IT Priorities in Aus and NZ, 2009

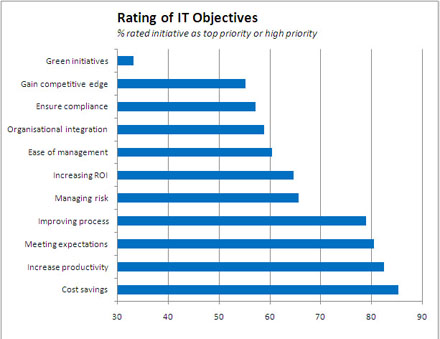

The results of the latest IT Insights & Priorities Research Report from the end of last year show that Australian and New Zealand IT decision makers have a clear focus on cutting costs and increasing productivity.

Savings are hot, green is not

In a survey conducted by Connection Research, 1355 IT decision makers in Australia and New Zealand were asked about their priorities and only 33 per cent said green initiatives were a top or high priority. Forty-eight per cent said it was a low priority or wasn't even on the agenda.

Cost-cutting dominates

The global financial crisis has clearly had a big impact, with a top or high priority placed on cost savings (85 per cent) and increasing productivity (82 per cent). "Money is tight and senior management is taking a greater interest in the justification of IT expenditure than was previously the case" concludes the executive report from CNET Direct.

Optimising or controlling costs was seen as a top or major challenge by 66 per cent of IT professionals, with the manufacturing (80 per cent) and finance (75 per cent) the most impacted by this demand.

IT companies are least green

Despite the importance the environment has on the national agenda it has clearly not been translated onto the agenda for Australia's IT departments. Only 7 per cent of respondents said green initiatives were a top priority, with almost half saying they were a low priority or not on the agenda. There were no clear standouts by sector here, although it's notable that companies specialising in the IT sector appear to come last.

Larger businesses (10,000 staff or more), however, are more likely to treat it as a top or high priority (56 per cent) than the average (33 per cent).

Impact of the GFC

IT managers have been affected by the economy, with 22 per cent stating that a major impact was a reduction in the IT budget. A further 36 per cent say this has had some effect.

The impact was felt the most in larger organisations, with the cuts creating a major effect in 30 per cent of companies with 1,000 or more employees.

A chunk of these respondents are from government organisations, with 36 per cent saying IT budget cuts have had a major impact.

The media, telecoms and entertainment sector seems to have been hit the least, with only 15 per cent saying IT budget cuts have been a major impact.

It seems budget cuts could have been worse. Instead the focus has clearly been on improvements that will enable the organisation to function more effectively. Building applications to better fix business processes was ranked as a top or major consideration by 77 per cent of respondents, closely followed by improving access to information or data (71 per cent).

Compliance and risk

It's perhaps not surprising during a time of economic uncertainty that the focus in the finance industry has been on ensuring compliance and reducing risk. Twenty-six per cent of companies surveyed in the finance, banking and insurance industries said compliance was a top priority, nearly twice the level across all industry sectors.

Managing risk was also important to these businesses, with 27 per cent giving it as a top priority and a further 53 per cent identifying it as a high priority.

Ensuring compliance was also important to government respondents with 23 per cent treating it as a top priority. Risk, while rating highly, was slightly less important for this sector. Seventeen per cent gave it as the top priority, close to the average for all respondents, with a further 53 per cent giving it as a high priority.

The construction, mining and utilities industries saw risk as an important issue, with 24 per cent treating it as a top priority, second place behind the finance sector, and a further 47 per cent seeing it as a high priority. The sector also had a higher-than-average focus on ensuring compliance — 20 per cent said this was top priority and a further 40 per cent saw it as a high priority.

Interestingly, compliance was low in the media, telecommunications and entertainment sector, with 44 per cent of respondents saying it was low priority or not on the agenda and only 10 per cent identifying it as a top agenda item.

Retail, wholesale and logistics were the least concerned with managing risk, with 37 per cent saying it was low priority or off the agenda.

Cutting costs and improving processes

Forty-six per cent of those in the manufacturing sector said cost cutting was a top priority, with a further 43 per cent identifying it as a high priority. Figures were almost identical for the retail, wholesale and logistics sector.

The importance placed on cutting costs in these sectors is significantly more higher than that for other priorities within this sector. The next highest ranking for manufacturing, for example, was for the related attribute of "improving productivity", rated by 30 per cent of respondents as a top priority. For the retail, wholesale and logistics sector "gaining a competitive edge" is the next-highest ranking top priority, selected by 34 per cent of respondents.

