrator, Software Firm

- VP Operations and COO, Systems Integrator

- Director of Financial Planning and Analysis, New Media Firm

- Director of Finance & Operations, eMedia Firm

- CEO, Cloud Financial Software Firm

- Project Director, Global Solutions Implementation, Major Brewing Firm

- EVP Asia, Major Equipment Manufacturer

- Principal, Global Strategy Consultancy

- Chief Explainer, Visual Arts Firm

- Business Owner, Consultancy

- CEO, Internet Marketing Firm

- Director of IT, Global Automotive Manufacturer

- and many more.

When I asked these executives what cloud software they used, I didn’t give them any hints or coaching. What these overwhelmingly financial/accounting executives said surprised me. They could rattle off all kinds of cloud solutions in use at their firms. These solutions ran the gamut from CRM, Marketing Automation, Sales Compensation, Financial Planning, Payroll, HR, Talent Management, Office Automation and storage to name a few. Salesforce.com was a fairly common component and appeared to be a gateway application that gets businesses comfortable with the on-premises to cloud transition.

These interviews produced other surprises, too. For one thing, integration (of cloud apps to on-premises apps or to other cloud apps) never came up as an issue. Even after I broached the subject, it wasn’t something these execs really focused on. Why? As one exec put it, “Cloud apps were designed to connect with all kinds of other software”. In comparison to most on-premises solutions, I’d have to say that he’s got a point.

Another surprise was in the level of acceptance of cloud solutions. These executives like cloud applications and like how they free up their IT people to work on more strategic (i.e., best your business) IT initiatives. But, more to the point, they like that:

- Many products possess security capabilities more robust than their own firm has.

- Vendors maintain the applications, not their IT people.

- Products scale up and down to meet changing IT and business demands.

- Applications are accessible anywhere, anytime

- Etc.

On this acceptance point, executives were also clear that they weren’t going to return to on-premises solutions and they’ll acquire more cloud solutions as they become available for their firm. Tom Roberts, an IT Director at Johnson Controls said: “Across the entire Johnson Controls enterprise, we are utilizing or in the process of deploying cloud based software in human resource management, procurement, supply chain, CRM, and in a number of additional areas.” I heard similar sentiments from other executives, too, and it was the tone that some of them used that indicated to me that this shift from on-premises to cloud deployed solutions was not a fad, a short-term phenomenon, or an experiment. Cloud solutions are a long-term, structural change that will profoundly affect IT organizations for many years to come.

When I asked financial/accounting executives what counsel they’d give a fellow CFO or Controller that was looking for new accounting software, the answers were all some variant of ‘go to the cloud’.

- “I just don’t see how everyone isn’t doing this” said John Petrillo of Bernstein & Andrulli a Salesforce.com and FinancialForce.com user.

- “What are they waiting for?” said Melissa Conners of Olympia Benefits

- “Go Cloud - cloud would be my solution” said Douglas Karr – CEO of DDK New Media a FreshBooks and ExactTarget customer.

To give you an idea of how interesting the content in these interviews were, let me recap some of the highlights I had in my conversation with Chad Varra, CFO of SendGrid.

- SendGrid uses Zuora for billings as well as ZenDesk, ADP for HR, NetSuite, Salesforce.com, Marketo and Box. And, this is, according to Chad, “only a portion of the cloud applications we use”.

- Chad is a CFO that also used a cloud accounting solution at his prior employer, too. That company uses NetSuite. It’s interesting to see a CFO with 2 different cloud solution/employer combinations already.

- Chad also didn’t think the public accounting firms are as current with cloud technology as they should be but they’re adapting.

Or, how about this interview with Nate Peterson, COO and VP-Operations of Aasonn? Their firm implements cloud solutions and they practice what they preach to clients. He said:

- “100% of our applications are in the cloud. (Our) direction from Day 1 was to be in the cloud”

- “We don’t have a single server”

- "We want our people to be analytic not data-entry centric”

- They use Salesforce.com, SAP SuccessFactor’s Employee Central, etc.

Jared Waterman, Director of Financial Planning and Analysis for Pandora made a couple of interesting points, too. When he spoke of on-premises software, he said he was “always two versions behind” with his vendor’s solution. Multi-tenant solutions are always current or as Jared stated “the systems you’re using are state of the art”. Pandora is using an impressive number of cloud applications that include: Coupa, FinancialForce.com, Anaplan, Xactly, Paylocity and Salesforce.com to name some.

