Intel: HP accounts for 20 percent of annual sales

Intel said in its annual report that Hewlett-Packard accounted for 20 percent of Intel's revenue, up from 17 percent in 2007. Dell accounted for 18 percent in 2008, flat with 2007.

No other customer accounted for more than 10 percent of sales, according to Intel's annual regulatory filing with the Securities and Exchange Commission.

The annual report didn't hold many surprises-especially about how netbooks and Intel's Atom chip would affect profit margins in the future.

Here's a look at the highlights from Intel's report.

- Intel's mobility unit is becoming a bigger part of the chipmaker's revenue mix:

- Intel also maintained that keeping its manufacturing assets are a competitive edge:

- Research and development spending as held relatively steady for the last three years: US$5.7 billion in 2008; US$5.8 billion in 2007; and US$5.9 billion in 2006.

- Intel headcount-83,900 employees in 2008-is down substantially from 2006's tally of 94,100 employees.

- Intel was snared in the Lehman Brothers fallout as it tried to buy its own stock. In its filing Intel said:

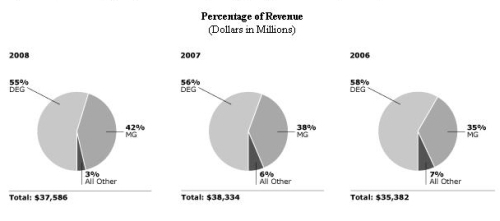

Net revenue for Intel's major operating segments, the Digital Enterprise Group (DEG) and the Mobility Group (MG), presented as a percentage of its consolidated net revenue.

Source: Intel

We believe that our network of manufacturing facilities and assembly and test facilities gives us a competitive advantage. This network enables us to have more direct control over our processes, quality control, product cost, volume, timing of production, and other factors.

These facilities require significant up-front capital spending, and many of our competitors do not own such facilities because they may not be able to afford to do so or because their business models involve the use of third-party facilities for manufacturing and assembly and test. These "fabless semiconductor companies" include Broadcom Corporation, NVIDIA Corporation, QUALCOMM Incorporated, and VIA Technologies, Inc. (VIA). Some of our competitors own portions of such facilities through investment or joint-venture arrangements with other companies. Advanced Micro Devices, Inc. (AMD) intends to sell an interest in its manufacturing operations.

We have an ongoing authorization, amended in November 2005, from our Board of Directors to repurchase up to US$25 billion in shares of our common stock in open market or negotiated transactions. As of December 27, 2008, US$7.4 billion remained available for repurchase under the existing repurchase authorization. A portion of our purchases in 2008 was executed under privately negotiated forward purchase agreements.

In the third quarter of 2008, we executed a forward purchase agreement with Lehman Brothers OTC Derivatives Inc. (Lehman Brothers) in which we prepaid US$1.0 billion and received an equivalent US$1.0 billion of cash collateral from Lehman Brothers. However, in the fourth quarter, Lehman Brothers failed to deliver shares of Intel common stock, and we foreclosed on the US$1.0 billion collateral.

This article was first published as a blog post on ZDNet.com.