IHS: Wireless driving semiconductor growth in 2013

While the PC industry may have flatlined over the past few years, post-PC devices are taking up the slack and helping to keep revenues at semiconductor firms buoyant.

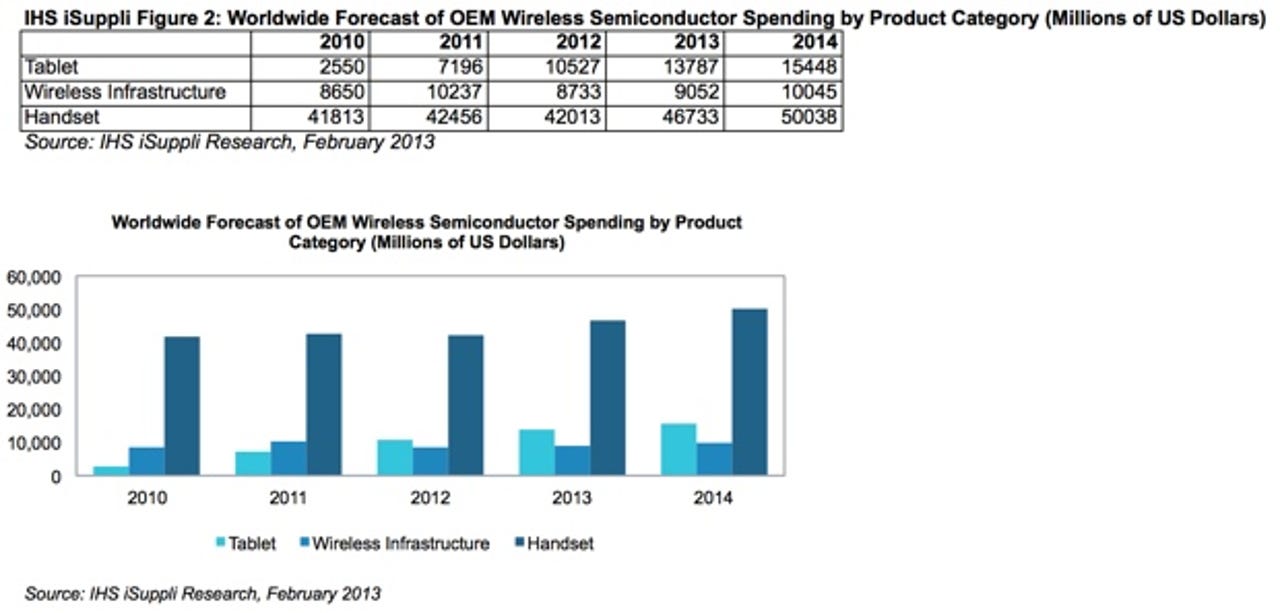

Spearheading that growth over the coming year will be wireless technology, with research firm HIS predicting that expenditure on wireless chipsets will rise by double-digit margins over the coming year, with tablets responsible for driving growth.

According to an IHS report, OEM spending on semiconductors for wireless applications is set to rise by 13.5 percent during 2013, reaching a total of $69.6 billion, up from $62.3 billion in 2012. This, according to IHS, represents the highest rate of growth of the seven major application markets, with the others set for more annual changes ranging from a modest 6.5 percent expansion, to a worrying 1.7 percent decline.

HIS predicts that the biggest winners during 2013 will be Apple and Samsung, but it also suggests keeping an eye on LG Electronics, as well as emerging players from China, such as Huawei Technologies, ZTE and Lenovo.

"The growth in wireless semiconductor spending this year reflects the strong and sustained consumer appeal of smartphones and media tablets—as well as the robust corporate infrastructure expenditures required to support this trend," said Myson Robles-Bruce, senior analyst for semiconductor design and spend at IHS. "Mobile handsets continued to be the leading category for wireless semiconductor spending, but tablets are on the rise, with the new slate computers surpassing wireless infrastructure in 2012 for the first time ever."

When it comes wireless infrastructure, IHS says that the top OEMs will remain unchanged: Ericsson, Huawei, Alcatel-Lucent and Nokia Siemens Networks. In particular, Ericsson and Huawei are described as "fiercely battling for the market leadership position in wireless infrastructure."

"These are all companies," writes IHS, "that will rely heavily upon growth in the U.S. and Chinese markets in the future."