And finally, let’s review what Kevin Ronson, Director of Finance and Operations at Voices.com said:

- “Wouldn’t want to” – what Kevin said about ever moving back to on-premises applications

- “Cloud is how I think now – everything else seems old now”

- “Cloud is the future – no, it’s the present”

Hypotheses Confirmed?

These interviews confirmed a number of the original hypotheses. First, virtually everyone we spoke with had a cloud CRM and cloud HR (or Payroll or Talent Management) solution. I was pleasantly surprised as to the number of firms using cloud financial planning tools (e.g., Adaptive Planning) and other cloud solutions for office automation and document storage. Other pleasant surprises included the number of interviewees using Marketing Automation software (e.g., Eloqua, Marketo) and sales compensation systems (e.g., Xactly). The numbers and niches that cloud solutions are filling in businesses is absolutely noteworthy and indicative of something more than an emerging trend. Once companies start embracing cloud solutions, the uptake of additional cloud applications is expedited.

Cloud application sales are having an adverse impact on traditional on-premises firms. In describing the disappointing earnings that an older, on-premises vendor recently reported, UK technology analyst publication TechMarketView noted: “This is another in a series of signs that the rate of growth in established vendors’ traditional software businesses is slowing, making it all the more important that disruptor technologies make a breakthrough.”[1] This impact is not some cyclical or economy-driven downturn in revenues. Cloud software deals are signaling a marked change in buyer intentions and market share changes will be seen soon.

Cloud software buyers are not just early adopters and innovators. It’s clearly being embraced by more early and late majority buyers. It’s going mainstream. When other accountants are recommending these solutions, enthusiastically, to their peers, cloud financial software is now mainstream and not something that only the most daring buyers will touch.

Financial accounting software appears to be crossing the chasm today and for the SMB (small to medium business) market, it absolutely appears to be crossed. I spoke with customer after customer of NetSuite, FinancialForce.com, SAP, Intacct and other solutions. They’ve successfully implemented these solutions, are vigorously recommended to others and are delighted to be free of support, maintenance and other issues associated with on-premises solutions. They’re not going back to on-premises.

For the large enterprise cloud financials space, I still need to do more homework. At present, Workday’s multi-tenant solution and some hosted/private cloud solutions are picking up steam. I’ll reserve judgment as to whether these have crossed the chasm once I get access to additional CFOs who are replacing large enterprise financial software.

Cloud applications overall, not just financial accounting apps, are absolutely mainstream now and buyers aren’t afraid of them anymore. In fact, they want more and more of them. The day and age of being a cloud solution naysayer is over.

Firms that pioneered the sale of cloud applications years ago (e.g., salesforce.com) probably had significant marketing and sales challenges as they had to convince buyers on the benefits and features of their product as well as convince them that a cloud deployment was acceptable for businesses. The need to educate and convince potential software buyers re: cloud deployed solutions is now markedly lessened from previous years. This lowered sales hurdle should help other financial accounting and other cloud solution categories expand in the marketplace.

Please continue to Part 3

[1] TechMarketView, 6/21/2013

PART THREE - Market Implications

The wave after wave of functionality moving to cloud deployed solutions is neither limited nor diminishing. What started with cloud based apps like CRM and HR software now includes office automation, marketing automation and financial accounting software, too. Supply chain and industry-specific/vertical solutions will soon have their day as well.

Different technologies have different adoption rates that can range from wildly ecstatic to non-existent. Consumer technologies frequently go from ice-cold to white-hot and back to ice-cold in the shortest time possible. Business technologies, in contrast, take longer to move through the acceptance cycle.

It’s done – cloud won!

Cloud software adoption within businesses can now be safely and assuredly seen as a fait accompli. More vertical solutions will likely follow the same well-worn path and should complete the transition.

Some vendors are already there. Plex has been in the cloud manufacturing space for quite some time. Rootstock, NetSuite and Kenandyare coming in this area, too. My colleague Tom Ryan adds that supply chain execution solutions like Deposco, LogFire, and SnapFulfil for cloud based WMS and Lean Logistics for cloud based TMS are also emerging. Numerous traditional vendors have begun the process of moving their on-premises solutions to the cloud world but many of these need new user interfaces, multi-tenancy, PaaS and more to be fully competitive. Nonetheless, cloud is where the development money, marketing focus, etc. is going and will continue to go.

