IDC: PC industry bleeding slows as Q3 global shipments beat estimates

For most of 2013, the narrative of the PC industry has been on the verge of becoming a bloody horror story. But the bleeding has finally slowed, based on the latest figures from the IDC.

Read more

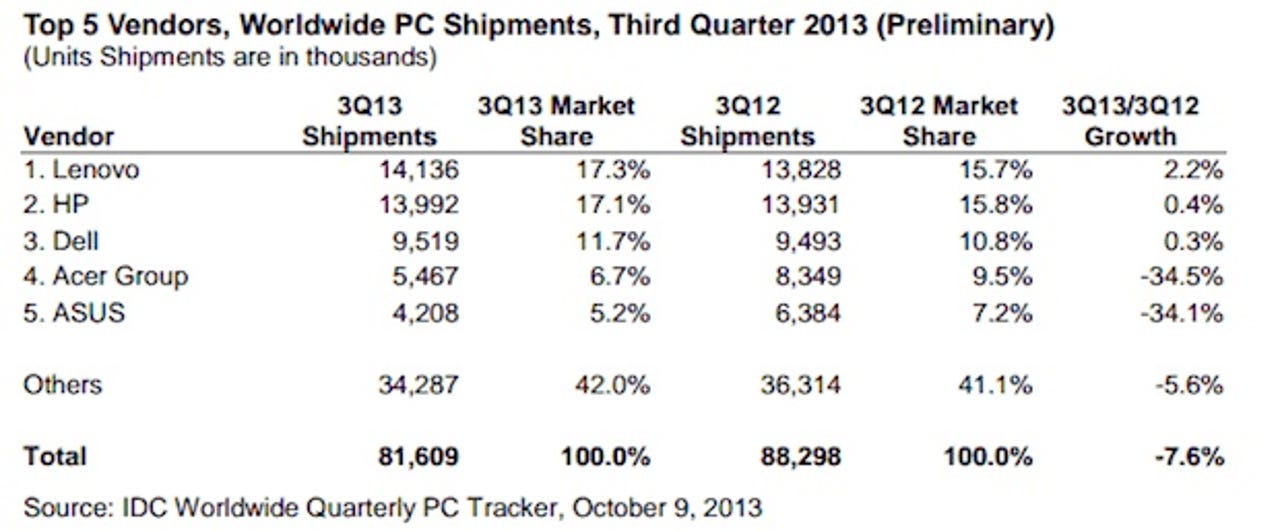

The market research firm published its third quarter report on Wednesday after the bell, with analysts affirming that worldwide shipments of 81.6 million units beat expectations.

However, sales are still falling as shipments were down eight percent from the same time last year.

The short story here is that the PC market didn't do as badly as expected (for the time being) thanks to the enterprise and public sector markets with a "slight uptick in business volume" being a contributing factor.

IDC researchers summed up the consumer market contribution and sentiment as "lukewarm at best," pointing fingers at market share losses by Acer and ASUS respectively.

Lenovo, HP and Dell all saw gains in their global shares over the three-month period on an annual basis.

Nevertheless, Loren Loverde, vice president of the worldwide PC Trackers team at IDC, warned in the report that these figures should not be construed as a comeback for the global PC industry.

Whether constrained by a weak economy or being selective in their tech investments, buyers continue to evaluate options and delay PC replacements. Despite being a little ahead of forecast, and the work that’s being done on new designs and integration of features like touch, the Q3 results suggest that there’s still a high probability that we’ll see another decline in worldwide shipments in 2014.

Researchers highlighted the Asia/Pacific region as particularly troubling looking forward, notably in developing markets. However, sales in China were said to be better than expected at least.

Zoning in on the U.S., IDC analysts said the domestic PC market is demonstrating "signs of recovery," although shipments were down by approximately 0.2 percent annually. These positive turnaround signs hovered mostly around Windows, including a wider range of Windows 8 devices available now along with a notable migration pattern from Windows XP to Windows 7.

HP took the crown once again for the U.S. PC market, followed by Dell, Apple, Lenovo, and Toshiba, respectively.

Within the top five, only Apple experienced a decline in market share on an annual basis, dropping by 11.2 percent.

But while also touting interest around Chromebooks during the quarter, IDC senior research analyst Rajani Singh, Sr. ended things with a gloomy outlook, remarking "the U.S. market has not changed much, with hopes for a small increase in Q4 followed by a challenging 2014."

Table via IDC