IT spending slowdown, emerging trends reshuffles megavendor deck

IBM, EMC, Cisco, HP and others are all saying that customers are becoming cautious about the economy and pulling back on tech spending. This pullback is more like tapping the brakes, but there's economic uncertainty for sure. The catch is this slowdown could accelerate the thinning of the enterprise megavendor herd.

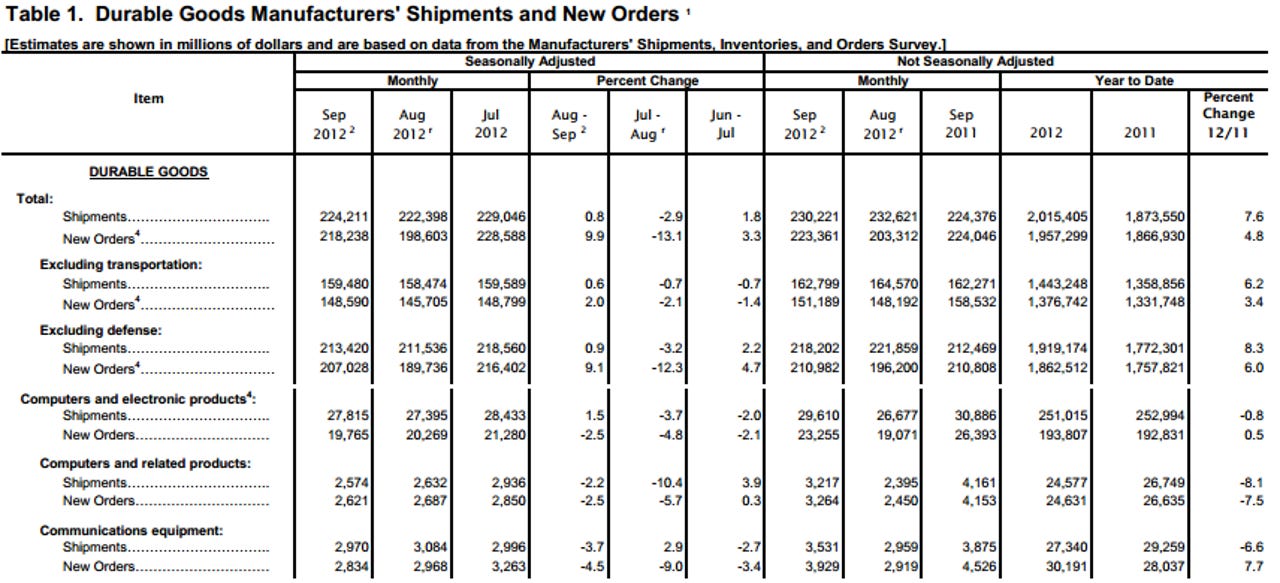

Outside the tech sector, companies such as UPS, 3M and other industrial giants also noted a slowdown as China's growth slows and Europe continues to struggle. The Commerce Department reported that new orders for computers and electronics fell 2.5 percent in September from August. Communication equipment new orders fell 4.5 percent in September from August.

EMC CEO Joe Tucci noted a "more uncertain global economic environment" as did other tech chiefs. IBM CFO Mark Loughridge said Big Blue saw a solid start to the third quarter, but "a fall-off in our growth rates in the third month of the quarter." "From a geographic perspective, it was really a fall-off that we saw in North America and our growth markets unit," he added.

Indeed, a dicey economic picture is bringing all tech companies down at the same time, right? Not so fast. There's a nuance about this tech spending sluggishness to ponder. At the Gartner Symposium, what's different this time was evident with CIOs.

In recent years, the Gartner powwow focused on budget cuts, CIO problems and innovating with limited resources. This year, CIOs weren't all that pessimistic---they were often joined by business leaders with IT budgets (think marketing chiefs). One keynote at Gartner featured International Speedway where the marketing chief and CIO are connected at the hip.

Perhaps the marketing types brought a little more optimism to the party, but I doubt it. Overall, this batch of CIOs didn't have the deer in the headlights look that was prevalent in recent years. These IT leaders were also gravitating toward vendors like Splunk and 1010Data, two smaller big data plays.

The disconnect looks like this: Giant IT vendors are citing customer caution. The guys responsible for IT spending don't seem all that cautious relative to previous years. Something here is off.

My conclusion: The IT leaders who have been connected to large vendors for years under the guise of one throat to choke and integrated stacks are moving on. These IT leaders have already moved some infrastructure to the cloud and are looking to innovate. The big guys aren't exactly screaming innovation these days. Often, the big vendors are selling you more stacks and upping maintenance fees.

Meanwhile, every budget inside companies is starting to focus on technology. As the technology calls move away from CIOs, the loyalty to lock-in happy vendors also fades. There's a reason companies like IBM and Salesforce.com are courting chief marketing officers. Vendors need to sell to a new audience.

In other words, blanket statements about IT spending no longer apply. Five years ago, tech vendors won---and lost---together. Today, CEOs of giant enterprise tech vendors are squabbling over who will be irrelevant in five years. Cisco CEO John Chambers sees the new reality. And who's going to argue with Chambers, who has steered Cisco through multiple market transitions?

Chambers said during his Gartner keynote:

"Any of the top six vendors who thinks they'll be in that top six five years from now for sure will be wrong. Out of the six of us at best four or three will be in the top five years from now."

Chambers then asked the audience of CIOs whether they look to their large vendors---IBM, Cisco, HP, SAP, Oracle, Microsoft---for innovations. I thought I heard a cricket or two. Chambers then asked whether they look to Apple, Google or Facebook for innovation and a majority said yes. Chambers' take is the megavendor herd will be thinned with the winners owning hardware, software and silicon. He hinted strongly that HP, SAP and Microsoft would have issues. HP CEO Meg Whitman disagreed. Whitman and Chambers have a lot in common, but the biggest one is they both happen to be selling you a stack of stuff.

My conclusion: Like a spouse who is moving on from a seriously flawed partner, customers are looking at the exits. Gartner's nexus theme---social, information, cloud and mobile will cause upheaval---was a bit corny but also correct.

A megavendor mental exercise

What crystallized the enterprise's new normal---that customers are looking well beyond their established vendors---was a talk with Appirio Chief Strategy Officer Narinder Singh. Singh gets a few tech leaders together, talks shop and plays the megavendor game.

The game goes like this: The players have to pick one company among IBM, Microsoft, Oracle and SAP. These tech observers have to pick the one that will be most likely to survive and thrive. And one that will be irrelevant.

Then the debate ensues.

Singh, who has tried this game a few times, noted that few people have the same answer. One CIO thinks SAP is toast. Another bets that Oracle is screwed. You get the idea. I tried the game and Singh and I disagreed completely on what giant would go extinct.

With a little more thought, this megavendor debate could easily become a drinking game.

This debate about enterprise vendor survival wouldn't have happened years ago. Back then, the answers would have looked like this:

- Of course, Microsoft will be dominant.

- Of course, IBM will reinvent itself yet again.

- Of course, SAP will underpin my infrastructure.

- Oracle can't be tossed.

Everyone would have agreed with those answers not so long ago. Today, even the big vendors are debating which one will be voted off the island first.

Bottom line: As the technology infrastructure of companies becomes more heterogeneous so do the vendors catering to them.