Stumbling blocks

Some potential stumbling blocks remain and could further delay future adoptions. The fallout re: privacy invasion activities by various governments on Internet communications and systems could have a dampening effect on cloud solutions uptake. What this may trigger though is:

- A review of one’s systems to ascertain which kinds of data are highly sensitive and strategic. Those systems would be kept in-house with others in cloud.

- Greater focus on encryption, security monitoring, etc. of data kept in cloud-based systems

- Sharper focus on where cloud-based data is stored. Limiting certain data to reside in specific countries can lessen the opportunity for some governments to gain access to data.

While the recent publicity re: government access and monitoring of internet powered information is viewed very negatively by many, it also is shining a bright light on how businesses need to think about and manage their cloud-deployed data, solutions and risks. This wake-up call, while painful in the short-term, should bring more clarity to businesses in how their cloud solutions should function and which cloud provisioners they should trust.

Integrators/Resellers/Consultants

Three weeks ago, I saw a reseller get on-stage to tell his colleagues about this wonderful new deployment strategy he’d come to learn about this last year. It was called: the cloud. I felt sorry for this fellow. He was the technology equivalent of Rip Van Winkle. Here’s hoping he discovers the iPhone by next year. I tell you this because some service firms appear to be caught in a time warp. They’re still hoping that the systems integration, ERP implementation or outsourcing markets will forever remain in a 1998 timeframe. They won’t and aren’t. Wishing won’t help – these firms need to advance their business models, cull declining service offerings and re-train/re-deploy some of their best and brightest to newer cloud driven solution realities. Adherence to old business methods, solutions and organizing paradigms will kill or economically cripple non-adaptive firms.

Cloud solutions will impact service firms in pronounced, possibly painful ways.

Multi-tenant cloud software has a compelling value proposition to software users: the vendor (not the customer) updates the one (and only) copy of the software. This is huge. Customers told us in 2010 that their 8-10 year TCO (total cost of ownership) breakdown of on-premises software shows approximately 40-60% of total software costs go to this one area: patching, upgrading and maintaining the software. On-premises software is simply a cost-intensive product compared to a multi-tenant cloud application. On-premises solutions are an expensive luxury that fewer and fewer firms will want.

Integrators, resellers and consultants used to make a lot of money from the on-premises world but those days may be facing a material decline. Let’s look at several of their offerings today:

Application Maintenance Outsourcing – This service transferred the application software patching, maintenance and upgrading activity from the customer to an external third party. While the outsourcer could achieve some measure of scale in doing this work for multiple customers, they were still dealing with uniquely configured client-specific solutions. This is, at best, single-tenant work and becomes mostly obsolete as customers adopt multi-tenant software products. The vendors will provide the bulk of the update work as part of the subscription. An integrator can keep the part of maintenance where they integrate the cloud solution to other cloud and on-premises applications. Bottom line: this is a troubled business model.

ERP Implementation Services – On-premises solutions used to require a lot of prep work to acquire, setup, tune, test and configure production and test environments for new ERP software. Integrators can still offer valuable change management and integration services, but, many cloud solutions can be provisioned in mere minutes (not months). The real help clients will need are in areas around configuration decisions (e.g., Do we need to select FIFO or LIFO for our inventory accounting method?), integrations with other systems and report design. This market has changed and is now less about busloads of young technicians and more about focused subject matter experts. An emerging market may arise though in porting data from on-premise solutions to cloud solutions, and, eventually, from one cloud solution to another.

Application Modernization - Previously, a lot of companies used third parties to standardize and make current their diverse, often far-flung application portfolio. When a company lacked the people, project skills or political will power to enforce the need to have just one application per function, they called in these firms. Often the firm doing the modernizing sold a continuing operations outsourcing contract with this deal. That way, they got to run the upgraded software stack for the client. In the cloud world, service firms can modernize and standardize applications for clients but more and more of the operations of the software will go to the software vendor not the outsourcer. This solution still has value today but will definitely be impacted by more cloud adoption.

