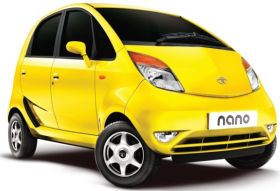

India's Nano to challenge global auto industry

INDIA--The launch of Tata Nano not only reinforces the country's strengths in IT and engineering, but also highlights the fact that global markets today are led by demand, and not supply, says a company official.

Ratan Tata, chairman of the Mumbai, India-headquartered US$50 billion Tata Group, today realized his biggest dream, Tata Nano, since the company introduced Tata Indica in December 1998.

Commercially launched in Mumbai on Monday, the ultra-cheap small car, runs on a 624cc-rear engine and is likely to be priced at around US$2,000.

|

The Indian middle class, along with the global auto industry, have been awaiting the Nano since it was first announced in January 2008. "With the Nano, Tata has challenged the global auto industry...[and] created an absolutely new segment with this car," Abdul Majeed, auto analyst at PricewaterhouseCoopers, told ZDNet Asia in a phone interview.

The Nano, Majeed added, is a huge lesson for other, bigger global auto majors. "Companies today need to be agile. They can no longer afford to dump a product in a market," he said.

Dilip Chenoy, director general at the Society of Indian Automobile Manufacturers (SIAM), concurred: "Today, manufacturers have to develop customized products at a faster pace.

"The world has seen a huge shift from being a supply-oriented market, to one that is led by demand," Chenoy said in an e-mail interview. SIAM is an industry body representing vehicle and engine manufacturers.

More codes per car

IT plays an important role in reducing the cost of developing a vehicle, and India is emerging as a research and development (R&D) hub for the auto industry.

According to Majeed, India offers the best location for the development of low-priced cars. "Nano is good for India. It marks the country's coming of age."

Yezdi Nagporewalla, head of industrial markets at KPMG, agreed: "India offers four key advantages to global auto majors--lower costs of operation, availability of talent, especially in the IT space, ability to carry out tests over different [and tough] terrains and weather conditions; and a potentially large domestic market that can justify the R&D investment."

Chenoy noted: "India is emerging as one of the prominent destinations for global automakers to set up their R&D centers." In last few years, most OEMs have scaled up operations and made heavy investments in their Indian technical centers. "This has resulted in significant improvement in product quality and value," Chenoy added.

Rajdeep Sahrawat, vice president of Nasscom, said cars are increasingly becoming more software-driven. "For instance, the engine of a BMW [runs on] several million lines of code, and what better place to write that code than India," he said.

The auto company recently announced that its 2009 models will be equipped with the BMW Assist system, which was built to notify emergency personnel not only where an accident has occurred, but also the likelihood of passengers being severely injured.

Software is used to execute microprocessor-based electronic control units (ECUs) networked throughout the body of a car. Even low-end cars now come with ECUs embedded in the body, doors, dash, roof, trunk and seats.

Various simulation technologies have also helped bring down design costs. "Earlier car companies would do a mock up," Sahrawat said in a phone interview. "Today, simulation allows companies to push the costs down.

Nagporewalla said in an e-mail interview: "Apart from applications like design software and simulation, IT can also help in significantly crunching product development timelines through improved collaboration and project management."

Chenoy added that modern-age design tools are helping automobile manufacturers develop better products in a shorter timeframe, as well as further reduce overall costs.

India as R&D hub

Major automotive manufacturers including Maruti Suzuki, Hyundai, General Motors (GM), Ford and Toyota, have tasked India to develop new product lines, as well as build competencies in computer-aided drafting and two- and three-dimension modeling. However, experts say India still has ways to go from becoming an international hub for auto R&D.

Nagporewalla said: "India is distant from becoming a global hub for the auto industry. To earn that title, a significant part of global auto R&D spend will have to happen in India." Nasscom estimates that India accounts for a meager US$3 billion of the global spend of some US$145 billion in auto and aerospace R&D.

For most global auto majors, the R&D center in India serves mainly as a link to their global R&D network. "Hence, end-to-end development of cars in India is still a dream," Nagporewalla noted.

According to Sahrawat, the Indian auto component industry is also still slow in deploying IT applications. "Our research shows IT deployment has not trickled down to tier two companies. Their budgets are small, and therefore, can't purchase expensive ERP packages," he explained. This impacts the ability of major auto companies to achieve leaner costs and bring about higher efficiencies.

However, the future looks bright for India's auto R&D centers. "In future, I see automobile companies leveraging IT in areas like simulations, rapid prototyping and project management to further drive down costs of developing a new model," Nagporewalla said.

According to Chenoy, the challenge for the local industry is to build future-ready products that are technologically-superior, cost-effective and eco-friendly. "Almost all companies are developing cleaner technologies that can satisfy the transportation needs of the future," he added.

Over the last one to two years, companies such as Bajaj Auto, Renault-Nissan, Toyota Motor and Chrysler have also announced their intentions to build low-cost cars.

"Since India and China are emerging as huge markets, with nearly 40 percent of the world's population residing in these countries, it's not surprising that companies are working on technologies for the emerging markets," Sahrawat said. For instance, manufacturers including LG, Samsung and Nokia, are launching solar-powered mobile phones for markets such as India, where power supply is a huge challenge.

Swati Prasad is a freelance IT writer based in India.