The importance of cost saving is spread across most sectors. The finance, banking and insurance sector, which ranks third in terms of the proportion of respondents rating cost cutting as a top priority (39 per cent) has a large number of respondents still rating it as a high priority (a further 56 per cent). The two industries with the lowest level of importance, demonstrated by the highest proportion of respondents saying it is a low priority or not on the agenda, are business services (19 per cent) and construction and utilities (17 per cent).

Many companies in the manufacturing sector obviously see improving processes as an important way to cut costs, with 30 per cent indicating this was another top priority. While this figure is slightly less in the retail/wholesale/logistics sector (28 per cent) a high proportion have additionally rated it as a high priority (58 per cent). Manufacturing is more polarised, with 20 per cent of respondents saying it actually was a low priority or not on the agenda, compared to 9 per cent in retail/wholesale/logistics. It's a similar story in the business services sector, with 28 per cent of respondents making process improvement a top priority but 24 per cent saying it was low priority or not on the agenda.

Competition and ROI

While survival and risk might have assumed more importance for many, staying competitive is still a focus in some sectors.

Retail/wholesale/logistics is a standout here, with 34 per cent stating it's a top priority and a further 41 per cent giving it a high priority. It's a similar story for media/telecoms/entertainment where the corresponding figures are 32 per cent and 39 per cent. As you'd expect, it's less of a concern in government and public service oriented sectors like health and education. Less expected is the relatively high proportion of business services respondents who said it was a low priority or not on the agenda (37 per cent). This seems unusual for a sector that is generally recruited to help client businesses to grow. Their focus seems to be more on process improvements and cost savings than assisting with business expansion.

Business services do rate slightly above the average for all sectors when it comes to ranking the importance of return on investment (ROI). Seventeen per cent give it as a top priority, but it's a polarised response with many more (31 per cent) saying it's a low priority or not on the agenda. Across all sectors only 15 per cent gave improving ROI as a top priority, which is an interesting response when you'd expect the economic downturn was driving efficiencies. Twenty-nine per cent said it was a low priority or wasn't even on the agenda.

Media/telecoms/entertainment is a leading sector when it comes to seeing ROI as an aid to improving competitiveness. Twenty per cent rated it as a top priority. The retail/wholesale/logistics sector, which ranked highest for placing the need to gain a competitive edge as a top priority, are less preoccupied with increasing ROI, with just 14 per cent giving it the same importance, midway down the sector by sector pecking order. The IT sector, however, 28 per cent of which saw gaining a competitive edge as a top priority, had 18 per cent of respondents rating "increasing ROI" as a top priority.

Integration and productivity

Perhaps a reflection of the ever changing nature of government departments, organisational integration is ranked highest by government respondents, with 24 per cent rating this as a top priority and a further 46 per cent said it was a high priority.

Overall, 34 per cent of respondents said this was a low priority or not on the agenda, with government respondents less likely to respond this way (23 per cent).

When it comes to placing organisation integration as a top priority, healthcare and finance/ banking/ insurance follow close behind, with 21 per cent and 20 per cent respectively.

As far as increasing productivity government respondents were at the other end of the scale, with 22 per cent saying this is a low priority or not on the agenda and only 17 per cent stating this was a top priority. This is significantly below the average across all sectors, with 27 per cent of respondents making productivity a top priority, with finance/banking/insurance leading the pack here (42 per cent).

IT sector respondents do not see organisational integration as important, but this is heavily influenced by the response base (43 per cent are from a company with 10 or less employees). This sector does see productivity as important though, ranking second here with 32 per cent rating it a top priority and a further 53 per cent saying it is a high priority.

Making it easier to exceed expectations

Companies offering IT solutions to clients have an understandable desire to make their services exceed customer expectations, with 44 per cent placing this as a top priority and a further 42 per cent ranking it as a high priority.

Meeting expectations was given a top priority by 35 per cent of all respondents, with a further 46 per cent saying it was a high priority. Behind IT, business services were most likely to treat it as a top priority (42 per cent).

Service sectors seem most likely to assign this as a low priority or indicate that it's not even on the agenda -- 22 per cent for healthcare and for education/R&D, against an average across all sectors of 15 per cent.

Education and R&D are more concerned with creating systems that are easy to manage. Twenty per cent of this sector indicated it was a top priority, compared to an average of 13 per cent, with a further 50 per cent saying it was a high priority.

Business services (16 per cent), IT (15 per cent), Healthcare (15 per cent) and Media/telecoms/entertainment (15 per cent) are all slightly more likely than average to rank ease of management as a top priority.

At the other end of the scale the finance sector, which is focused more on compliance and productivity, had 41 per cent saying ease of management was a low priority or not even on the agenda, compared to an average across all sectors of 32 per cent.