Infrastructure (traditional) Outsourcing – With more systems moving to the cloud, fewer applications (and their attendant hardware and systems software) will remain to be outsourced. In the past, companies would ask an outsourcer to ‘lift and shift’ their IT software and technology to an outsourcer’s operation. Cloud solutions definitely affect this space in an adverse manner. What remains to seen however is the impact that all-new solutions, like analytics, big-data, etc. will have on this space. Given what software vendors, like SAP with its HANA software and own cloud farm, can do in the cloud for customers, traditional outsourcing looks tough. There may also be a private cloud play here as well for some of the larger businesses.

Business Process Outsourcing and Outsourced Shared Services Operations – In this world, businesses entrust to a third party the operation of one or more key processes. This includes transferring people, software and/or other assets to a third party. The theory is that the third party has identified a number of best practices to improve the process, has scale and focused personnel, and, optimized technology to deliver first quartile process performance for the customer. Businesses often need to revisit how they do work and whether they’re as efficient and effective as they could be. However, the need to have your own solutions (managed by a third party) could be in for a change. Businesses will want business process re-engineers to benchmark processes and design better ones. However, they’ll make their changes in cloud software where the technology rests on a vendor’s cloud. Yes, the BPO provider will still have people handling aspects of the process but the technology component of their solution will likely shrink.

Cloud solutions will impact business processes. For example, Tom Ryan adds that: "Third party logistics (3PLs) companies are perfect candidates for blending outsourced services with SaaS based software. Today they already offer WMS, TMS, and other supply chain execution solutions as IT services to go along with the physical services and physical assets (e.g. distribution centers) they offer their customers. Shifting from their predominately on-premises IT model to a SaaS based solution set would allow them to cut their costs while continuing to provide other necessary services. Their customers are already looking to them to take care of their supply chain execution software needs."

Software Developers and Independents

The new market will create opportunities for entrepreneurial software developers in creating analytics, vertical or industry-specific bolt-on programs to cloud applications. These extensions will become a revenue stream for smart developers (and resellers). SalesForce.com has its Force.com PaaS (platform-as-a-service) along with a big marketplace to hawk these value-added extensions to salesforce.com, FinancialForce.com and other products running in this ecosystem. Likewise, NetSuite has its NS-BOS PaaS. SAP has the HANA analytics tools, too. Opportunities are there but developers (and resellers) need to shift their focus from basic ERP software tasks to more value-added intellectual property creation.

Developers and resellers should look for vendors with open architectures and PaaS environments. Closed environments don’t offer as many opportunities to create and market new intellectual property solutions. If you want to be where the money is, then bet on the following:

- Align with vendors with PaaS and/or other open platforms

- Seek vendors with growing product lines/suites as these are going to be preferred by more and more customers over standalone or best of breed solutions. Buyers like getting as much pre-supplied integration and common look and feel as possible from one source (BTW - I heard this independently from two sources this week alone). Look for ‘convenience’ plays and develop your solutions and skills to these growing spaces.

- Find ecosystems that are growing. Don’t focus on already mature or declining spaces. All you’ll get for your trouble in mature markets is a billing rate war, lots of competition and little joy. Seek spaces with lots of upside growth, limited competition and the room to stake out your own, growing space.

Final Points

Structural changes in markets deserve serious thought and consideration. These changes occur somewhat infrequently but can be quite thunderous in their disruption to the status quo.

The interviews and the tone of these executives tell us all that the move to cloud applications is permanent and will continue. This is bigger than just any one segment, like CRM. It cuts across all kinds of application solutions and will not stop. After financial accounting, you can expect supply chain, manufacturing and other sectors will cross the cloud chasm, too.

Structural changes mean all kinds of firms will be affected. Your firm, software firms, hardware firms and service firms must transition (or perish). If your firm hasn’t done a thorough long-range strategic IT plan, you need to get cracking on it now. And, if your execs need someone to scare them into action, give me a call. The stories I could tell….

For More Information

If you’d like to read more, the 2010 report I mentioned in Part One was licensed by Workday some time ago but should still be available here.

I also just finished a new a e-book on the top executive interviews for this work. FinancialForce.com has made that available on their site here.

Thanks/Comments

If you made it this far, then you have my thanks for your patience and attention. Comments?