Intel cuts third quarter outlook, cites challenging economy

Intel reported better-than-expected second quarter results, but cut its outlook for the third quarter due to what it described as "a more challenging macroeconomic environment."

The company remained hopeful that new ultrabooks and smartphones would boost growth in the second half.

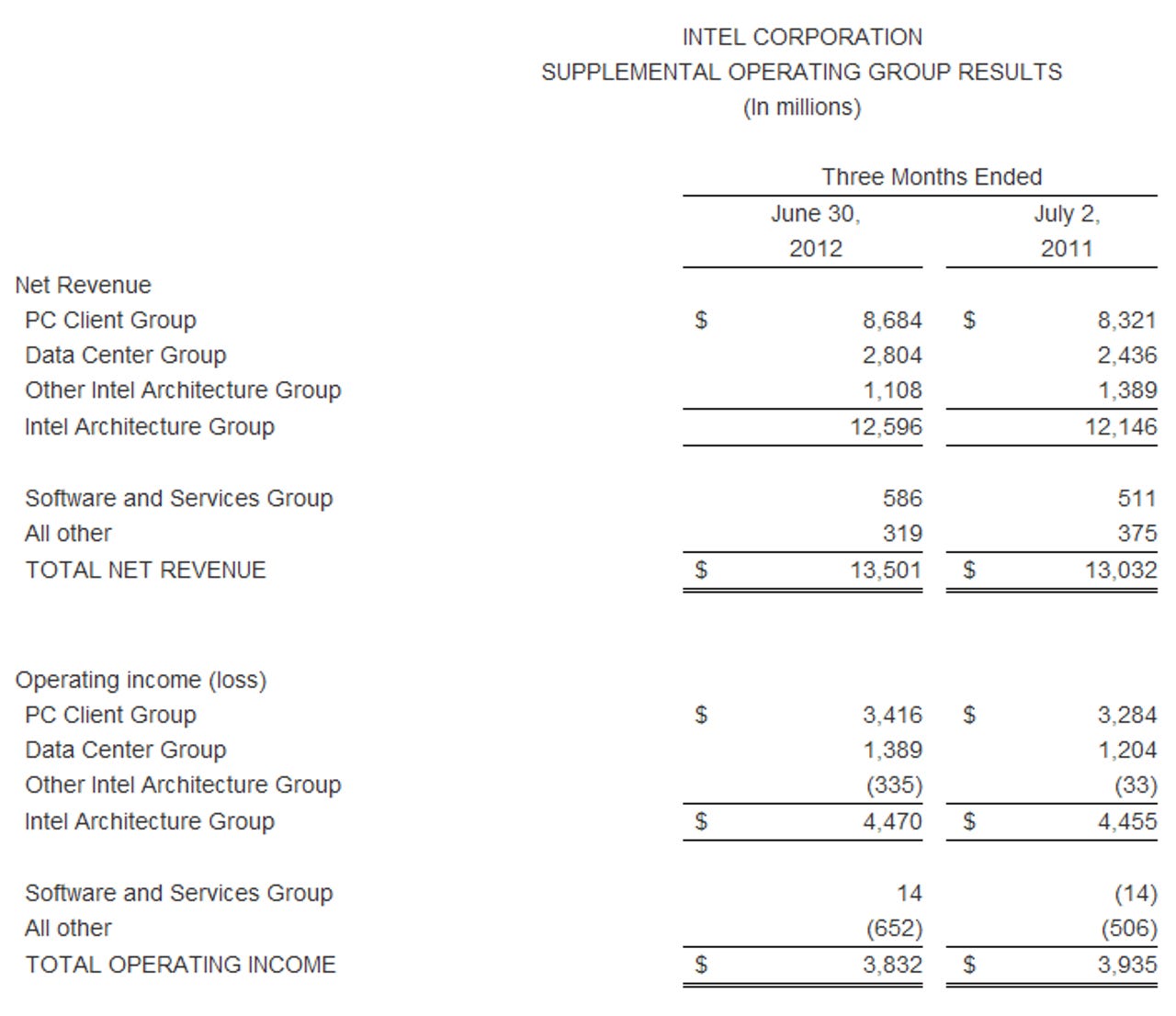

Specifically, Intel delivered second quarter earnings of $2.8 billion, or 54 cents a share, on revenue of $13.5 billion. Wall Street was expecting earnings of 52 cents a share on revenue of $13.56 billion.

As for the outlook, Intel projected third quarter revenue of $14.3 billion, give or take $500 million. Wall Street was looking for revenue of $14.6 billion for the third quarter. For 2012, Intel said revenue growth will be about 3 percent to 5 percent from 2011. The chip giant had expected revenue growth in the high single digits.

In a statement, Intel CEO Paul Otellini said:

As we enter the third quarter, our growth will be slower than we anticipated due to a more challenging macroeconomic environment. With a rich mix of Ultrabook and Intel-based tablet and phone introductions in the second half, combined with the long-term investments we're making in our product and manufacturing areas, we are well positioned for this year and beyond.

Analysts have questioned Intel's assumptions given PC demand has been lackluster. If Intel can't become a leading tablet player its growth may be hampered.

For now, Intel's data center group is a strong performer. PC revenue, however, remains solid.

By the numbers:

- PC client unit volumes were up 7 percent in the second quarter, but average selling prices fell 2 percent.

- Data center volumes were up 4 percent in the second quarter compared to a year ago and average selling prices jumped 12 percent.

- Intel's PC unit delivered second quarter operating income of $3.42 billion on revenue of $8.68 billion.

- The data center group had second quarter operating income of $1.39 billion on revenue of $2.8 billion.

- Intel's software unit had second quarter operating income of $14 million on revenue of $586 million.

- The company ended the quarter with 102,800 employees.

- Asia Pacific revenue was 58 percent of sales with Americas accounting for 21 percent. Europe revenue was 12 percent of sales and Japan was 9 percent.

- Intel expects to spend $18.2 billion in 2012 on research in development and general and administrative expenses.

UPDATE: During the quarterly conference call with investors and analysts on Tuesday afternoon, Otellini further commented about how the global economic climate played into second quarter figures and why Intel is projecting a stronger second half of 2012 than the first half.

What we had had expected that we would see by now is that the U.S. and Western Europe consumer businesses would be recovering from sort of a softness that we've seen for several quarters. And as a result of not seeing that, two things are happening. One, we don't see the PC sales to be as robust as we first thought. But the inventory replenishment coming off of the hard drive shortage is not as deep as we thought or as large as we thought because people are expecting to sell into a smaller overall TAM growth.

Much like how Oracle executives discussed during their quarterly earnings call in June, a higher U.S. dollar is also proving to be difficult for Intel. Otellini further explained that in some of the countries, the prices of computers continue to rise as a result of the currency fluctuations against the dollar.

"Most PC components, including ours, are sold globally in dollars, and PCs are typically priced in dollars -- at least to the distributors in those countries. So the price goes up as the currency changes," Otellini said.