iPhone 6: Coming from behind to unleash the next killer feature in mobile

"If you have an iPhone 6 then you can pay with your phone."

The cashier at Whole Foods blurted this out of nowhere. Surprised, the customer at the front of the line paused for a moment, glanced down at the device in his hand -- he didn't have an iPhone 6 -- and mumbled something about it being due for a phone upgrade.

Three months ago, barely anyone in the US knew that you could use a smartphone to pay for something at retail. Now, mobile payments are being championed in one of America's iconic hipster outposts where customers can wirelessly pay for artisanal knitted hats, Kombucha drinks, and raw hemp seeds.

The difference-maker, of course, is that Apple has finally rolled out mobile payments with the iPhone 6. The iPhone still has enormous mindshare in the world's most lucrative mobile market, even if Android has zoomed past it in marketshare -- even moreso globally.

While Android has had wireless mobile payments in the US since the launch of Google Wallet in 2011, it never caught on in America. Unfortunately, it's been available on a limited number of devices, the user interface can be glitchy and unintuitive, and Google and its retail partners haven't done a very good job of letting users know that they actually have the feature. To make matters worse, many of the wireless companies such as Verizon and AT&T have tried to limit Google Wallet in favor of their own mobile payment solutions -- all of which have flopped even worse than Google Wallet.

That's why mobile payments in the US have lagged behind countries such as Kenya, where half of the world's mobile payment transactions currently take place and 80% of mobile phone customers use mobile payments.

The US mobile industry has been expecting Apple to get in the game for over two years. The hope has been that Apple's entrance would stimulate the spread of the NFC chips that enable mobile payments and would light a fire under retailers to set up the infrastructure to accept mobile payments.

While it's easy to blame Apple for being a big, slow corporation that took way too long to make this happen, we should also remember that Apple had to corral and get consensus from a bunch of bigger and even slower corporations in order to launch a system that enough consumers could use in enough places to make it interesting.

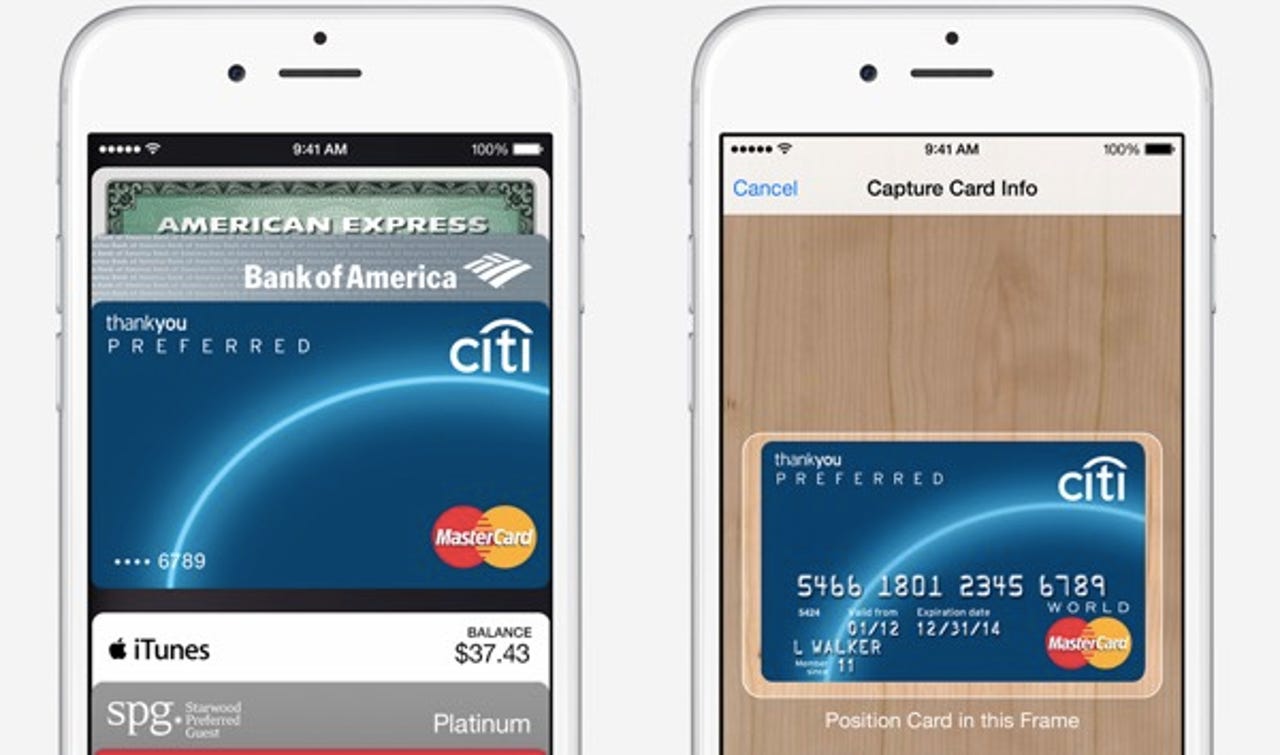

With the launch of Apple Pay, the company has generally pulled it off. It got a huge swath of America's biggest banks and retailers on board at the launch of Apple Pay, and more of them plan to jump on the bandwagon before the end of the year. A few retailers like CVS are digging in their heels and trying to shun Apple Pay in favor of their own mobile payment systems. However, it's easy to predict that these payment systems will likely go the way of the ones the wireless carriers tried to launch and they'll end up supporting all mobile payment systems including Apple Pay and Google Wallet.

While Apple has done some admirable work in making mobile payments easy to use and getting US businesses on board with the concept, the purpose here is not to pat Apple on the back. It's to say that the rest of the mobile industry, financial sector, and technology ecosystem needs to take the cue to get its act together and finally make mobile payments the next big thing in mobile.

Google needs to make Google Wallet easier to use and work a lot harder with phone makers and carriers to integrate it and educate users about it. Retailers need to not just make mobile payments a thing, but take advantage of this opportunity to further streamline loyalty cards into smartphones as well. And a lot more banks and retailers need to get into the action, including local businesses -- which could benefit from a disruptor to help get NFC capability into their hands at a low cost.

And wireless carriers need to get over themselves and stop holding back progress. They should still work on their own solutions and focus on making them easier to use than any other mobile payment solution. But, if they can't do that, then it's time to stop holding back innovation.

Americans have already waited too long to wirelessly buy their Kombucha.

ZDNet's Monday Morning Opener is our opening salvo for the week in tech. As a global site, this editorial publishes on Monday at 8am AEST in Sydney, Australia, which is 6pm Eastern Time on Sunday in the US. It is written by a member of ZDNet's global editorial board, which is comprised of our lead editors across Asia, Australia, Europe, and the US.

Previously on Monday Morning Opener

- Surface versus iPad: A tale of two tablets?

- For enterprise, mobile devices about to become irrelevant

- Why I bought a $10 band instead of waiting for the Apple Watch

- Smartphones and loyalty: Hardware is still the heart of the matter

- Can Apple help drag banking into the modern age?

- The future of tech jobs: 5 themes to watch